This week’s analysis is about the USD/CAD. Although we’re looking at this Forex pair on a weekly basis, in what should be considered a snapshot in time, given the current fundamental and technical picture, all factors point toward it being a bearish year for the Canadian dollar. In other words, we want to find an entry to get long the U.S. dollar versus the Canadian dollar.

Fundamentally, the market is being driven higher by a few major factors.

- U.S. and Canadian treasuries' interest rate differential

- The divergence between U.S. and Canadian monetary policies

- Falling commodity prices

- Hedge fund shorting

Monetary Divergence

Simply stated, U.S. Treasury interest rates will be moving higher in 2016 while Canadian rates are expected to decline. The spread between the two yields will widen, making the U.S. dollar a more attractive investment. The disparity in rates will trigger a flight of investment capital from Canada to the U.S.

The divergence between U.S. and Canadian central bank policies is easy to detect. The U.S. Federal Reserve raised rates on December 16, 2015 and is expected to make its second rate hike in June 2016. It is possible that it will raise rates twice more in 2016, depending on the strength of the economy.

At this time, rumors are circulating that the Bank of Canada may opt for a negative interest rate environment in 2016. The central bank will be guided by falling crude oil prices and the weakening economy, which may be headed towards recession.

Commodity Pressures

Falling crude oil and gold prices are expected to continue to pressure the Canadian economy and may push it into a 'technical' recession. Current conditions suggest that crude oil may eventually trade at $25.00 a barrel. This could be the price where rebalancing in the market finally begins. The Saudis want to drive the U.S. drillers out of business. The U.S. rig count is dropping, but not fast enough. A sudden plunge to the mid-20’s may just do the trick. In the meantime, the Canadian dollar will suffer.

The stronger U.S. dollar is expected to continue to weigh on gold prices. The dollar will continue to strengthen globally because of the higher yields being paid in the U.S. Since gold is dollar-denominated, support for the precious metal is expected to continue to erode.

Shorters

Hedge funds are seizing the opportunity, given the perfect storm of bearish fundamental factors, and are aggressively shorting the Canadian dollar. This trend is likely to continue into 2016 until a bottom forms in crude oil, or if the Bank of Canada says the economy is turning a corner.

Looking at the charts

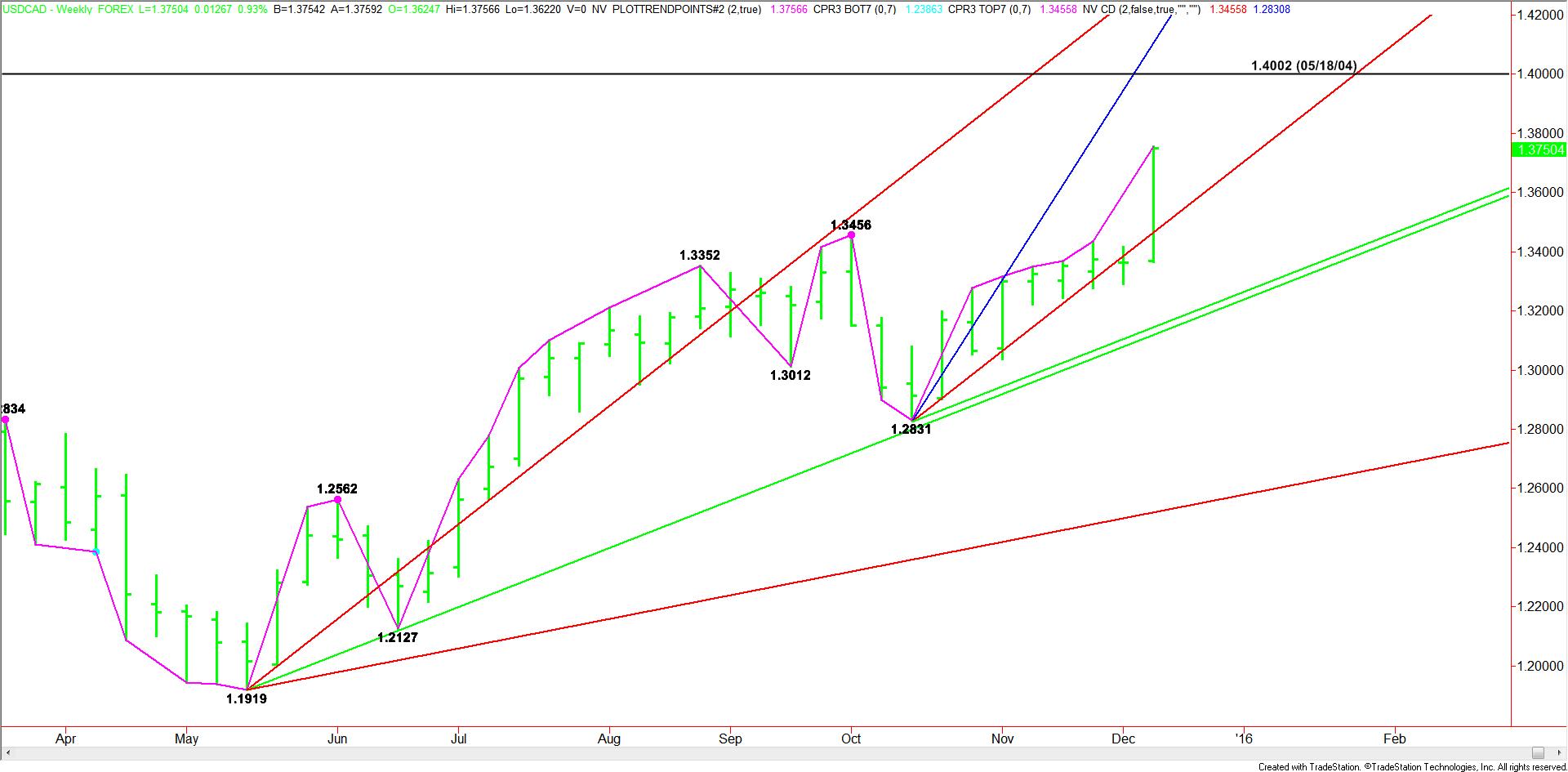

Technical investors have two choices: you can buy value or you can buy strength. After reaching a high of $1.4000 the week-ending December 18, the USD/CAD is drifted sideways-to-lower. The top occurred two days after the Fed raised rates, which suggests the rate hike was already priced into the market.

Based on the end-of-the-year close, the first potential support is an uptrending angle on the weekly chart at $1.3711. This angle has provided guidance for 11 weeks, or since the USD/CAD bottomed at 1.2831 the week-ending October 16.

Watch for a technical bounce on the first test of this support angle. This will be the first sign that buyers are coming in to support the market.

If the angle at $1.3711 fails as support then the selling pressure may extend into a major value zone at $1.3415 to $1.3278. This is the best area to go long for the next drive through $1.4000. However, the commodity funds are going to have to allow the market to reach this zone since they are holding onto long USD/CAD positions.

Finally, if there are no corrections and the buying picks up with the start of the new year, then investors may be forced to buy strength if $1.4000 is taken out with conviction.

Conclusion

In summary, the fundamentals support a bullish USD/CAD scenario. These fundamental factors are not short-term events tied to the weather, but real, long-term policy decisions so conditions aren’t likely to change. Our plan is to try to get long the Forex pair this week for an upside play that lasts most of the year. Sure, there will be normal counter-trend swings, but for the most part, the trend is expected to be up in 2016.