Admiral Markets recently launched its CFD Trading Platform , we wrote about this back in January when Admiral received its ASIC authorization. CFD trading becomes more and more important for Forex brokers as they are trying to increase their revenue channels while traders are looking to diversify their portfolio through trading more exotic instruments.

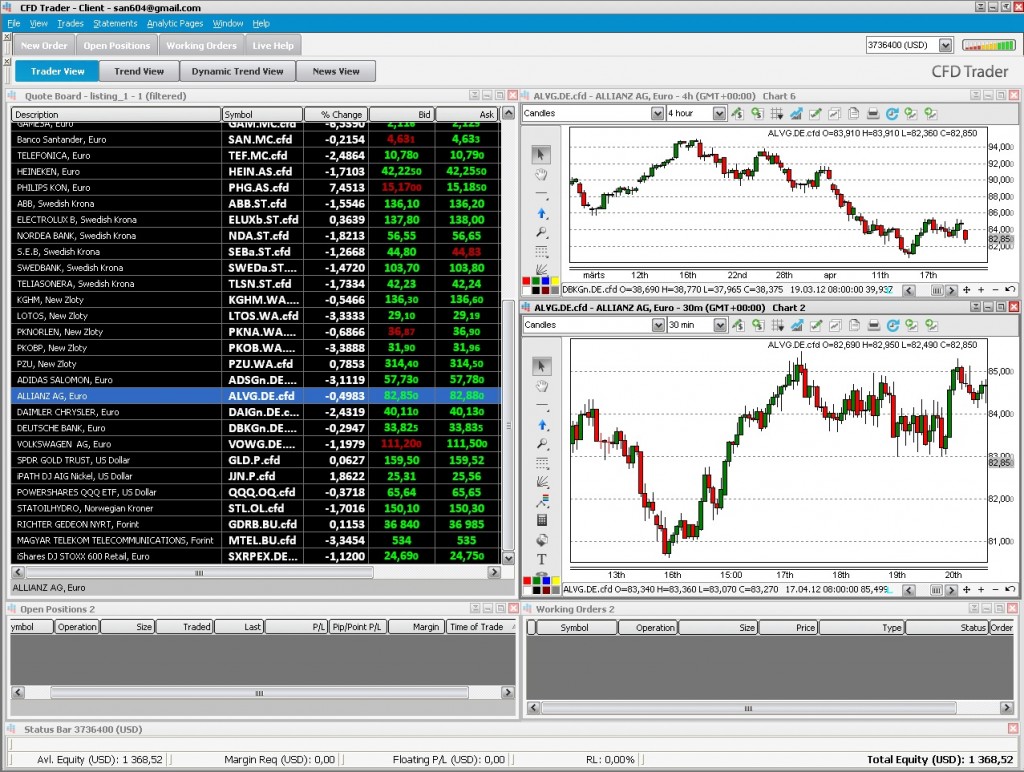

Admiral Markets, one of the EU’s most popular online European brokerage agencies, is delighted to announce the launch of their new CFD platform. As part of their ongoing commitment to offer new trading solutions, the platform is designed to expand the range of markets available to clients, allowing them to profit from the movement of stock markets by trading CFDs for individual equity shares. The new CFD Trader features over 20 local exchanges around the world, more than 2,000 equity CFDs and up to 1:10 leverage for most contracts.

“We believe that this new platform will open up a host of new opportunities for our clients, allowing them to take advantage of the natural movements of markets around the world,” explains Dmitri Laush, Executive Vice President of Admiral Markets. “With more favourable margins and low commissions, CFDs are a great way for new clients to enter the market. This easy to use platform gives them the opportunity to begin to build up a strong trading portfolio that will give them a great return on their initial investment,” he adds.

What are CFDs?

CFDs or Contracts For Differences are agreements between a buyer and a seller that states the buyer will pay the seller the difference between the current value of a share and its value at the end of the contract. So they are basically financial derivatives that allow traders to profit from price movements in both long and short positions. There is no expiration date, so the position is only closed when a second reverse trade is done.

Unlike normal share trading, with CFD you do not have to buy an entire share, which makes the initial outlay lower. Instead, you merely purchase the CFDs traded on the margin. “We ensure that this is an accessible way to enter the financial markets,” comments Dmitri Laush “With Admiral Markets, new clients are able to open an equivalent position of individual equity shares with a margin of just 10% in most of the available markets. That makes it an affordable option, when you compare it to the initial outlay of a full share purchase.

“Obviously, as with any financial transaction, there are risks involved. But in an uncertain financial world, CFDs are more risk-adverse than other, more traditional trading options, and are ideal for clients who have limited experience in other stock options,” he adds.

Try it out today

The new Admiral Markets platform is available to download quickly and easily – simply go to open Admiral.CFD demo and download the CFD platform. “We believe that this is going to bring a whole new level of opportunity to new and existing Admiral Markets clients,” comments Dmitri Laush. “We are always seeking out new ways to improve our client’s trading experience, and we think that these expanded trading tools will give them the ability to find even more ways to enhance their trading opportunities and, bottom line, make more profit,” he concludes.