Market participants always look for the direction of price trends. Retail brokers, however, should be more interested in Volatility than price direction itself. Recent market turmoil after the SNB’s decision to remove the EUR/CHF peg taught the FX industry a painful lesson. Some brokers reported large losses while others went out of business. How much would we have given to know that volatility was going to rise?

Volatility is a good thing for the markets. Excluding abnormal situations like January 15th, all market participants wait for big market moves and increased volatility. This benefits all. Traders get more opportunities for trades, and brokers report higher turnover and increased revenue. Even though sudden volatility growth can result in dramatic losses, it is still preferable to know one way or the other whether volatility is prone to grow or subside.

As it turns out, such knowledge is available to anyone willing to listen to the markets. Simple technical analysis methods can be applied to volatility charts just as they are being applied to price charts. Forex Magnates already conducted a study of this kind in December 2014, more than a month before SNB's decision, predicting future volatility. What were the results of our analysis? The answer may surprise you.

Charts Will Show You the Truth

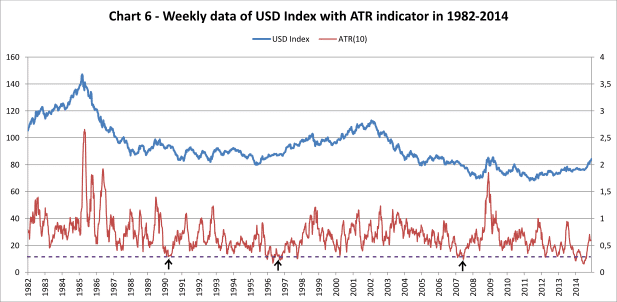

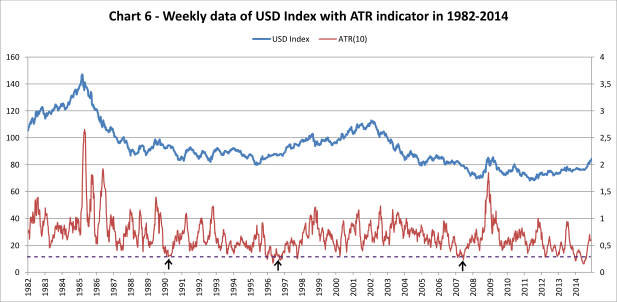

In our QIR4 article we lined up and applied specific technical analysis tools to identify the pistons of the engine that keeps markets alive. We conducted research on volatility using several technical analysis tools on weekly and daily charts of the USD Index. Results obtained via these methods look especially interesting today in the "post SNB era."

What will the future bring for the FX industry? How should volatility evolve in the near future and can our analysis methods be used again? Learn all this and more from the full article appearing in our Quarterly Industry Report.