This article was written by Dwayne Buzzell, a financial analyst with more than two years experience in Forex trading and private investing.

Statistics

The Office of National Statistics of Great Britain announced production data for June. It is expected to decline by 0.2%, with industrial production increasing by 0.1%.

Industrial and factory output fell in May after an unexpectedly large increase in April, although the decline was less than economists predicted. Factory production fell on a monthly basis after an impressive 0.5% growth from 2.4% in April.

For June, economists forecasted a drop again but this time by 0.2%. The pound dropped to the bottom of the month in relation to others major currencies after data released, which showed that manufacturing in the UK fell in June, more than expected.

Last week the Bank of England lowered interest rates to a record low of 0.25%, to implement the new measures of easing monetary policy to mitigate the impact of Brexit over the economy. It is expecting a slowdown in UK economy in the second half of the year, due to uncertainty over the future direction of the country after leaving the European Union.

Pound

During Asian trading, the British pound continued to weaken against the dollar after the BoE member of Monetary Committee, Ian McCafferty, said that it is quite possible that they would need new monetary easing if the situation in the British economy deteriorates.

Forex pair GBP / USD recorded on the bottom 1.2965 and subsequently consolidated at 1.2977. Official data showed that manufacturing in the UK fell in June by 0.3%, while the predicted decrease was a 0.2%, after falling 0.6 % the previous month. About the annual basis, it grew at a rate of 0.9% and predicted growth was a 1.3%, after an increase of 1.5% in May.

Reports also showed that industrial production rose 0.1% in June, after a drop of 0.6% in the previous month. On an annual basis, it grew at a rate of 1.6% after rising 1.4% in May. A separate report showed that retail sales in the UK rose in July by 1.1% after falling 0.5% in previous month. Analysts had expected a drop of 0.7 %. Trade balance fell from minus 11.5 billion pounds to minus 12.4 billion pounds. Economists expected minus 9.6 billion pounds.

Compared to the European currency, the pound fell. EUR / GBP climbed to 0.8542. German's trade balance fell in July to 21.7 billion euros from 22.1 billion in the previous month, while analysts had expected a growth of 22.4 billion euros. The British pound fell against the yen and the franc. GBP / JPY dropped to 132.80, and the GBP / CHF fell to 1,2760. Japanese M2 money supply fell in July to 3.3% from 3.5% in the previous month. It was in line with predictions of economists. The unemployment rate in Switzerland remained unchanged in July at 3.3 %. It was in line with analyst forecasts.

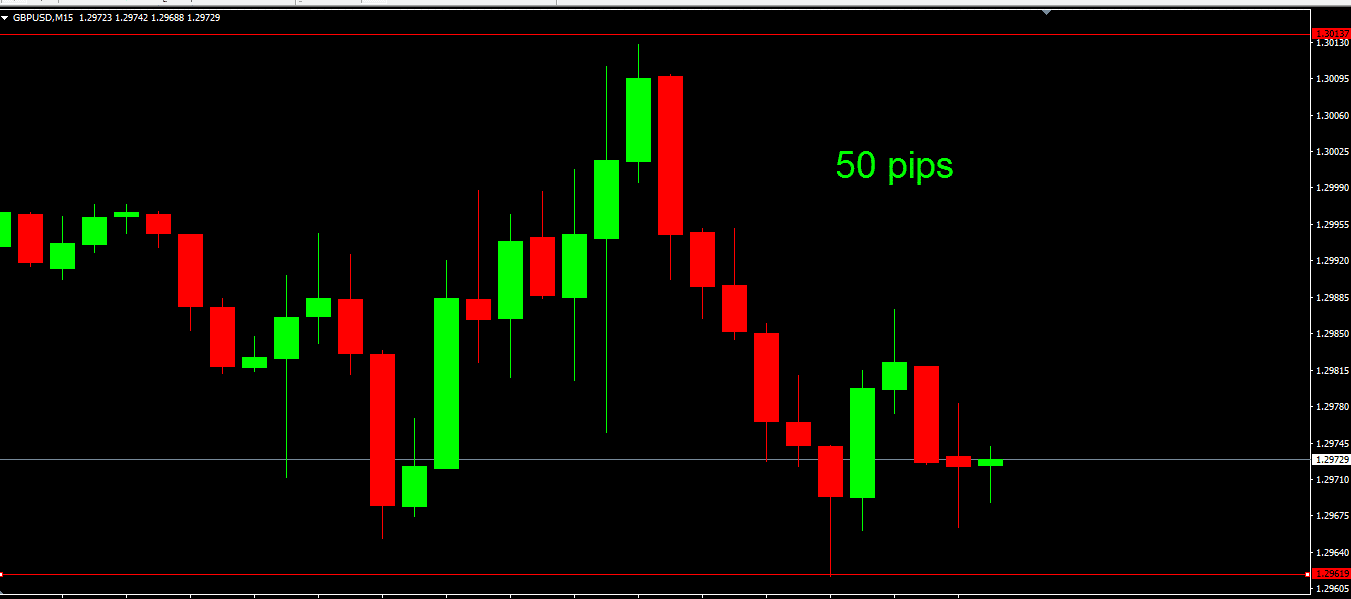

The downside momentum with targets 1.29200 and 1.2850 in extension. Supports and resistances levels:

- 1.32200 resistance

- 1.31750 resistance

- 1.31050 resistance

- 1.29729 Last

- 1.29200 support

- 1.28500 support

- 1.27900 support

Pressure

It can see reverse trend in the image below. The currency pair rose to 1.30150 and dropped to 1.29600. The price was trading between the first resistance level 1.31 and the first support level to 1.29600. It is expected that the price could break the first support level 1.29200. Level 1.29600 showed a double bottom and a temporary stabilization. This week the currency GBP/USD is under pressure. It can see long term declining trend line. So far it is trading at symbolic 1.30 area.

The price of gold maintained close to the minimum weekly. It was dropped as a result of the growing expectations of the excellent results of the labor market in the US.

Strengthening of the dollar had a negative impact on the demand for gold, hence its price. The price of crude oil has not moved much. It closed to the highest level in the last five days. Baker Hughes reports showed that the US once again increased the number of active oil wells. Several OPEC members are trying to revive the idea of setting upper limits production for further restriction. Today in the US, Petroleum Institute will release its inventories report.

US indices have fallen during a peaceful trading period, while investors focused on the business results of the company ahead of the end of the season disclosure of financial reports.

Prices of US stocks fell moderately during yesterday after a stronger growth over the last week. Six of the ten sectors of the S&P500 index closed the previous day in decline. Dow Jones was down 0.08%, the S&P 500 dropped 0.09% while the Nasdaq was lower by 0.15%.

Quarterly earnings of companies fell in the second quarter, the fourth consecutive quarter, despite better results were expected. Analysts predicted that earnings in the third quarter will of 0.2% lower than the same period last year. Asian stocks were mixed after the publication of the Chinese data.

Japan's Nikkei 225 index jumped 0.70%, the Hang Seng index in Hong Kong fell 0.25%, while Australia's ASX/200 rose by 0.26%. Official data showed that producer price inflation in China rose in July to minus 1.7% from a minus 2.6% in the previous month.

Analysts had predicted a growth of minus 2.0%. Consumer price inflation in China fell in July to 1.8% from 1.9% in the previous month which was in line with forecasts.

European stocks rose. Euro Stoxx 50 rose 0.10%, France's CAC 40 climbed 0.16%, German's DAX 30 was higher by 0.15%, while London's FTSE 100 gained 0.21%. European stocks closed in profit yesterday. US stocks closed in red while the Asian stocks indices were mixed. It shows that markets reacted differently.

Summary

The pound is under pressure. US stocks are mostly are under pressure this week. The gold price was down. The gold is in range trading level of $1220-1334 an ounce. The price of crude oil could break $43 per barrel.