Alpari has ushered in a new component of its investment funds service, which aims to capture financial movements, thereby granting exposure to the Asian emerging markets (EM) realm, according to an Alpari statement.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Alpari presently offers a multitude of investment services and portfolios, many of which are dedicated to the FX space, as well as an emphasis on different classes of assets such as equities, bonds, shares, etc., in multiple economic blocs. In addition to its Asian investment fund, Alpari offers dedicated funds for energy, indices, precious metals, Forex , as well as a balanced portfolio. The broker’s Asian investment fund accomplishes this same end, albeit with an emphasis on EM economies in the Asia-Pacific (APAC) region.

EM investments have been a mixed bag in recent years – after seeing rampant growth in the latter years during the 2000s, EMs reached a nadir of investment last year, culminating in steep losses that were propagated in large part by market turmoil in Chinese stock markets. With volatility in China and the world economy more stabilized at the present, one of the principal economies in Asia, EM assets have once again managed to creep higher, illustrating the potential for growth in the region as a whole.

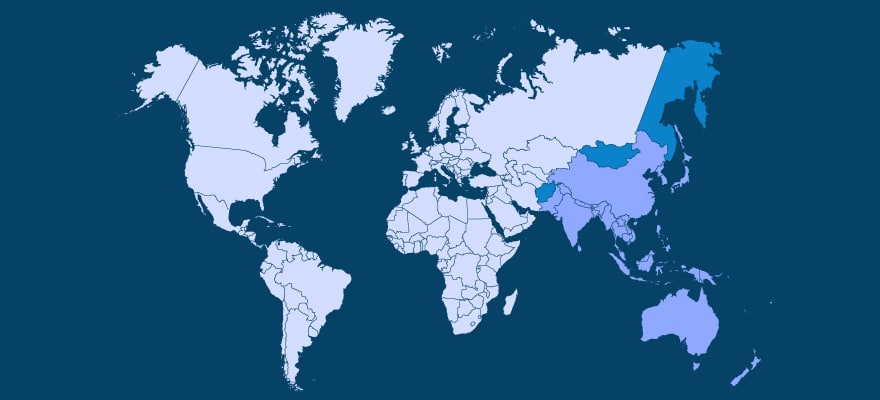

The Asian investment fund was designed to tap into some of the fastest growing economies in the APAC region, including Taiwan, Singapore, China, Hong Kong, South Korea, India, Malaysia, Indonesia, and Thailand, among others. The fund features a balanced exposure to these respective economies, as well as a wide range of sectoral diversification, commensurate in nature with other mutual funds offered by other financial service providers.

Since 2008, Alpari’s Asian investment fund has averaged roughly 12.9% per annum, as well as an 89.5% yield, which factored in the aforementioned period of growth in the region. In tandem with the launch, Alpari has also opted to lower its commissions to 20%, from its traditional 30% seen across its other investment funds.

Alpari made headlines earlier this week after it reported its April 2016 FX trading turnover, rising to $91.8 billion in the month, which was good for a climb of 4.0% MoM.