This guest article was written by James Hyerczyk, financial analyst at FX Empire.

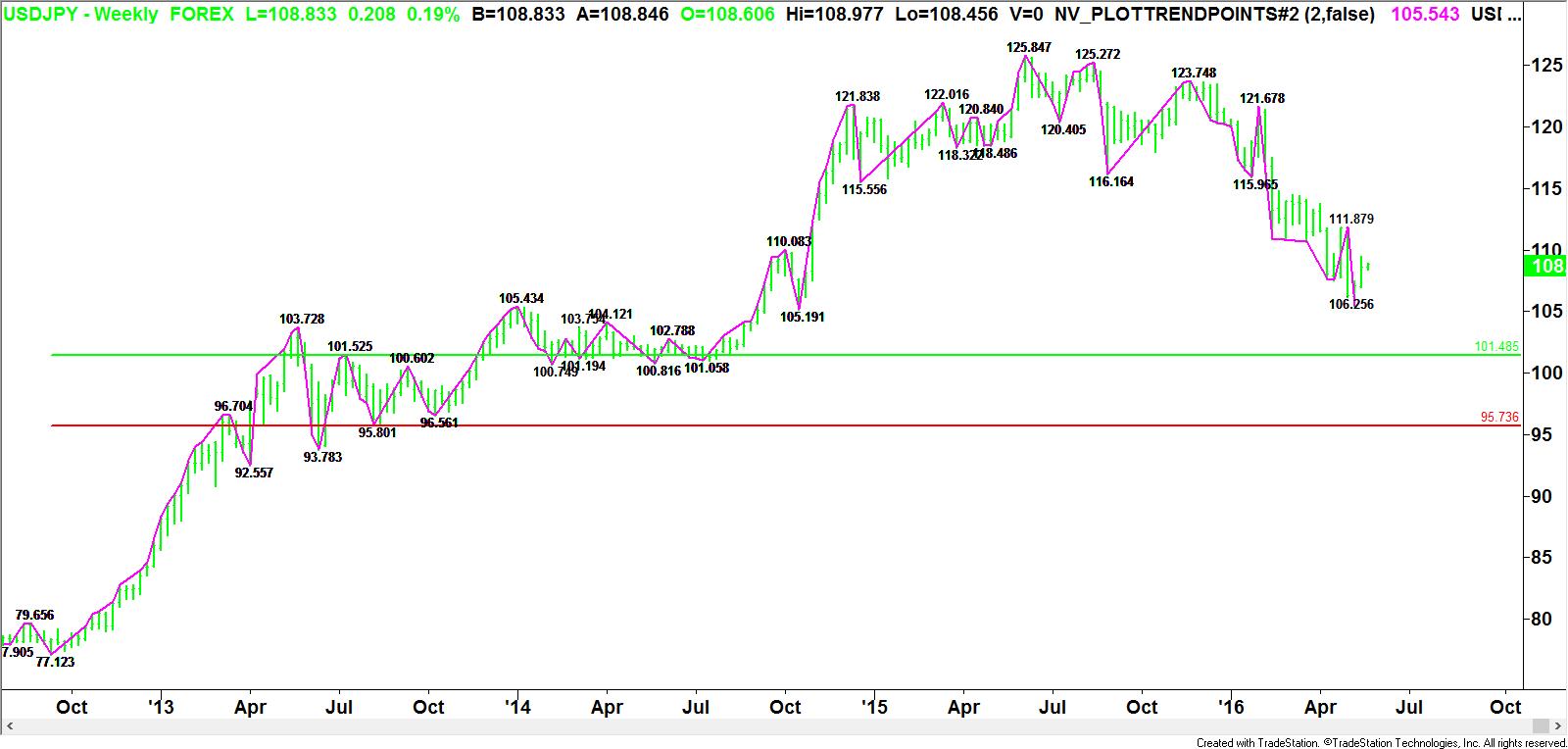

WEEKLY USD/JPY

Volatility could be in play this week for the USD/JPY with the release of Japan’s first quarter gross domestic product data on May 18. Traders expect Japan’s GDP to show the economy expanded a scant, annualized rate of 0.1 percent in January-March, after a 0.3% percent contraction in October-December.

There are likely to be some market swings if the results were to come in much weaker than expected. If the GDP number is weak, Japanese equities will probably fall initially and bolster safe haven demand for the Japanese yen. The yen might retreat later, if such an outcome leads to some form of economic policy response by the government such as shifting toward delaying a sales tax hike set for next April.

Technically, the main trend is down according to the weekly swing chart. If the selling pressure resumes then look for the USD/JPY to eventually challenge the bottom from the week ending October 17, 2014 at 105.191. This could eventually lead to a test of the major 50% level at 101.485.

If buyers come in, then look for a surge to the upside. The main upside objective is the main top at 111.879.

A neutral report is likely to hold the market inside the 111.879 to 105.191 range. If this scenario develops then look for a choppy trade on both sides of its 50% or pivot at 108.535.

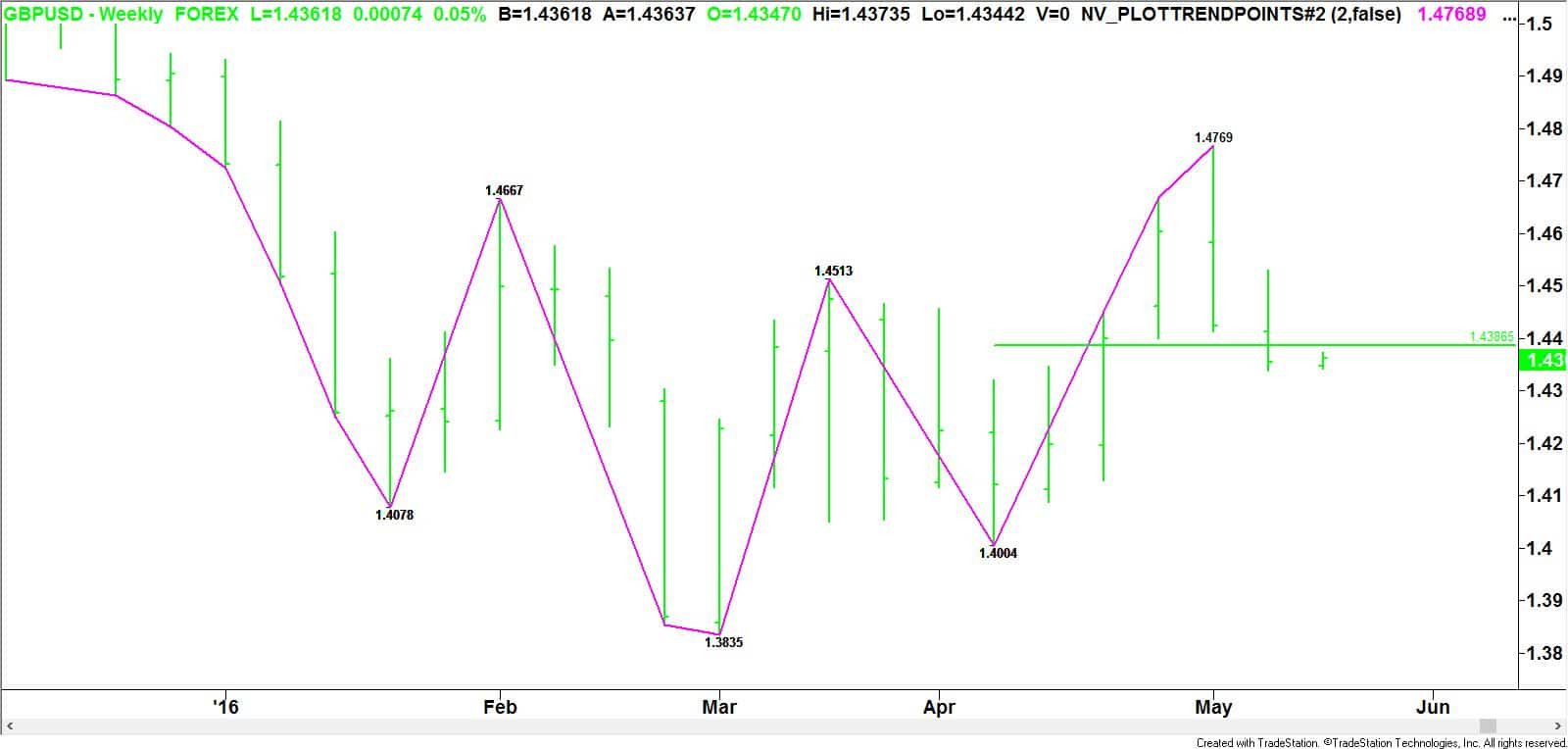

WEEKLY GBP/USD

Although GBP/USD are primarily focused on Brexit at this time, especially after last week’s warning from the Bank of England of the negative impact leaving the European Union will have on the UK, traders will take time this week to react to the latest inflation figures on May 17, the UK unemployment data on May 18 and the UK retail sales report on May 19.

UK CPI is expected to remain unchanged at 0.5% in April. Core CPI is expected to ease to 1.4% from 1.5%. If the reports come out as estimated then this will signal that the recent firm showing is moderating.

UK unemployment data and jobless rate is expected to stay at 5.1% in the three months to March. The earnings portion of the report is expected to show a slight slowdown from 1.8% to 1.6%. However, excluding bonuses, the underlying trend could inch up from 2.2% to 2.3%.

Retail sales are expected to show the volume of retail sales bounced back from -1.3% in March to 0.6% in April.

Weaker than expected readings will be strong indications that the economy is already reflecting a negative impact from a possible UK exit from the European Union.

The weekly GBP/USD chart indicates that the key level to watch this week is the 50% level or pivot at 1.4386. A sustained move under this price will give the Forex pair a strong downside bias. Recapturing this level and sustaining the rally will shift the bias to the upside.