A little less than a month has passed since the introduction of the new ESMA regulatory framework for retail brokers. As we reported last week, one key aspect which brokers got mandated to disclose is the profitability of traders. While for industry insiders those numbers are not a surprise, the figures can have an adverse impact on onboarding prospective clients.

Granted, if a client is hooked on beating the market, he/she will always dream of being a part of those on average 23.7 percent. However, if we are to take a cue from the first several weeks into the new ESMA regulatory framework, market conditions are changing.

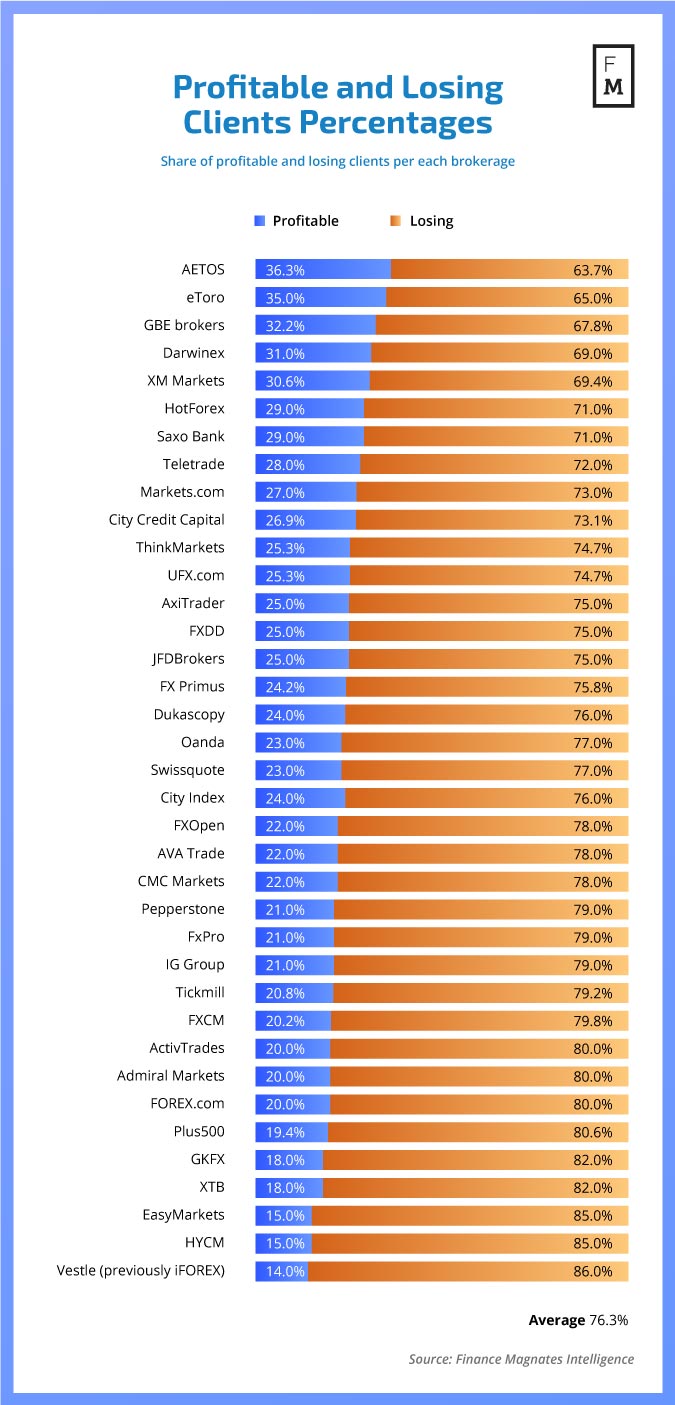

But let's refresh our table from last time:

Percentage of profitable and losing clients per brokerage, Source: FM Intelligence

Marketing Trends

From what we are picking up on the market and from data shared by senior execs of publicly listed companies, the average cost of acquisition of traders is spiraling higher. If we are to follow what brokers with big coffers are doing, the picture gets even clearer.

On Tuesday, eToro announced the biggest football sponsoring deal in the history of the industry. FxPro launched a new Youtube ads campaign, and CMC Markets are adopting a new approach towards marketing to clients. Overall, brokers are committing more and more resources to generating content, be that paid or organic.

All of this is happening because the next several months will be crucial for the long-term survival of brokers. Rising client acquisition costs are only one part of the equation, and the reduction in Leverage available to retail traders is yet to be felt. If scientific data is to be any clue as to what the future holds - the lifecycle of traders is about to change dramatically.

Client Lifecycle Changes

Brokers have been accustomed that the average life of a retail client is close to six months. This has pushed some to neglect the long-term impact on the business model, which ultimately attracted regulatory attention. Let’s not kid ourselves, the primary reason why we have this disclosure mandate in the industry is that regulators got worried.

Note that the figures which brokers have to report are based on the performance of their active clients over the past 12 months. As a diligent commentator on our previous post pointed out, these figures deteriorate over time. The statistical probability of a client being profitable while trading the market over a period of several years gets closer to zero with every passing year.

Brokers universally agree that the reduction in leverage to 30:1 is a step which is going to make traders last longer. It is much easier to lose your deposit at a leverage ratio of 500:1 than at 30:1, hence the changes which the ESMA considered prudent to adopt. We are not going to discuss whether these were the right changes here, what we are going to do instead is focus on what can brokers do to raise their revenues per client over time.

Education, Education, Education

We can’t stress enough that education is probably the most important aspect of gaining a valuable customer. Over long periods of time, active, profitable traders are generating a much more sustainable source of revenues for brokers. Firms which have been operating on a true-STP business model know this, and they have committed significant resources to help their clients avoid snapping into a losing streak.

If brokers are willing to improve the client profitability stats on display on their ad campaigns, a consistent and diligent approach is essential. There are several ways for the companies to approach this matter and a combination of unique strategies might be the most prudent way to beat the new marketing rules.

Tools that provide more information to traders about the market are valuable, but it is also important to use the right tools. Overwhelming clients with information has been one of the strategies used by the brokerage industry for a while. It basically works until it doesn’t, and this is cyclical. Whether you choose to provide market cues from influencers, AI or advanced algo building engines, try to keep in mind that the goal for success now is keeping a client for the long term and generating more revenues from spreads and commissions.

Technology and Execution

This last point I want to make is, of course, quite an important one. Technology has been at the core of this industry ever since it was created. Accurate quotes and execution are the way to gain client loyalty, something that over the years has become less important due to the aggressive competing strategies employed by companies with a questionable reputation.

I remember starting in this market as a trader in 2004 when the space was much tighter and opening an account was much harder - i.e., sending documents by post, translating ID’s, etc. This age is now behind us, but the default leverage at the first decent broker that I used was 20:1. Then came the ads that kept promising more and more leverage.. then came the SNB, now comes ESMA. Time to get a grasp of this new reality and play this game for the long run.