In trading, to fight against the trend is a hard thing, and the undergoing bullish trend in US stock market has been remarkable. But, every trend experiences a correction, with everybody now trying to find a top in S&P 500 Index. Are they on the right track?

We use technical analysis to find out which seems to be making a “call” for a top

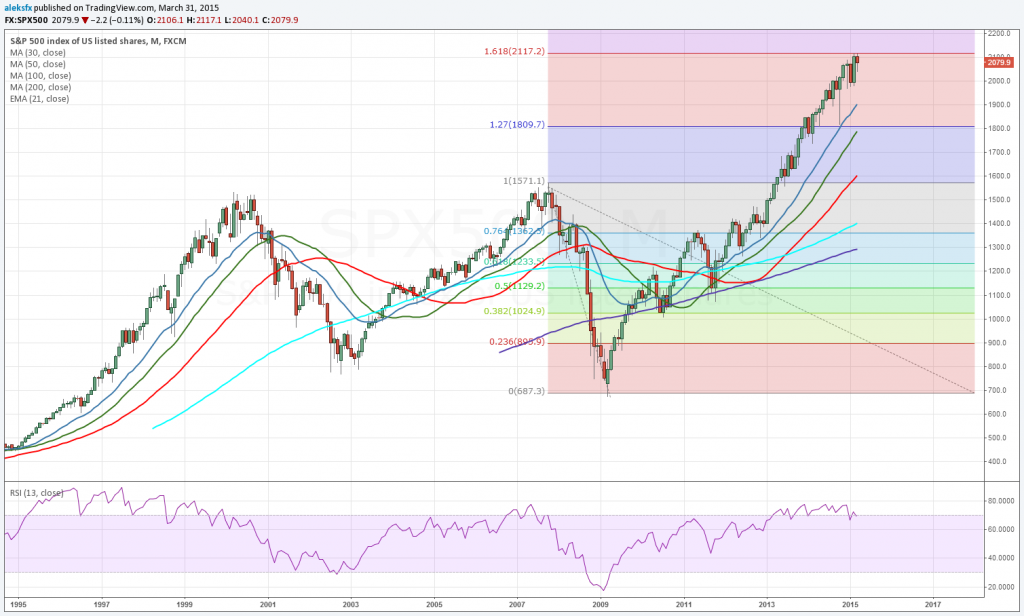

For identifying a top in S&P500 Index I use technical analysis and its tools. First let us look at the monthly S&P500 Index chart (Chart 1) showing that the S&P500 Index has reached perfect Fibbonacci expansion level of 161.8% in a period 2007-2015, to around 2110 points from a low of 700. This 161.8% expansion occurred after a Fibbonnaci retracement of 61.8%, which was the stock market collapse of 2007-2009. We are seeing now the first evidence of a strong resistance here and maybe a top. Also if you look at RSI (13) indicator applied on chart you can see bearish divergence (Index is going up and RSI indicator is falling).

Chart 1. S&P500 INDEX MARCH 31, 2015 MONTHLY CHART

From a technical analysis and traders view things are getting clearer if we look at weekly Chart2. There is a bearish rising wedge formation and a falling top. Here we have a question for traders, who wants to be a buyer here?

Chart 2. S&P500 INDEX MARCH 31, 2015 DAILY CHART

I would say that traders have a clear picture and a near resolution of this situation. If S&P500 Index breaks 2110 points higher decisively then we could see a trend continuation. On the downside, break of the wedge would be confirmed by going bellow 2030 points.

Real breaking of this long term rising trend should come if S&P500 Index goes bellow 1920 points. Traders will closely watch this levels in the coming weeks and break of this wedge either top or a bottom of it would be a beginning of a huge move.