Online trading today is completely different from what it used to be. In the early 2000’s brokers were competing by simply offering better spreads and lower commissions. Then execution became the game changer as it could provide an edge over the competition. A few brokers started filling the orders without any dealing desk intervention and soon it became a must-have feature for every major player in the industry.

However, today the trading costs are incredibly low and there is almost no space for improvements in the speed of execution. This is why the next big thing in slicing the retail FX market share comes with the trading platforms.

Importance of WebTraders

There are two key items that make the availability of WebTraders vital for any broker. Firstly, technology is moving to the cloud. Think of such services as photo storage, file sharing or anything else. The services people use are stored beyond their hardware and trading platforms should not be an exception.

Secondly, it is obvious that onboarding a client is much faster if a certain browser-based platform is in place. This way a client does not need to think twice before downloading and installing the Trading Platform .

Let’s take a look below to see three of the best alternatives for a broker to offer as its cloud-based trading platform.

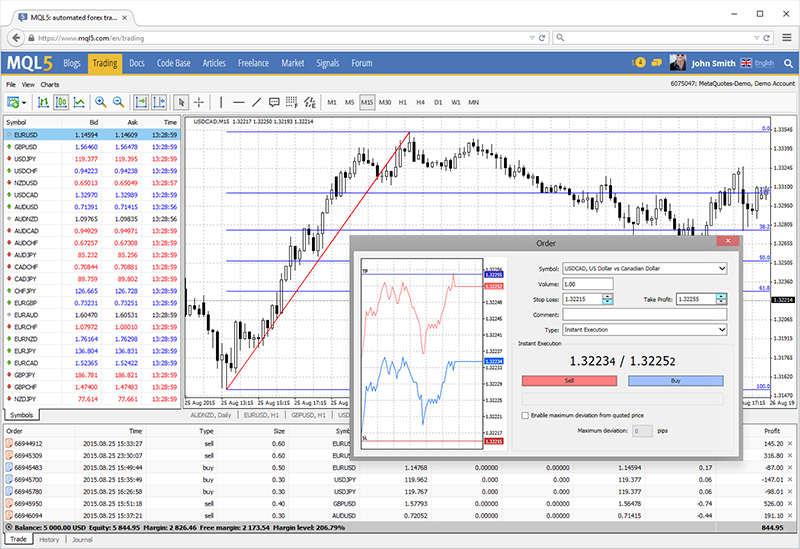

MT4 Web

Even though it has taken MetaQuotes quite a few years to release its proprietary solution for trading in the browser, it is still quite inferior to the desktop platform. This is probably the main reason behind low adoption rates from brokers. While a desktop MT4 platform is a piece of software that comes with over 50 built-in indicators, great customisation options and, most importantly, support for custom indicators and trading robots, a web edition of this platform certainly misses on nearly every point.

www.metaquotes.net

The platform has certainly improved its colour scheme and gained the whole idea of the user interface, however the scope of features still remains rather narrow. It is not possible to customise the way the chart looks or perform any serious technical analysis. Custom indicators and EAs are also not supported when trading via the browser.

Having said this, it is still a great option for the broker to quickly onboard the clients and supply them with some limited trading features. This way a starter would not feel overloaded with features and could steadily move to a more advanced, standalone application.

The main disadvantage of this platform is simple: any experienced MT4 user could hardly take the web version seriously.

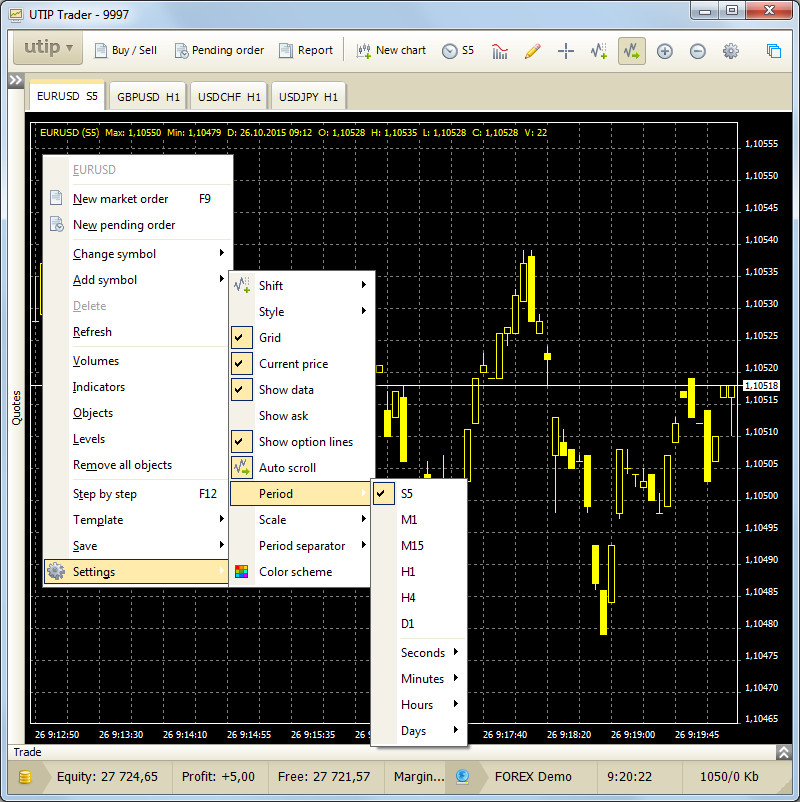

UTIP Platform

It is very probable that today is the first time you are hearing about this platform. The main reason why this platform is on the list is that it comes with its own Liquidity and can be deployed as the only solution the broker has. In other words, a broker does not need to run a MetaTrader 4 or any other platform prior to starting with UTIP.

www.utip.org

Binary options integration is another advantage of this trading platform. A Forex broker does not need to have two different pieces of software to expand its services in the promising binary industry as with UTIP it is possible to offer regular and binary trading within the same application.

When it comes to customisation, UTIP also excels compared to MT4, as this software allows a trader to change the platform from A to Z. Technical analysis is rather basic, yet the amount of indicators is larger and UTIP also allows changing the periods of the indicators.

This platform could be regarded as a solid option for starters in retail FX, as it is pretty easy to understand its ins and outs even for inexperienced traders. Next to this, a broker can start offering this platform at lower costs compared to the MetaQuotes distributives.

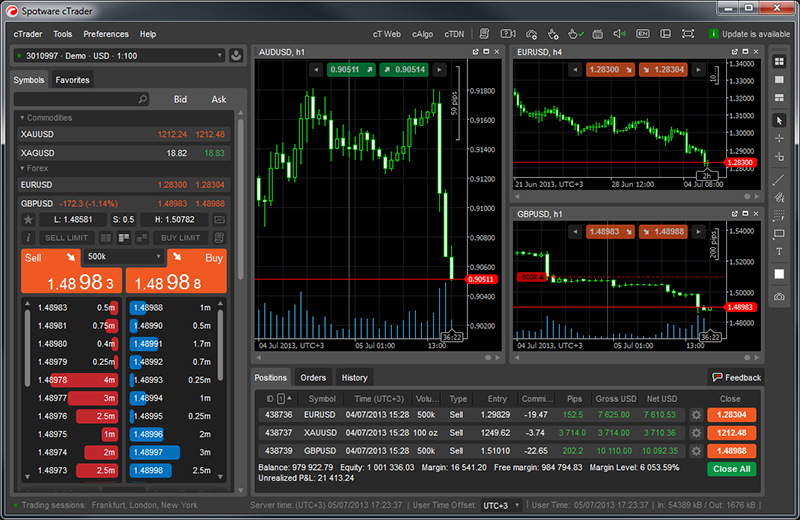

cTrader Web

There are quite a few software developers in retail FX, but I feel that so far only Spotware has managed to show decent breakthroughs. cTrader Web comes as a part of the cTrader suite. The best feature of this platform is that the web version is identical to the standalone application. In other words, a trader that has this software installed would not feel any difference when moving to a cloud-based solution.

www.spotware.com

cTrader Web is an advanced solution for filling the orders. The amount of available features is just astonishing as the platform comes with draggable stop losses, integrated market depth, 1-click-trading, tons of graphical objects and a significant number of the built-in indicators.

I am sure most seasoned traders will appreciate this platform and prefer it to the alternatives. On top of this, there is also cAlgo that runs perfectly in the browser and allows using trading robots coded in C#, which is a great advantage when compared to MT4 Web.

Having said this, I feel that some starters could be puzzled by the wide scope of the platform’s functionality. Still, it remains a great choice.

Summing up

Undoubtedly, WebTraders are vital for a broker to progress in the 21st century as the availability of browser-based platforms influences conversion rates and client loyalty. A regular MT4 broker would most probably adopt an MT4 Web platform, while a new FX brand is advised to take a look at UTIP. Brokers that are looking to offer advanced trading capabilities should take a better look at cTrader.