This article was written by John Benjamin, market analyst at Orbex.com.

The Japanese yen is at it again! Or rather yen speculators to be more precise. It has been an interesting year for yen traders, especially on the USD/JPY currency pair. To put it one way, it has been all about yen speculative positioning versus the Bank of Japan's monetary policy which started off early on in January this year.

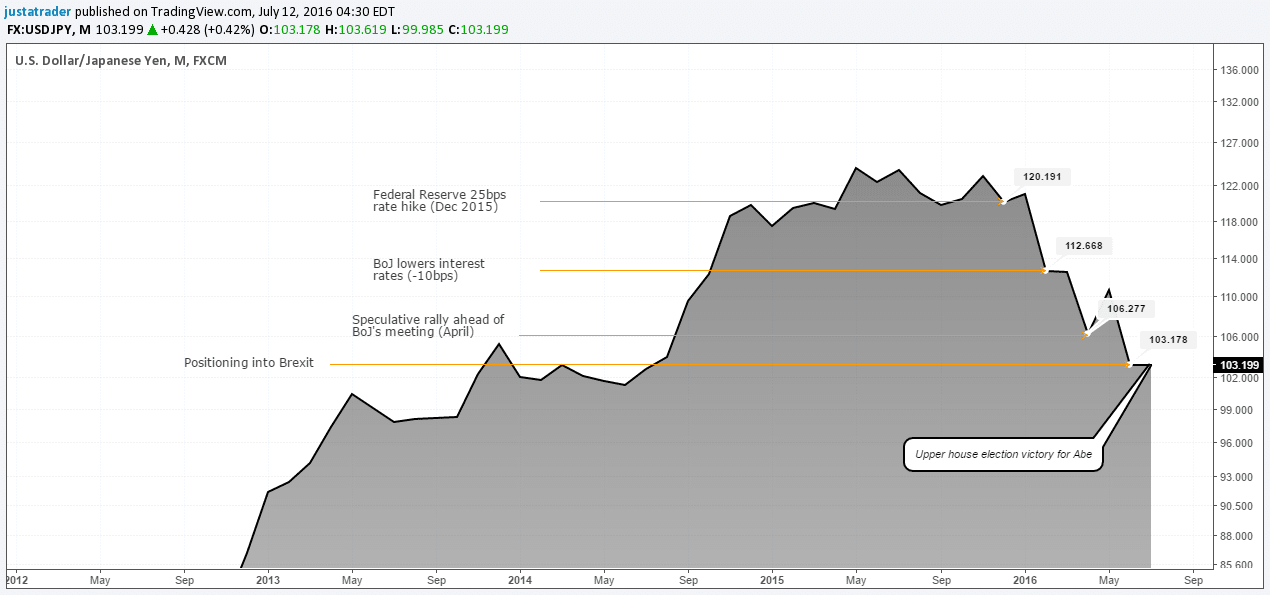

The Bank of Japan stunned the markets in early January by cutting interest rates into negative at -0.10%. The US dollar, which had been steadily declining following the December 2015 rate hike from the Fed, briefly strengthened against the yen only to give up the gains just as quickly. After falling to lows of 106.277 yen by the end of March, the US dollar managed to retrace some of the gains by early May only to resume its declines yet again.

After the BoJ’s initial monetary policy salvo, speculators started paying special attention to the yen crosses, and this was seen at the height (or rather the trough) of the declines when in April, speculators rushed to offload their long yen positions ahead of the April’s BoJ monetary policy meeting. Thanks in large to the article by Bloomberg, the markets saw extreme positioning selling the yen, but it eventually caught traders by surprise as the Bank of Japan held monetary policy steady.

“Having adopted a negative interest rate on some excess reserves to penalize financial institutions for leaving money idle, the Bank of Japan may consider helping them lend by offering a negative rate on some loans, according to people familiar with talks at the BOJ.” ~ Bloomberg.com

The USD/JPY rally to local highs of 110.7 yen was short-lived with the pair quickly falling back below April’s lows of 106.277. BoJ Governor Kuroda maintained that the central bank was committed to achieving the 2% inflation target rate. The strong market positioning ahead of the event obviously fell through as a result.

In May it was all about verbal interventions and threats from the BoJ and Japan’s Finance Ministry about possible intervention. However, speculators grew bolder by then following the US Treasury’s report on currency manipulation which pointed to Japan among other countries for actively engaging in keeping the Exchange rate low to boost trade.

"Pursuant to the Act, Treasury finds that no economy currently satisfies all three criteria, however, five major trading partners of the United States met two of the three criteria for enhanced analysis. Treasury is creating a new “Monitoring List” that includes these economies: China, Japan, Korea, Taiwan, and Germany." ~ US Treasury report on currency manipulation

The comments were in reference to the countries listed that were actively engaging in “one-sided intervention in the foreign exchange markets.”

Following the arguments back and forth between Washington and Tokyo, Japanese officials toned down their rhetoric knowing very well that the upcoming Brexit referendum would continue to keep yen speculators bullish. It was no surprise then that in early June, the BoJ opted to keep rates unchanged.

The first chart below outlines the above timeline of events over the first 6 months of 2016.

USDJPY, Monthly Chart – 2016 with timeline of events

Japanese yen – looking ahead

The latest fundamental catalyst behind the yen’s recent two day gains has been the weekend elections in Japan. Shinzo Abe’s Liberal Democratic Party (LDP) won with a decent majority in what some see as an approval for his Abenomics. While Abe had previously put off the proposed sales tax hike, he signaled that the government would be looking at launching fiscal stimulus measures.

The yen weakened by Monday’s close (11/07/2016). The Bank of Japan's monetary policy meeting is scheduled for July 28/29 and expectations start to mount once again that the Bank of Japan could pull the monetary policy trigger once more.

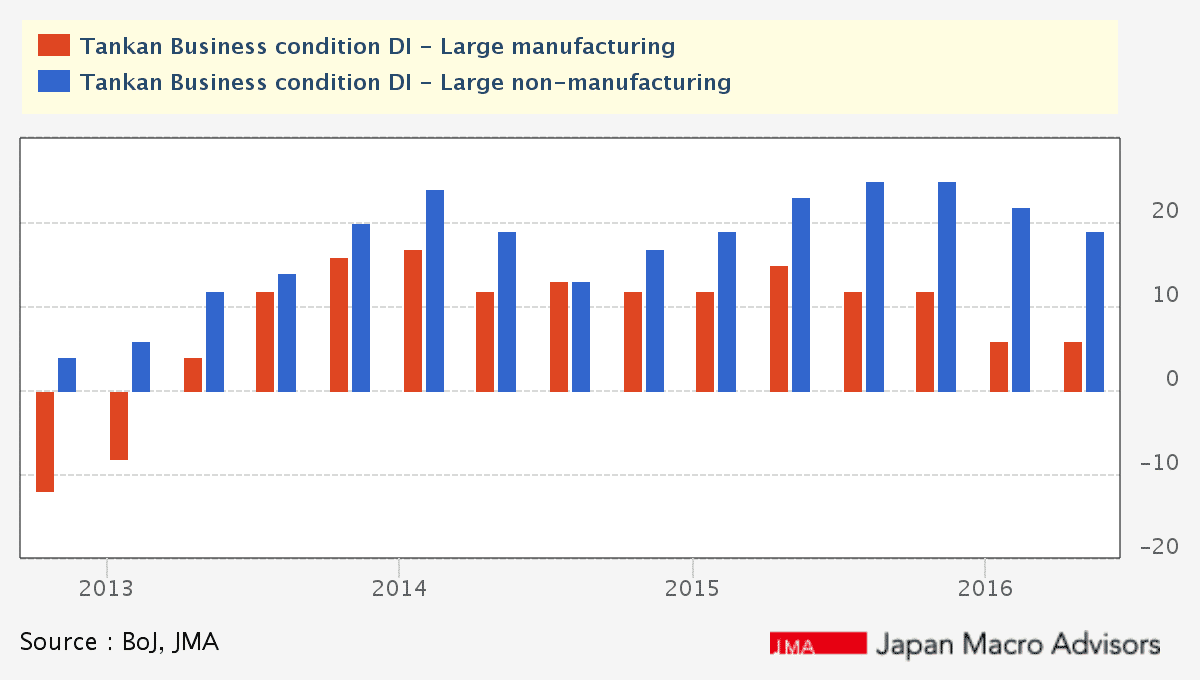

Indeed, this time, around, there is a higher chance that it could indeed act. The second quarter Tankan surveys for manufacturing and non-manufacturing showed an unchanged print. The BoJ's June Tankan survey showed that business conditions for large manufacturers in Japan were unchanged from 3 months ago at 6. The non-manufacturing survey deteriorated to 19 from the level of 22 a quarter ago. Businesses upped their forecasts for the yen at 111.41 yen to the dollar compared to previous forecasts of 117.46 yen.

BoJ Tankan Survey, June 2016 (Source: Japan Macro Advisors)

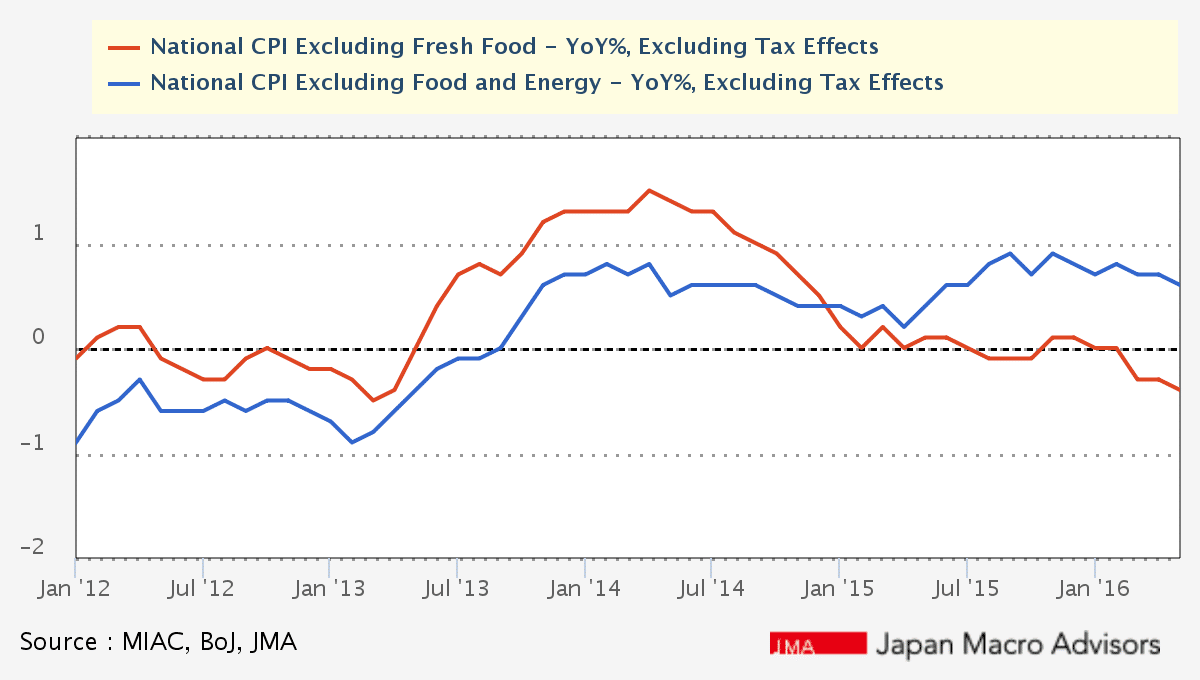

Inflation also remained weak as of June’s reading for May. Japan’s core inflation fell 0.40% in May, compared to a year ago indicating that the underlying inflation continues to weaken.

Japan National CPI y/y 0.40% (Source: Japan Macro Advisors)

With the uncertainty surrounding the Japan’s upper house elections done with, and the fact that there is some normalcy returning to the UK with news of Theresa May likely to become the UK’s next Prime Minister, the markets are likely to see a period of relative calm at least as far as the Brexit uncertainty surrounds.

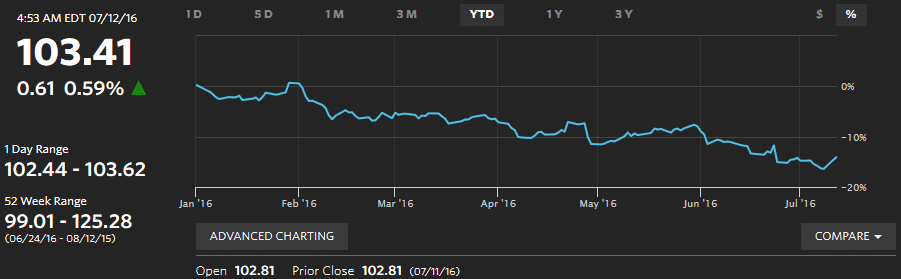

From a technical perspective, USDJPY is currently showing signs of a strong recover from the lows of 99 – 100 seen during the Brexit verdict. In the near term, USDJPY is likely to remain to range within 104 – 106 and 102 levels with a potential breakout likely to come closer to the BoJ’s event. Following the breakout above 106, USDJPY clearly shows the potential for a rally towards 116 – 117 support level which held since late 2014 and was breached in February this year.

USDJPY – YTD performance: -14.00% (Source: WSJ.com)

For a currency pair that has currently down around 14%, it wouldn’t be too surprising to find USDJPY regain some of its declines and perhaps close 2016 on a flat note.