This article was written by Evdokia Pitsillidou, Risk Management Associate at easyMarkets.

Silver prices rallied this week, but gains softened as traders ascribed greater certainty to the view the Federal Reserve may raise interest rates next week.

Interest Rates in Focus

March silver futures climbed nearly 3% on Wednesday to close at $17.28 a troy ounce, their highest in nearly a month on the Comex division of the New York Mercantile Exchange . It was also the first time in three weeks that silver had settled above $17. However, prices turned lower the following day, falling 1.2% to $17.08. Prices were last seen hovering around the $17 mark.

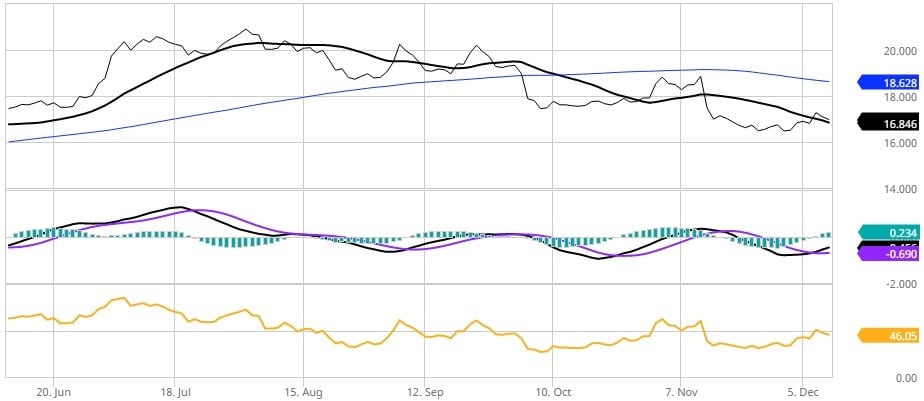

The grey metal is on track to gain roughly 3% this week. Momentum remains weak, with relative strength hovering in the mid-40 range and the MACD holding below the trendline.

Gold’s trajectory this week has shown limited upside. At the time of writing, the yellow metal is on track to break even for the week. It was last trading at $1,168.20 a troy ounce, not far from its recent ten-month low.

Silver’s attempted rally in the middle of the week was really traders pre-positioning ahead of next week’s Federal Open Market Committee (FOMC) meeting, which will almost assuredly result in the first interest rate increase in a year. The markets have assigned a more than 97% likelihood that the Fed will raise interest rate by 25 basis points next week, according to the CME Group’s FedWatch Tool, which has long been used to express the market’s views about US monetary policy.

Official Policy Decision

The US central bank will release its official policy decision December 14 at 2:00 pm ET. The statement will also be accompanied by revised projections for gross domestic product (GDP), unemployment and inflation. Traders may be closely monitoring the report for signs of future policy developments in the wake of Donald Trump’s surprise election victory last month. Trump’s economic platform might lead to faster inflation, thus accelerating the central bank’s policy tightening schedule.

Growing rate-hike bets have drawn a bigger wedge between the dollar and precious metals. The US dollar index has surged to nearly 14-year highs in recent weeks. On Thursday, the dollar rose 0.8% against a basket of other major currencies, virtually offsetting a week-long skid.

Higher interest rates generally make the dollar a more attractive investment because it pays interest. A stronger dollar also makes greenback-denominated commodities, such as silver, more expensive for foreign buyers.

The US central bank is expected to leave a mark on precious metals next week, although many analysts say a rate-hike has already been priced into the market. Silver prices appear to have established near-term support around the six-month low of $16.50. A hawkish Fed may expose that level to the sellers.