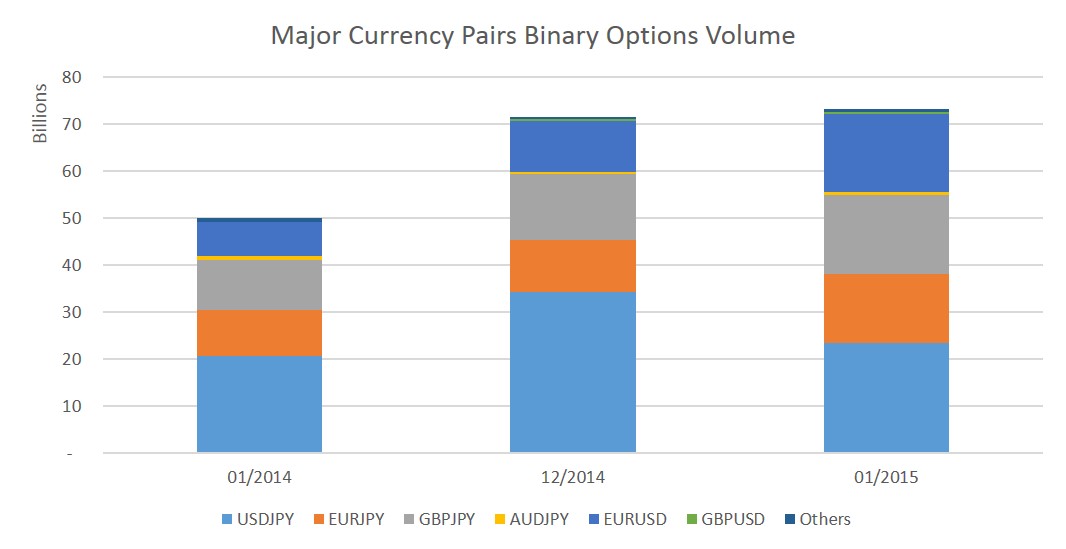

The Financial Futures Association of Japan (FFAJ) posted today its monthly figures for retail over-the-counter currency binary options. Trading volume increased from 71.57 billion yen in December 2014 to 73.16 billion yen in January 2015 (figures include the closing of both long and short positions during the trading period but not representative of the actual total payouts Settlement figure to individuals). January 2014 volume was only 50.13 billion, marking an impressive increase of 42.77%.

Trading payment (the total premium payment including all live binary option premiums paid between position takers and binary option providers and closed positions for the trading period) decreased from 26.39 billion yen in December 2014 to 23.52 billion yen in January. This is consistent with January 2014’s figure of 22.12 billion yen, though figures varied wildly in early 2014.

Making up most of the trading volume in January was USDJPY binary options, accounting for 23.38 billion yen. EURJPY currency binary options accounted for 14.73 billion yen, GBPJPY had a trading volume of 16.92 billion yen and EURUSD was 16.54 billion yen. All major currency pairs saw an increase in trading volume month-over-month save for the USDJPY, which posted a trading volume of 34.38 billion yen in December.

Out of the brokerages, GMO Click had a total profit-and-loss ratio of 97.4% for January and a loss customers’ ratio of 79.1%. Traders Securities had a P&L ratio of 90.8% and a loss customers’ ratio of 79.6%. IG Securities had a P&L ratio of 98.5% and a loss customers’ ratio of 76.2%. JFG had a P&L ratio of 99.7% and a loss customers’ ratio of 63.6%. YJ FX was 90.3% and 80.5% respectively; Hirose FX was 88.1% and 75.8% respectively; and FX Trade Financial was 96.9% and 81.8% respectively. Traders fared best in January using FX Trade Financial’s Range Binary Options, with a loss customer ratio of only 55.2%.