London-listed Plus500 (LON: PLUS) has allocated an additional $100 million for its share buyback programs, the broker announced today (Tuesday). It was a part of the company’s returns to shareholders, which also included a dividend payment of $75 million.

Shareholder Returns and Performance

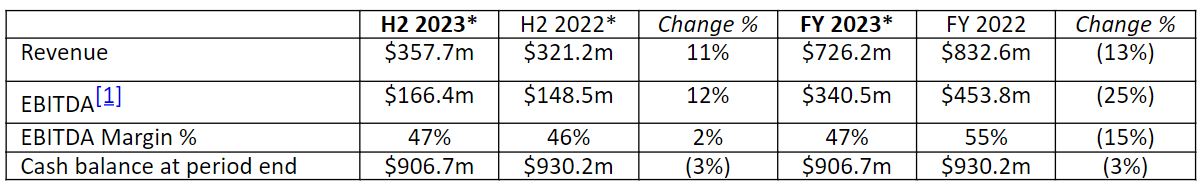

The company decided to return $175 million to the shareholders as it ended the fiscal year 2023 with a group revenue of $726.2 million, 13 percent lower than the previous year. The total figure comprised $674.3 million in trading income and $51.9 million in interest income.

In the fiscal year, the Israeli broker generated $340.5 million in EBITDA, down 25 percent. The EBITDA margin also dropped 15 percentage points to 47 percent.

Despite the yearly decline, the broker's performance improved significantly in the second half. Between July and December, the broker generated $357.7 million in revenue with an EBITDA of $166.4 million, a yearly increase of 11 percent and 12 percent, respectively.

Buyback Continues

Plus500 has been buying back its ordinary shares from the open market for a few years now. In the last fiscal year, it bought back $257.5 million worth of shares and distributed $90 million in dividends.

The company highlighted that it initiated the share buyback in 2017 and repurchased 36,651,165 ordinary shares, amounting to a total of $0.6 billion, at an average price of £13.52 per share.

The latest trading update detailed that 90,944 new customers joined the brokerage platform in the fiscal year 2023, a dip of 15 percent from the previous year. The active customers on the platform also dropped 17 percent to 233,037.

“Three years ago, Plus500 presented its new strategic plan to become a global, multi-asset fintech group, by expanding into new markets, developing new products, and deepening relationships with customers,” Plus500’s CEO, David Zruia, said. “2023 saw further progress against all three strategic objectives.”

“All of this strategic progress has led to our FY 2023 results being significantly ahead of market expectations.”