Turkey’s economy grew more than expected during the first quarter as domestic consumer spending climbed at the highest pace since 2013 according to the latest economic figures published yesterday. This report may ease, at least in the short term, government pressure on the Central Bank to lower interest rates.

Gross domestic product expanded by 2.3 percent in the first quarter of 2015, and seasonally-adjusted output was 1.3 percent higher from the previous quarter, causing the lira to strengthen, however it still remains vulnerable to further weakness down the road. On the other hand, in the event of a new sharp sell-off due to political jitters caused by post-election uncertainty, the need for higher rates may resurface.

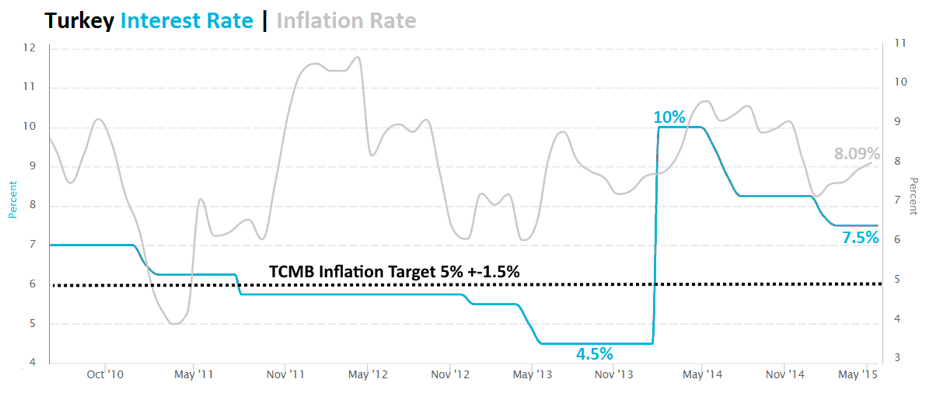

At first glance, the stronger-than-expected growth figures may seem like good news for the lira, indicating that the Turkish economy may be recovering from the impact of the central bank’s emergency tightening in January 2014. The Turkish benchmark interest rate is currently at 7.50%, after a series of rate cuts that followed the steep rate hike from 4.5% to 10% in January 2014 which aimed to support the sharp decline of the Turkish lira.

Turkey Interest Rate Chart, Source: JFD

Furthermore, the country’s inflation rate has remained at levels higher than 7% during the last two years, while the current unemployment rate stands at 11.20%. The surprise first-quarter GDP boost was mainly a result of a sharp pick-up in consumer spending, at the cost of a lower domestic savings rate as well as a wider current account deficit. It therefore does not seem sustainable in the medium term and growth will likely remain weak over the coming quarters.

Following the Turkish central bank’s decision to raise interest rates back in January 2014, in an effort to support the lira, consumer spending remained very sluggish during most of the year, contributing to a slowdown of growth down to 2.9 percent from 4.2 percent a year earlier. The government in turn pressured monetary policy makers to lower interest rates again, in order to revive growth.

Furthermore, the country’s lagging economic growth has not been helping the growing debt which is heavily based on foreign financing and will worsen in the event of a U.S. Federal Reserve interest rate hike.

Although new figures published this morning show that Turkey’s current account deficit narrowed to $3.4 billion in April, down from last month’s figure of $5.0 billion and the $4.9 billion recorded in April 2014, the economy still remains extremely vulnerable due to the huge external financing reliance. Turkish Banks need to roll over 95 billion US Dollars in external debt over the next twelve months and in the event of a US Dollar interest rate hike, paying off this dollar debt will become extremely challenging.

The outcome of the last national elections indicated that President Recep Tayyip Erdoğan’s Islamic based Justice and Development Party (AKP) is no longer able to secure majority in parliament, for the first time since 2002. It therefore now needs to decide whether to seek support from other parties in order to form a coalition, or go to early elections, causing a new wave of uncertainty in the markets.

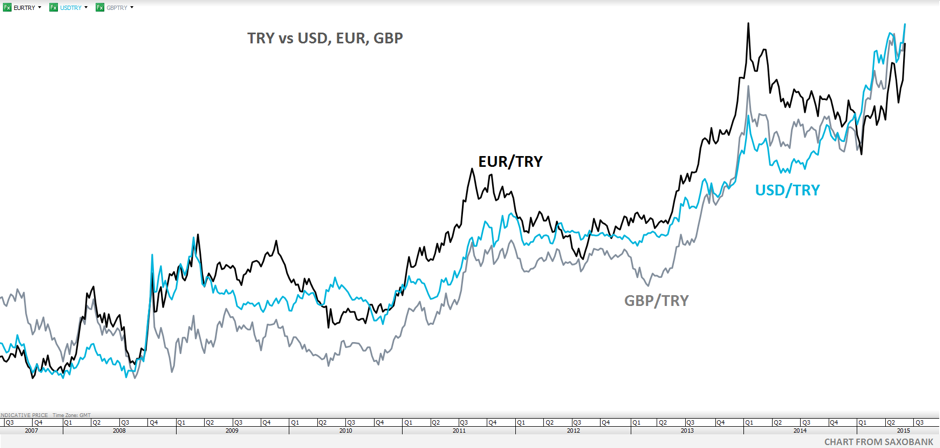

TRY Exchange Rate Charts, Source: SaxoBank

Earlier this week, following the political election outcome, the Turkish lira fell sharply to a record low versus the US Dollar and the British pound. It also retreated by more than 6% against the Euro since the beginning of this month.

The lira is trading today in the 2.74 range against the US Dollar, trimming this year’s losses to 15 percent. The US Dollar versus the Turkish lira currency pair (USD/TRY) jumped by 238% since the record low of 1.15 in July 2008, making the lira one of the worst-performing emerging market currencies over the last few years. The currency pair hit a record level of of 2.8075 last Monday, following last Sunday’s the political election results. Additional weakness is likely to persist, which could cause the USD/TRY currency pair to climb back to the 2.90 level.