Update UK’s FCA Issues Warning Against Bitcoin Brokers Bit4X and VenetFX

Prices of Bitcoin are skyrocketing in the past month as the Cyprus bank haircut has highlighted the worries involved with trusted established banking systems. The foundation for bitcoin appreciation has actually been building much before the current events in Cyprus. While its use is still a small drop in the bucket of overall commerce, demand for bitcoins has been boosted with the expansion of firms beginning to accept the currency for internet transactions. While firms accepting bitcoins aren’t household names, products available for sale cover pretty much every item a person could purchase from name brand clothing, electronics, and food. With demand rising steadily, the Cyprus financial crisis has simply led to a perfect storm of increased need and awareness of bitcoins which has allowed the currency to take off.

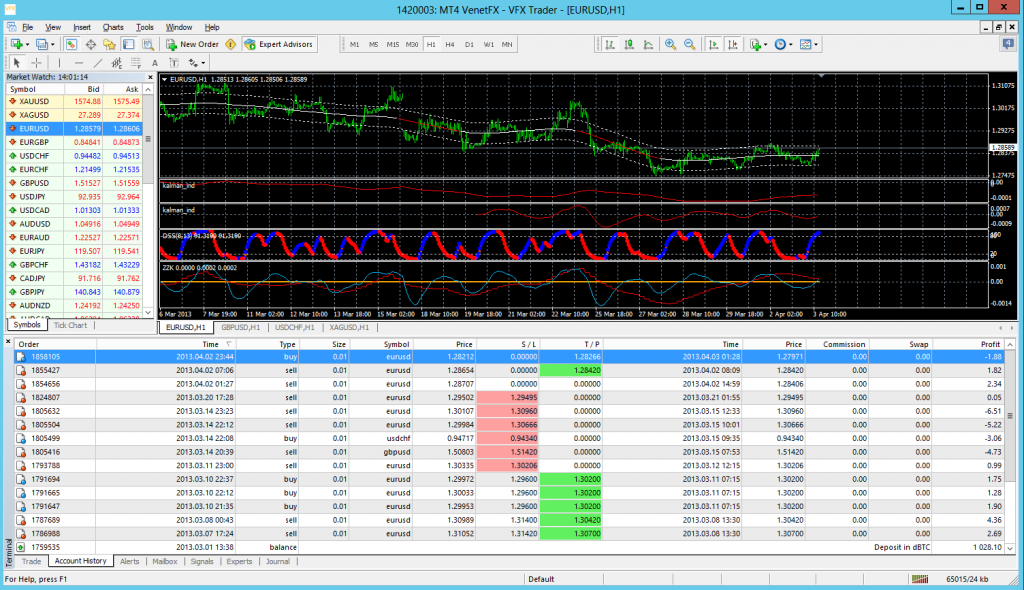

With the rising prices, one of the big questions being asked by FX traders is how to trade the currency? While bitcoins as a tradable instrument doesn’t yet exist among the major platforms, one firm has been providing clients the ability of holding bitcoin denominated MT4 accounts. Bit4X, a Slovenian IB of VenetFX, has launched bitcoin based accounts for clients, with both funding and withdrawals using the digital currency. In a twist from traditional brokers, Bit4x requires no client documentation with customers allowed to provide any alias and email address. All that is needed is a digital location to receive withdrawals to. This feature could provide appeal to traders desiring an anonymous location to trade with. However, the anonymity also Leads to the inability of clients to make claims against the broker in the case of fraud or trading errors, but this seems to be the accepted trade off of migrating away from fiat currencies.

With the NFA on the verge of banning credit card deposits in the US, alternative funding options are expected to be in demand. While it remains to be seen whether more brokers decide to begin accepting bitcoins, it will be interesting to see how their emergence is greeted by financial regulators. As regulators are most concerned with client safety, how will they regulate bitcoin customers who are interested in less government control and anonymity? Also, knowing that bitcoins have become synonymous with money-laundering, will regulators work to create a solution that solves this worry or is a full ban on the currency eventual?

In any event, regardless of how the digital currency will be taken up by the established players, the arrival of Bit4x shows that there is little question that funding options for FX bitcoin users is becoming readily available. Also, while not out yet, it’s only a matter of time before BTC/USD on MT4 and other major platforms will arrive.