It is hardly a secret by now that CMC Markets, the established UK-based group, is heading towards an imminent Initial Public Offering (IPO). FxPro and XTB are also eyeing a similar path for 2016 in London and Warsaw, respectively. If the said brokers intend to go public in the near future, they may find themselves joined by other firms.

Such, at least, is the recent chatter in the industry. Market sources suggest that few contenders, including both the usual suspects and some surprising names, are looking to float. On the one hand, similar rumors arose in 2013, and then in 2014, with few results so far, and when it comes to such an ongoing process timetables are never too rigid. On the other, it would make an interesting case to look at the companies various people in the industry allude to, and explain what assets these companies can exploit, and what hurdles they would face, should they aim for the AIM.

Background

The successful IPOs of Plus500 and SafeCharge, in 2013 and 2014 respectively, have spurred a great deal of interest in going public by forex and binary options brokers, media companies and every other type of service provider.

The remarkable surge of Plus500's stock price (a staggering 541% growth from its inception to 770 pence in April) caused pretty much the whole industry to set its sights on an IPO.

Plus500 stock performance

2015, however, has been less welcoming so far. FXPrimus withdrew from its IPO process in Australia, even though it was oversubscribed and fully underwritten, due to the local regulator's unfavorable position. TechFinancials was listed on LSE-AIM, but didn't raise the amount of capital management required and the stock went from 27 pence at launch to as low as 11 pence per share.

Most notably, in May, Plus500's stock plunged after an AML inquiry by the FCA led to compliance revision and freezing UK accounts. The CFD brokerage known for its "marketing machine" sought refuge and was taken over by Playtech with a £459.6 million bid. The deal's approval has not been given yet, arguably as a consequence of the Central Bank of Ireland's opposition to the AvaTrade deal.

Despite these events, sources insist that several industry players are laying down the groundwork to pursuing an Initial Public Offering.

Bforex

Bforex Holding Group, the operator of Bforex, FXGM, and numerous other trading brands, is a strong contender for going public, according to several sources familiar with the matter.

While headquartered in London, BForex is not authorized by the Financial Conduct Authority in the UK or by any other regulator. Consequently, Bforex's site is blocked for residents of various countries, including the UK, the US, Switzerland, Brazil and Israel. According to Analytics website SimilarWeb, most of the traffic to bforex.com comes from the MENA region.

While trading volumes of the main brand are around $14 billion per month, the group operates several other trading names, where it delivers deft marketing schemes translating milder volumes into revenues. Some of these brands, such as FXGM and GTCM,do work under CySEC license. An internal restructuring may pave the way for the group to present a robust balance sheet going down the Plus500 road.

However, if the group's owners do plan to float, they will be required to act in a more transparent way and cope with regulation challenges. In 2013, for example, the Financial Service Committee of the British Virgin Island issued a cease and desist enforcement action against Bforex Ltd for carrying investment business in or from its territory.

One may question the logic behind such a move for a group that at least some of its trading brands are unregulated, with all due consequences. But an Initial Public Offering may bulk up its figures and increase its worth, and whether or not the IPO will eventually materialize, industry sources suggest that Bforex Holding Group is well into the process.

Anyoption

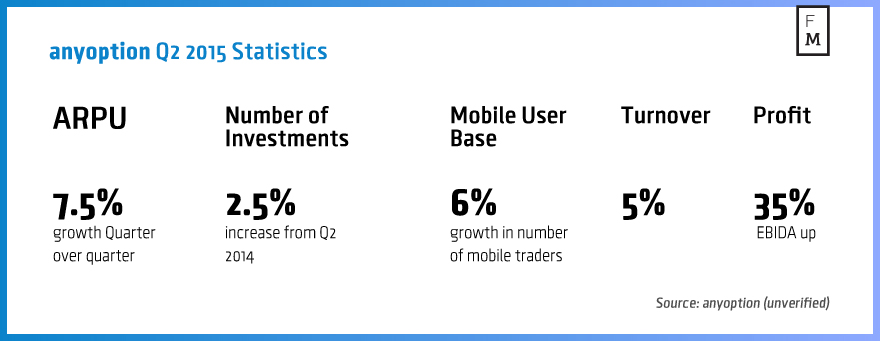

Turning to firms with a higher public offer, a natural name for this list is anyoption. It is considered to be one of the biggest binary options brokers in the world. According to estimations, the company has revenues of $40-$50 million a year and 100,000 active clients a month. It was expected to file earlier this year with a £150 million valuation. However, Finance Magnates has learned that the IPO is still in the making, and will be rolled out when the company "sees fit in terms of market conditions."

24option

Another binary options firm that is always considered a possible candidate is 24option. Possibly the biggest binary options broker in the world, it is making $9-12 million per month in deposits with a margin of about $1.5-3 million.

24option excels in its operations, and as far as marketing is concerned it is among the top spenders on sport sponsorship deals, aimed at engaging traders with the brand. The recent agreement with French football club Olympique Lyonnais was preceded by endorsing German tennis legend Boris Becker, and, more significantly, partnering with Italian Juventus in 2014. 24option remains a lucrative client for agents and clubs in leagues where they are not represented, and among others ends their sponsorship frenzy can be understood as an attempt to boost their public profile and ahead of issuing shares to the public.

Trying to gauge its valuation, it would help recalling that earlier this year the group had rejected a $90 million acquisition offer from Teddy Sagi. This suggests that its owners have other plans to expand the business on their own, or are looking for higher valuation and public listing could be on the table.

UFX.COM

Like 24option, the brand represented by rugby legend Mike Tindall is no stranger to such analyses. With $20-30 million a year in net profit, the broker could be valued at $200-300 million in an IPO scenario. And just like 24option, it has recently turned down a buyout offer from Teddy Sagi. While the firm itself is known to keep a low profile, sources familiar with the matter were able to confirm that UFX.COM is still looking into this possibility.

SpotOption

Last but not least is SpotOption, arguably the leading B2B platform software provider. It may seem that it also has the most to risk by going public, considering the performance of parallel binary options technology provider, TechFinancials. However, it also has the motivation to show that SpotOption can do it better.

It was recently revealed that the developer established an office in New York, in order to penetrate the highly regulated US market. Such a bid, if successful, can certainly polish its image with investors. There are also reports from some of its competitors that unregulated brands have been turned away by SpotOption – a possible sign that it is becoming pickier before exposing its operation to public investors.

The Harsh Reality

Will any of these firms that we've focused on actually go public? Playing against them are several factors, including investor appetite and the realities of being a public company.

While nearly every private company wants to achieve a Liquidity event and cash in their chips, the public market hasn’t proven to be an attractive solution for forex brokers. Some firms do own proprietary technology, and, as in with Anyoption, represent a product that has not yet been offered in the market. However, for many investors, brokers are glorified marketing companies. With little unique about their business models, they simply rely on heavy marketing to feed their growth.

As such, there is a low moat on their business that prevents other firms from competing against them. The result is that valuations will nearly always be low. Even with Plus500, at the time it was a stock market darling sporting a forward PE ratio below 10.

Also, due to regulation, taxes and other reasons, many of the above mentioned brokers and technology firms operate several different entities in various countries. Therefore, although a broker may have a UK FCA license, a portion of customers may be onboarded through their offshore entity.

Becoming public will force these firms to disclose more information about their business in non-regulated jurisdictions, which is not always in their favor. As opposed to CMC Markets', most of the said forex and binary options firms do not enjoy the position of an established UK-based market player, and will have to work hard to prove to investors that they can deliver in becoming "another IG".

As a last word, it’s worth noting that when Teddy Sagi elected for liquidity event for Markets.com, he used a buyout by Playtech instead of via an IPO.