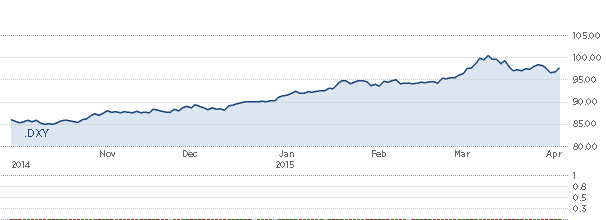

Over the last couple of months the US economy has shown a considerable (strong) economic growth, this can be attributed to consistent recovery in the jobs market, oil price crash and an increase in oil production in North America has also added to the value of the US dollar because it is priced in the US dollar. Futhermore, different policies embarked upon by central banks have also driven the value of the US dollar up, most especially the quantitative easing embarked upon by the ECB in the eurozone because of slow economic growth and low inflation. The Japannese central bank also embarked on rigorous bond buying, pumping out too much money. All these expansionary monetary policies have relatively impacted the value of the dollar to a bullish currency.

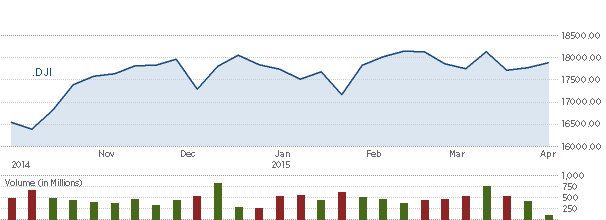

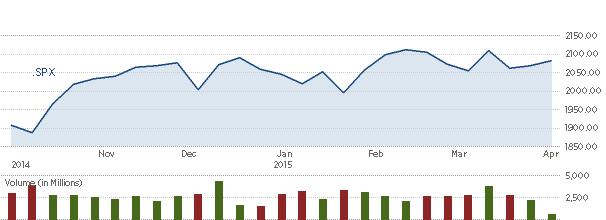

However, since the breakout of the US dollar last year, its effect has been seen in the US stock market, with indicies reaching record highs (Dow Jones, S&P500). Dow Jones' industrial average reached a record high of 18,288, while S&P touched 2,117. The strong dollar simply means more money will be attracted to the US economy and companies with domestics market target will benefit more from a strong dollar.

The strong dollar has a negative impact on companies with international markets.

On the contrary, the strong dollar has a negative impact on companies with international markets. Fundamental economics shows that the strong dollar will have an impact on export because the goods produced in such an economy will be too expensive. This is the current situation of multinational firms in the US, whose profits have been sliding due to the strong dollar in which their products are all priced, affecting overseas sales and thereby slowing down profits.

Overall, a strong dollar affects export from the US economy, because the goods are too expensive for customers abroad and goods produced abroad will be cheaper. This will affect the trade balance negatively in the long run.

Below is a chart of the USD Index for the last 6-month, Dow Jones Industrial Average and S&P 500.

6-Month View of the DXY Index (Image Source: CNBC)

6-month chart of Dow Jones Industrial Average (Image Source: CNBC)

6-month View of s&p 500 (Image Source: CNBC)