As September arrives we review the events of August. The previous month has shed light on broker performance with the issue of company financial statements and volume reports. Sports sponsorships also continued to take place, but this time around it was the binary option brokers who stole the spotlight. Also occurring during August were a slew of new products and brokers entering the market. But, none of those stories rivaled the intergalactic revival of the Clone Wars….

Clone Wars

It’s been 37 years since the world first got introduced to the Clone Wars

https://youtu.be/YZ_mjtTCdcg?t=3m

Perhaps not intergalactic yet, but definitely spilling over to the world of FX, the Clone Wars now affect both small and large firms alike. What are we talking about? Broker clones: The phenomena of fake websites being created using credentials of regulated companies to solicit accounts from unknowing customers. Clone sites primarily come in two forms. One case is a fake broker website almost identical to the broker it is cloning with the aim of gleaning client information, such as bank account and credit card numbers to commit financial fraud on affected customers. Such websites don't actually sell Forex services, but use phishing for confidential information.

The other form of cloning is actual online forex brokers who slap the existence of regulation on their websites, often stating they are affiliated with a licensed broker. In this case, the actual broker can become the target of angry customers who unbeknownst to them are actually trading with an unregulated broker.

Over the past two years Forex Magnates has viewed a plethora of websites as being clones of regulated brokers, such as Boston Prime, TradeNext and FXCM. Recently, a spike in cloned brokers has been taking place, with regulators also becoming more aggressive in realizing the problem and issuing warnings about the websites. During August, the FCA issued multiple warnings against cloned firms. Similarly, FXOpen issued its own warning against BE IN FOREX stating they aren’t affiliated with the broker. However, the big news, and bringing the matter to the mainstream media this past month, was the arrival of a string of sites cloning global financial giants such as Goldman Sachs and JPMorgan. The string of related sites being cloned is believed to have been conducted by professional hacking teams viewing opportunities in the financial sector to take advantage of naïve customers.

Volumes – Check out FXCM

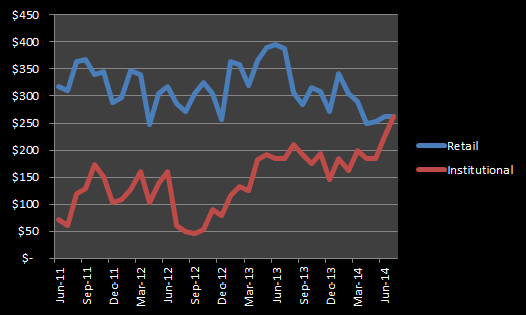

Moving over to volumes, check out this chart.

FXCM Retail vs Institutional FX Volumes

Those numbers are a breakdown from FXCM of their retail and institutional activity. The bottom line, as retail has been more or less treading water over the past three years with a few spikes higher here and there, with the exception of a trough in late 2012, institutional volumes have been growing. Being reported in August, FXCM revealed that for the first time ever, its institutional volumes nearly surpassed those of retail during July. The final tally was $263B versus $262B in favor of retail. But, the performance shows that counting on retail to grow a broker’s bottom line isn't what it used to be, along with the virtues of diversification.

So who is losing market share as FXCM, and similarly GAIN Capital grow their institutional activity? Look no further than EBS and to a lesser extent Thomson Reuters (although the latter is cannibalizing itself with the growth of FXall). Even after launching its relationship-based FX platform, EBS Direct, EBS continues to struggle, experiencing an 8% MoM decline in volumes during July. The MoM decline was similar to other trading venues such as Hotspot and the CME, but at $70.6B in average daily volumes versus consistently hitting triple digits two years ago, the ECN/relationship-based aggregator is seeing a waning interest of its products. Partially explaining the decline is a lack of volatility which has driven down the need for accessing deep market depth ECNs such as EBS and Reuters. In regards to EBS, market participants have also complained about the firm’s technology and support. While pricing always remains a primary driver of business, FXCM and GAIN Capital financial reports have shown that each firm’s institutional revenues per million dollars traded is above that of the major ECNs; thus signaling that they are winning business without focusing on costs.

Elsewhere during July, volumes were mostly reported lower, with Saxo Bank, Alpari and Japanese brokers, GMO Click and DMM Securities, reporting weaker MoM activity.

Q2 Earnings Decline

The overall weakness seen in July continued as a weak Q2 of Forex Trading due to historically low volatility. The trading ultimatlety affected the bottom lines of brokers as every firm releasing their Q2 results during August reported weaker figures during the period. Among individual brokers, FXCM's YoY revenues fell 30% while those of GAIN Capital declined by 5%. GAIN’s numbers slumped even as its volumes rose with the inclusion of business acquired in their buyout of GFT. However, despite the volume increase, GAIN Capital was affected negatively by a drop to $77 of revenue per million dollars of retail volumes, versus around $120 in their previous two quarters. Forex traders were known to have achieved higher profitability during the quarter, which would have affected brokers like GAIN Capital who utilize a market-making model as part of their business.

Binary Options Brokers Inspired by the World Cup

While July offered a slate of forex related football sponsorships, August headlines were grabbed by binary options brokers. Announcing sponsorships was 24Option who partnered with Juventus. Elsewhere, EZTrader diversified its marketing by striking twin deals with German Bayer and Dutch Feyenoord. Also in a regional pact, iTrader signed a $280,000 deal with Beitar Jerusalem FC. The marketing ties come at a time when we have also seen global regulators taking a more aggressive stance about warning against unlicensed firms. As such, the football sponsorships can be viewed as an attempt to raise the credibility of the binary options brokers, as well as increasing their marketing.

Also of Note:

Darwinex launches DARWIN exchange: New broker Darwinex revealed publicly its new copy trading exchange product DARWIN Exchange. The product provides copy trading within a regulated framework.

Copy trading M&A – During August Invast strengthened their partnership with Tradency by taking a 15% stake in the Mirror Trader creator. Also, Ayondo’s CEO announced his firm’s continued focus on social trading as they received further capital from Luminor Capital.

Banks see drop in FX related revenues : A topic of discussion in our Q1 Industry Report. Due to margin compression in FX, banks are seeking means to protect their trading business from further revenue deteriorating.

New HTML5 Products: FxPro launches new HTML5 webtrader for MT4 accounts using charting technology from ChartIQ. Caplin Systems adds trading enabled mobile apps to its suite of single-dealer platform products. Devexperts to release HTML5 white label trading platform offering.

Broker Launches: ATC Brokers launches UK regulated broker. Trade Interceptor expands from tech provider to broker as they launch mobile-based brokerage.

Interesting story of the month goes to.... Todd Crosland, former CEO and Founder of IBFX, emerges with his new project, launching crowdfunding platform, Seed Equity.

(Image courtesy of Deviantart)