2013 can be most certainly regarded as an eventful year in the FX industry as a whole. Whilst companies in the institutional and retail sectors approached the beginning of the year with trepidation, licking the wounds of what had turned out to be a year of very low trading activity, a complete reversal took place, empowering many firms and driving forth mergers, technological advancements and corporate restructures, leading to market participants viewing a landscape which is somewhat different today than it was just twelve months ago.

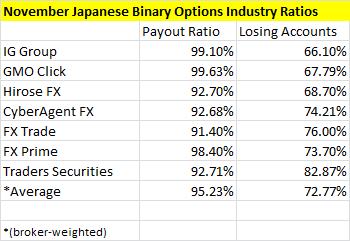

Regulation On Location - Japan Creates Binary Options Structure

Just two years after Cypriot financial services regulatory authority CySec set rulings in place which categorized binary options as a financial instrument, Japan's Financial Services Agency (JFSA) has followed suit.

This time, however, stringent criteria has been applied, which has led binary options platform providers MarketsPulse, TechFinancials, TRADOLOGIC and SpotOption to re-engineer their platform offerings in order to fit the requirements set forth by the JFSA.

The new platforms were showcased at the Forex Magnates Summit in Tokyo in August this year, where the general consensus was that the new rulings should serve to benefit the industry insofar as that it intends to create a framework by which binary options products can be sold in Japan, which is a very large market for retail OTC derivatives, therefore engendering longevity within firms wishing to establish operations in Japan, and providing a means by which companies can establish a uniform business model.

Binary Options Generated More Profit Than Forex

In Japan In November 2013

Whilst the JFSA's final rulings precluded the provision of short-term options, it did spur the platform providers into re-engineering their technology solutions with a view to embracing the Japanese market.

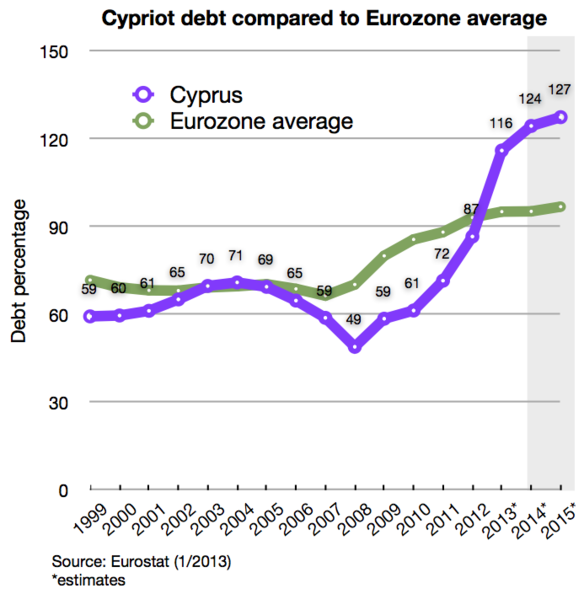

A Blustery Start For Cyprus

Whilst Japanese authorities worked on establishing a bona fide business environment for binary options, its forerunner began to experience financial woes on a national scale.

In March this year, Cyprus, home to over 135 FX and binary options companies, experienced a situation in which both of its national banking institutions, Laike Bank and Bank of Cyprus, became insolvent and required a bail out from the International Monetary Fund (IMF).

National Debt in Cyprus

Led To Insolvency of Two Major

National Banks

For the first time ever, the IMF did not agree to an unconditional bailout, instead insisting that customer deposits were seized by banks as part of the fiscal realignment, which in some cases equated to 60% of the account holders' funds. Doubt hang over Cyprus' future as a viable and cost-effective jurisdiction in which to establish an FX firm which can attract a worldwide client base as customers became concerned for the security of the funds deposited with brokers, however the industry emerged triumphant and still continues to succeed in Cyprus due to the ability to section operational capital away from the island itself.

Business As Usual:

1,500 FX Executives Attended

iFX EXPO in Cyprus In May

Indeed, in May, just two months after lines of customers formed to withdraw funds from the two banks, the iFX EXPO took place, hosting 1,500 senior industry figures from around the world, and companies in Cyprus showing no sign of the banking crisis having impeded them whatsoever.

On the contrary, CySec continued to issue licenses, and the industry continued to grow, with many Cyprus-based firms expanding internationally and opening offices in London and the Asia-Pacific region. An interesting dynamic however, was that despite the increase in brokers registering in Cyprus, a handful of new registrants immediately canceled their CySec licenses and headed toward the auspices of London's Financial Conduct Authority for European business.

North America - Institutional FX Reigns Whilst Retail Firms Pack Their Bags

Despite the huge volumes experienced during the early part of the year among Japanese firms, the results of companies elsewhere demonstrated a disparity between Japan and the rest of the world, with Alpari having deemed its US operations no longer a viable venture and announced its plans to exit the region completely in September and hand its retail accounts over to FXCM, despite an overall strong performance over four months during the middle of the year, culminating in a $250 billion monthly combined volume figure in November this year.

Alpari's decision to pack up and leave the US represented a recent example of the general move in that direction by retail FX firms, with FX Solutions having been among the first to do so in February this year, leaving just a handful of companies to serve the retail FX market's American client base.

The remaining firms, however, have engaged in M&A activity this year, creating what could be viewed as almost a monopoly with GAIN Capital having purchased GFT during the course of the year for $40 million in cash plus extras, with GAIN Capital itself having been an acquisition target earlier in the year with FXCM making an unsolicited bid to purchase the firm.

GAIN Capital's response was to acquire GFT, itself a broker which had eschewed the US market during the last few days of 2012, in order to stave off acquisition interest by FXCM - a plan which indeed worked.

In November, FXCM revisited corporate acquisitions, although this time rather than holding rival FX firms in its sights, put up an initial $5 million cash payment for a 50.1% stake in FX intelligence firm Faros Trading, as well as Canada's OANDA Corporation having bought Currensee, giving rise to a perspective that North American firms are beginning to seek diversification by way of mergers and acquisitions, as well as novel ways of expanding their client bases.

Swissquote acquired MIG Bank at around the same time as this year's extensive North American merger and acquisition activity took place, along with significant structural changes at the top of the UK division of Alpari, which waved goodbye to CEO Daniel Skowronski, a vaunted industry leader who took the firm from its domestic market-orientated Russian origins, to global success as one of the largest FX firms in the world today.

Alpari's UK CEO Daniel Skowronski

Departed For Pastures News

A series of changes at the top has blighted City Index this year, with a number of key personnel having departed, not all of which were voluntary, and in North America, OANDA Corporation commenced the year by appointing several key figures, only to undergo a further restructure at the end of the year which saw the end of K Duker's tenure as CEO.

Technology - Software Firms Go Open Source After MetaQuotes Debacle

Whilst many FX firms were reveling in the successful start to the year, retail FX platform provider MetaQuotes had other ideas, and set about antagonizing the software companies which had designed an entire ecosystem of Liquidity bridges, trading signals and copy trading solutions, as well as the brokers who use them.

MetaQuotes' initial onslaught was to block MT4i's interface in April this year, then follow this up by releasing software upgrades to the MetaTrader 4 platform which ensured that certain ancillary software no longer functioned in accordance with the platform, and eventually issuing a warning on its broker support website against the use of Zulutrade, Tradeo, myfxbook and Tradency.

There is an adage among software developers that sometimes unexpected factors can drive the evolution of technology, and most certainly this applies here, as the entire copy trading and third party application sub-sector has headed toward an open-source methodology, embracing new platforms and allowing full customization, and in the case of Tradency, partnering with CFH in order to gain a distribution channel via institutional B2B business.

A furore ensued MetaQuotes' draconian treatment of ancillary software firms, leading to newcomers in the market such as cTrader and tradable being adopted by firms wishing to provide a more flexible solution to their client base, with equities platform firm NinjaTrader eyeing the FX space, and PFSOFT looking toward increasing its presence.

Despite the platform firms and copy trading companies concerned having taken a dim view of MetaQuotes' actions, brokers and traders continue to provide the ubiquitous platform, including a remarkable switch by some of the UK's CFD and spread-betting orientated companies toward MetaTrader 4, as exemplified by IG Markets and ETX Capital, in a bid to increase their client base away from the UK where proprietary platforms are favored, thus reinforcing the continued demand for such a standardized platform among retail traders.

On the institutional side of the business, things are somewhat different, with regulatory factors having driven the advancement of technology.

In the United States, the Commodity Futures Trading Commission (CFTC) and Securities and Exchange Commission (SEC) issued final rulings on the means by which OTC derivatives firms can be operated according to the Dodd-Frank Act.

Changing The Landscape Of Electronic Trading:

Dodd-Frank Act

Final Rulings on FX Set In Place

Three Years After President Barack Obama Signed It In

One of the major changes in technological landscape was the introduction of Swap Execution Facilities (SEFs), which were set in place in order to generate greater transparency for trade reporting. These, in conjunction with trade repositories, required firms to adopt extremely low-latency infrastructure in order to compensate for the extra layer added to the trade cycle.

Post-trade processing firm Traiana has invested significantly this year in such technology, in order to track trades and monitor credit relationships, which represent one of the biggest headaches that financial firms deal with.

When it comes to trades, there is a maze of post-trade flow that needs to be processed for each execution. For each transaction, beyond the basics of price, size and instrument, a broker needs to report on a huge array of details. Such information can include the trade counterparty and on whose behalf the execution was made, whether it is a direct trade or a prime-brokered trade, or whether it was executed on an anonymous or disclosed platform.

The company created its Harmony product which is a cross-institution network that connects PBs, EBs and buy-side clients. The effect of the introduction of this network was that it not only provided users with post-trade monitoring services beyond their own walls, but expanded the messaging capabilities to counterparties.

The approval of SEFs by the US authorities came thick and fast this year, with many firms having been granted temporary SEF registration with a view to permanency based on the companies carrying out their duties correctly, with European firms due to follow during 2014, and the Asia-Pacific regions such as Singapore expected to follow suit in approximately one year's time.

The continued success and world-leading business acumen of the established US institutional firms does not, however, equal immunization from demise. FX Concepts, the oldest FX hedge fund in North America, lost its last institutional client this year after a series of poor fund performance.

2013 Saw The Demise of FX Concepts

After 32 Years In Business

Forex Magnates broke the news of the corporate demise of FX Concepts, and the loss of its last mandate some two weeks prior to it becoming available via any other source worldwide. The fund, started in 1981 by John Taylor, had $14 billion in assets under management on its books just six years ago, reducing to zero and resulting in bankruptcy in October.

Venues In Emerging Markets Go Mainstream

With low latency connectivity between venues and trading desks having improved dramatically this year, executing venues such as Moscow Exchange and the Dubai Gold and Commodity Exchange have set their sights on becoming coveted venues among institutional traders. With Russia defining a regulatory structure for FX as an asset class, and indicating that the ruble could become a feasible major currency, infrastructure firms began to experience demand for points of presence between Moscow and London, the world's largest financial center and home to many institutional firms.

The Importance of Dialog

The international FX industry engaged in a series of highly important conferences this year, commencing with the iFX EXPO in Macau in January, where Asian brokers and vendors came together with foreign technology and Liquidity Providers , and more than anything showed how big this market is and that there’s huge room for growth.

Traditional Ceremony Meets Modern

Technology At iFX EXPO Macau in January

The iFX EXPO made its way to Cyprus at the end of May, hosting retail and institutional firms in every sector of the business worldwide for a two-day event, featuring panels where subjects ranging from innovation to liquidity, to the viability of Cyprus as a hub for FX firms post-financial crisis.

Japan's capital city of Tokyo hosted the Forex Magnates Summit just a few weeks later, concentrating on the latest advancements within the most highly acclaimed market for retail FX in the world, among which brokers indicated that they would onboard platforms which are often more synonymous with Western markets, such as MetaTrader 4 and tradable's uptake by MONEX Group.

The Forex Magnates London Summit welcomed 900 senior industry executives in November, where the majority of the discussion centered around institutional FX, with HFT and the technical and regulatory challenges it faces being discussed, following European rules to stem it, and Australia's acceptance of dark liquidity as part of the landscape, as well as most of the HFT-related expertise being situated in North America.

This particular event represents a highly prestigious entry in the FX industry's calendar, with some unique opportunities for the world's FX industry leaders to take their part in driving the industry forward, including a special networking event, under the designation of "Networking Blitz" in which key executives could engage in a short but valuable one-to-one meeting before moving to the next table to network with further influential FX industry professionals.

The annual awards ceremony was presented by Forex Magnates' CEO Michael Greenberg, featuring candidates representing each category within the industry as a result of careful consideration based on a series of criteria, and the popular and exciting Elevator Pitch in which new innovators are provided with a platform and a short time in which to demonstrate their innovations to the world's key figures, with an award being presented to the most interesting, this year being payment processing firm SafeCharge.

Networking In London's Financial District

During the discussion panels, industry leaders debated the future of algorithmic trading among institutions and how this specialist side of the business will adapt as the technology changes, and rules tighten. The world of electronic trading is one which makes constant technological advancements, with state-of-the-art systems continuously arriving on the market, therefore is poignant among institutional participants.

Within the heart of London's financial district, attendees and delegates were able to conclude the proceedings with an evening party, during which further highly valuable networking within the prestigious venue in the world's largest financial center was conducted.

FX Liquidity A Major Discussion Point

At Forex Magnates London Summit

The Good, The Bad And The Ugly

Indeed, when reflecting on a year during which so much has taken place, it is impossible to avoid the inevitability of firms and individuals having been censured for transgressing legal parameters.

This year has been no exception, however with regulatory authorities becoming increasingly vigilant, as in the case of Australia's ASIC which has garnered a number of enforceable undertakings against FX firms by using its automatic surveillance system.

North America continued to hand down very large fiscal penalties via the CFTC, and in the case of one particular transgressor, a 15-year jail sentence.

One of the most interesting of such cases on US soil this year was that of the CFTC's lawsuit against binary options brand Banc de Binary for unlawfully soliciting clients in the US, despite OTC binary options not being permissible.

This spurred a discussion between binary options firms as to whether developing exchange-compatible platforms is a worthwhile venture, along with partnering with NADEX or Cantor Exchange. The outcome of this suit is not yet finalized, however the prominence of such exchanges was reinforced in the latter part of the year when NADEX CEO, Yossi Beinart was elected to head the prestigious Tel Aviv Stock Exchange.

New Zealand, previously regarded as a jurisdiction with relatively light regulation and a springboard to the Asia-Pacific region, has developed its regulatory stance toward FX firms, with the recently invoked Financial Markets Authority having thrown the book at the orchestrator of the country's largest ever Ponzi scheme, resulting in a 10-year jail sentence.

In the UK, the FCA has been engaged in issuing investigations into major banks for manipulating FX benchmarks, with stratospheric fiscal penalties for those involved.

Money laundering into and out of FX firms via third party payment providers was a focus for the United States' authorities, in addition to the activities of FX firms themselves this year, with Liberty Reserve having been seized by the government in May, followed by the arrest of its founder Arthur Budovsky Belanchuk and his extradition to the United States for trial.

Vladimir Kats, one of the firm's founders, pleaded guilty in November this year for his involvement in the raking in of nearly $6 billion in illegal proceeds, and with many smaller FX firms unable to conduct business in jurisdictions such as the Middle East and Africa as this was a popular method of transferring funds to FX firms from such regions.

Bitcoin - Was George Orwell Right?

The envisioning of a cashless society had been a daunting one 65 years ago during the writing of dystopian novel '1984' by George Orwell.

It appears that in 2013, this line of thinking has gone full circle, and crypto-currency is becoming regarded as a very exciting instrument.

Not only has it become recognized as an actual currency, under the symbol BTC, but prices have soared according to high demand and difficulty of mining, rising to $247 to 1 BTC during the period affected by the Cyprus bank crisis, and then passing the $1000 to 1 BTC mark this December.

Technology aimed at making BTC transactions more accessible is currently being pioneered in Israel and Canada, with an actual ATM having seen the light of day in Vancouver, British Columbia, and illicit anonymous market places such as Silk Road are being cleared out, further legitimizing the currency as a genuine one.

Argentinian enthusiasts have held several meetups this year, and BTC is becoming a widespread means of payment, with values at a premium over those in neighboring Uruguay due to capital control laws, and the Chinese government had become so concerned that it has attempted to ban the use of it for any transactions, however, German firm Fidor Bank began offering current accounts and traditional banking facilities for BTC this year.

A Terrifying Prospect?

George Orwell Feared Cashless Society

Many literary and social commentators could quite easily argue that the automated surveillance and control mechanisms depicted in Mr. Orwell's dystopian scaremongery 65 years ago have made their way into the every day life of businesses and private individuals, much to the dismay of many, however his portrayal of a cashless society being a terrifying prospect appears to have turned out to be quite the opposite.

A very eventful year indeed, and in this highly versatile, varied industry, next year promises to move the game on further, and advance the cause of how business is conducted. Forex Magnates wishes everyone a very happy and prosperous start to 2014.