This guest article was written by James Hyerczyk, financial analyst at FX Empire.

On Thursday July 28 the Bank of Japan will begin a two-day monetary policy meeting. The recent price action suggests that investors are anticipating new stimulus from the central bank. Additionally, the prevailing risk-on mood in the global equity markets has also been supportive for the USD/JPY.

This month’s upbeat U.S. economic data has also underpinned the U.S. dollar with investors shifting the chance of a Fed rate hike before the December meeting from 20 percent to 60 percent.

The Japanese yen has been on the defensive since its post-Brexit low at 98.887 on June 24. The initial reaction from this low was likely short-covering and profit-taking due to technically oversold conditions, however, the real buying appears to have come in on July 11.

The USD/JPY surged on July 11 after Japanese Prime Minister Shinzo Abe won a sweeping victory in elections to the upper house of parliament. At this time, Abe also confirmed that an economic stimulus package would be compiled within a day. Based on this news and the subsequent price action, I have to conclude that the Bank of Japan’s new stimulus plan has already been fully priced into the market.

Unless the BoJ knocks it out of the park with proposals the market hasn’t seen before, the USD/JPY is likely to break from current highs as the news will likely trigger a wave of profit-taking.

Of course, the BoJ monetary policy statement will be released two days after the U.S. Federal Reserve’s monetary policy announcement. If the Fed continues to stall with its plans to raise interest rates and the BoJ comes in softer than expected, we could see a substantial break in the USD/JPY.

Currently, traders are pricing in a 20 basis point rate cut by the BoJ and 3 trillion yen of additional quantitative easing. In order to sustain the USD/JPY rally and get it above the 110.00 target, the BoJ is going to have to do more than just increase quantitative easing.

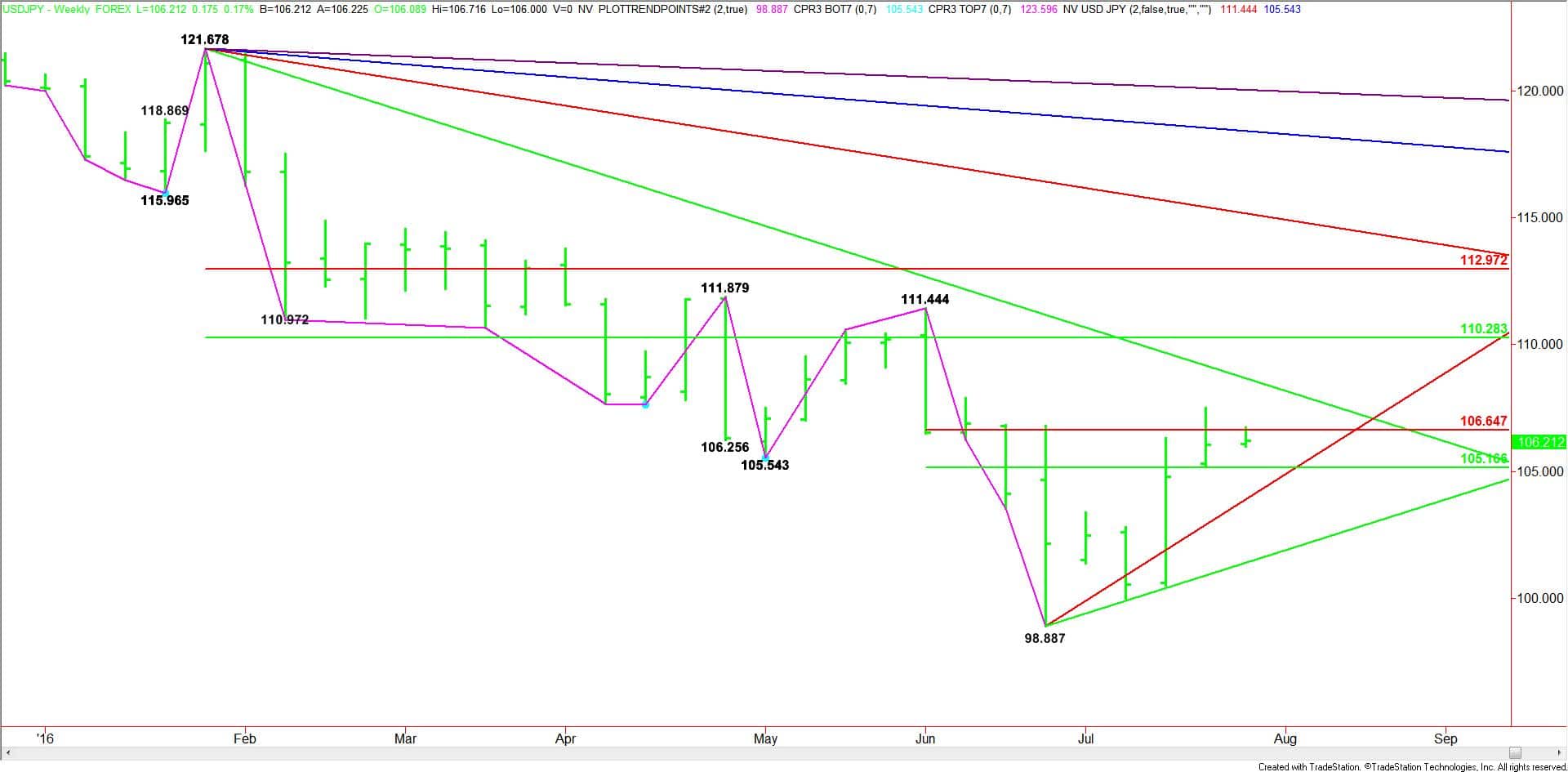

Technically, the main trend is down according to the weekly swing chart. The trend will turn up on a trade through 111.444. The downtrend will resume on a trade through 98.887.

The main range is 121.678 to 98.887. If there is a breakout to the upside then its retracement zone at 110.283 to 112.972 will be the primary upside target.

The short-term range is 111.444 to 98.887. Its retracement zone at 105.166 to 106.647 is currently being tested. Trader reaction to this zone will determine the short-term direction of the market.

If the Fed is hawkish and the BoJ provides more stimulus than expected then look for a breakout over 106.647. This could create enough upside momentum to test a downtrending angle at 108.678. This is followed by the main 50% level at 110.283.

If the Fed is dovish and the BoJ disappoints then look for a break through the 50% level at 105.166. This is followed by an uptrending angle at 103.887. A failure at this angle could trigger an acceleration into 101.387.

Watch the price action and read the order flow at 105.166 and 106.647 this week and especially after the BoJ monetary policy announcement. Look for a bearish tone to develop on a sustained move under 105.166 and a bullish bias to develop on a sustained move over 106.647.