This article was written by Evdokia Pitsillidou, Risk Management Associate at easyMarkets.

Sugar prices edged slightly lower at the start of June, but have maintained a solid upward trajectory since the middle of April, as large production shortfalls and collapsing Latin American economies have created firm expectations for a continued supply deficit.

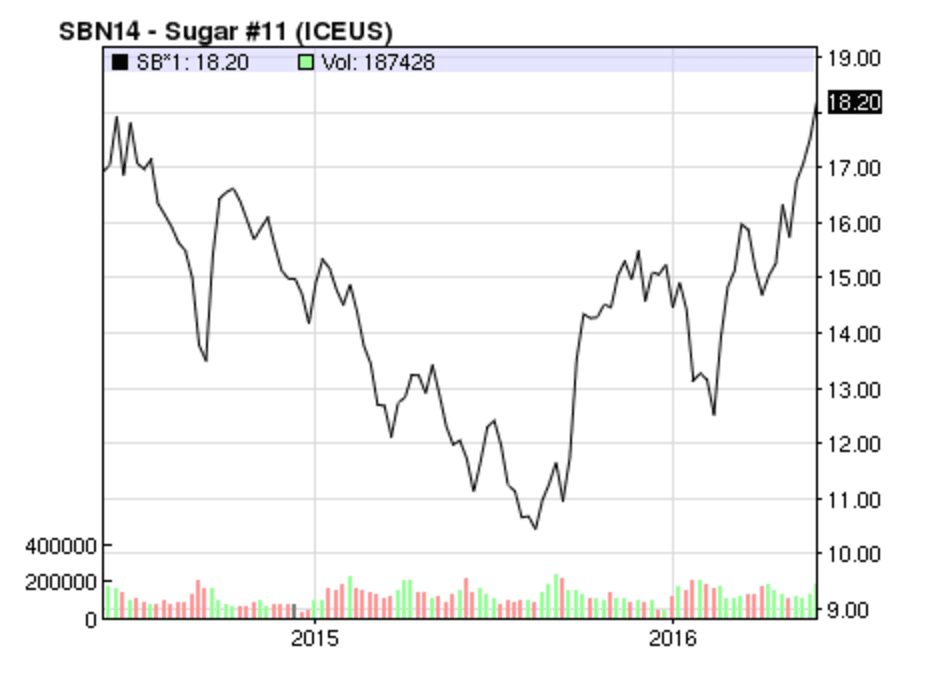

Raw sugar futures were last seen trading at $17.42 a pound, a nearly two-year high, as investors continue to expect tighter global supplies. Prices traded as high as $17.63 a pound in the New York session on Tuesday.

Technical indicators suggest further upside is in store for the sweet commodity. Price action is strong, with the 50-day moving average maintaining a clear upward trajectory. Relative strength is approaching 64 and rising, while the MACD shows continuing upward momentum.

When it comes to the sugar markets, very few economic releases are more exciting than Brazilian cane crush data. Sugar output in the country’s Centre South – the world’s largest sugar producing region – rose 68.4% year-on-year, data from Unica recently showed. Despite the increase, investors remain weary about the production downside emanating from disruptive weather patterns.

Brazil’s cane belt is currently facing wet weather patterns that could disrupt yields and shipments of sugar. This is a major concern, given the growing pressure on Brazil to compensate for a bad producer season on the other side of the world in Asia.

Sugar remains one of Brazil’s largest industries, with exports reaching 24 million metric tonnes in 2014-15. Latin America’s biggest economy is mired in a deep recession that is expected to worsen this year.

Declining sugarcane production and rising output costs have led to supply disruptions in many parts of the world. The impact has been most severe in Venezuela, a country facing its biggest socioeconomic crisis in recent memory.

Venezuela has more or less run out of sugar (and many other basic goods deemed necessary for survival). This prompted Coca-Cola to stop producing soft drinks in the country, a devastating blow for the nation struggling to regain its footing after collapsing oil prices wreaked havoc on its economy.

In a recent article by CNN that highlighted the extent of the crisis, Rafael Romo and Patrick Gillspie wrote: “Venezuela is running out of just about everything. Food, medicine, electricity, toilet paper, condoms – you name it.”

Sugar production has proven to be an even bigger disincentive for local farmers because, unlike other crops, it is subject to price controls. As a result, small scale farmers have abandoned its production entirely.

Sugarcane production in Venezuela is forecast to decline to 430,000 tonnes in 2016-17, down from 450,000 tonnes in the previous 12 months, according to the United States Department of Agriculture.

According to Commerzbank, the latest rally in sugar prices has been mainly driven by market fundamentals, suggesting that higher prices are likely.

“It is still the deficits anticipated for this season and the next that are driving up the price,” Commerzbank said. The bank added that speculative buying was still part of the equation. “The upswing has been finding support from short-term-oriented market participants, who have sharply increased their net long positions.”

Investors with a sweet tooth may be eager to chomp at the bit of higher sugar prices. However, they should bear in mind that the cyclical sugarcane market is subject to wild swings, which may leave buyers with a bitter taste in their mouths.

Sugar futures price

Source: Yahoo Finance