Following a significant number of brokers who have announced temporary changes to their trading conditions as the UK’s referendum vote - which set to take place next week on June 23rd - is expected to create volatile market conditions, the latest broker to unveil changes is BMFN, Finance Magnates reports.

BMFN, a leading online brokerage with a presence across Asia-Pacific and other parts of the world under its group structure, explained in an update to clients that there is less than a week until the Brexit vote will occur and trading conditions are already starting to become more volatile than usual.

Our number one priority at BMFN is to remain stable and pass this situation adequately - as we did during the SNB crisis in 2015 - and to protect our clients, partners and counterparties.

As the company expects that Liquidity will deteriorate across various trading instruments as the event approaches, it decided to implement a number of changes to its margin requirements across all client accounts, following an in-depth analysis of upcoming Brexit risks.

The new world of online trading, fintech and marketing – register now - for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Leverage Reduced

Luis Sanchez

The company explained that potential gap risks could occur, coupled with spreads widening and reduced liquidity, which could hamper the ability for traders to open or close positions including large trades.

As a precaution, effective Sunday, June 19th, at 5pm EST, BMFN is increasing margin on all FX instruments to 2% or 50:1 leverage, margin on commodities will be raised to 5% or 20:1 leverage, all indices will require a margin of 10% or 10:1 leverage, and the company noted that the stop-out rate will be 100%.

BMFN emphasized that it may further raise margins without additional notice depending on market conditions and said that FX margins could reach 10% without further announcement - again depending on how market conditions change as the Brexit vote nears- in an effort to help reduce client's exposure.

CEO Comments

Finance Magnates spoke with BMFN CEO Luis Sanchez around time of the news. He explained:

"Being that today is less than a week away from the British EU referendum, BMFN is aware that the closer we get to the 23rd of June, banks and brokers will be trimming their FX liquidity in the majority of currency pairs, and as a direct consequence of this we announced related changes.

We expect that market trading conditions will become more volatile than usual and spreads could be as wide as they have ever been before as execution may get worse and worse with lots of trade rejections starting to take place.

Our number one priority at BMFN is to remain stable and pass this situation adequately - as we did during the SNB crisis in 2015 - and to protect our clients, partners, and counterparties.

Each sales person at BMFN had contacted our clients and partners personally to inform and warn them of the current and possible future scenario, so they can be aware of their trading strategies and trading conditions," Mr. Sanchez added.

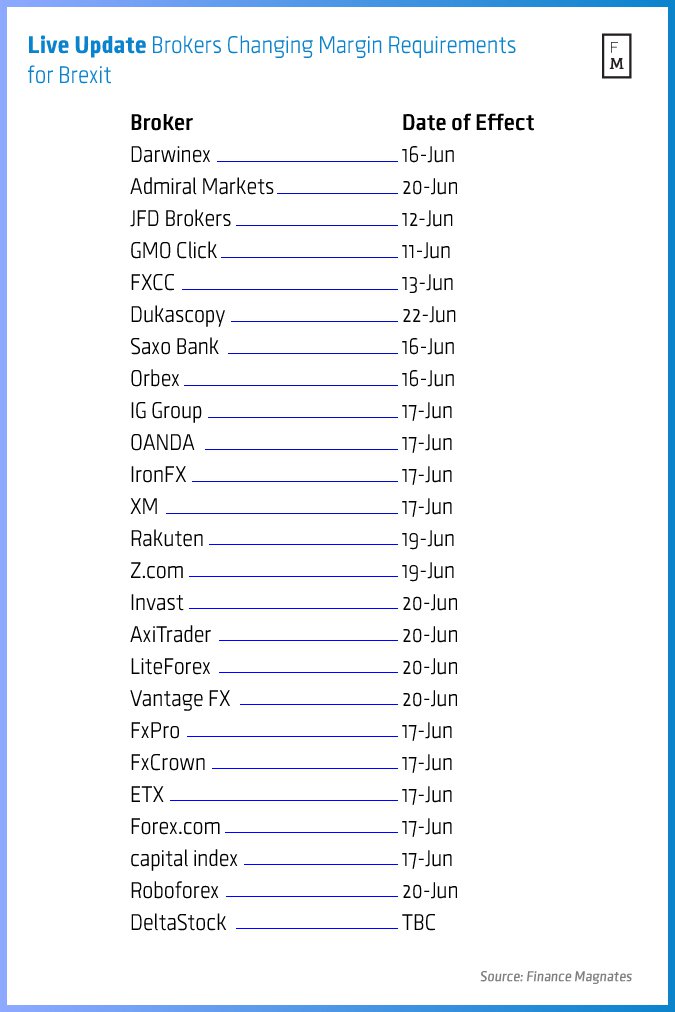

Finance Magnates has reported on an increasing number of brokerages making related changes as can be seen in the list below.

Finance Magnates