The UK Financial Conduct Authority (FCA) is taking material measures to protect retail clients that are trading rolling spot Forex and contracts for difference (CFDs). The measures are the result of a study which shows that 82 percent of retail brokerage clients are losing money.

To unlock the Asian market, register now to the iFX EXPO in Hong Kong.

[gptAdvertisement]

The FCA’s new guidelines extend beyond the limitations that CySEC proposed last week. The regulator states that the growing number of companies providing such products is worrying because clients do not usually understand the risks associated with trading spread betting, CFDs and rolling spot forex contracts.

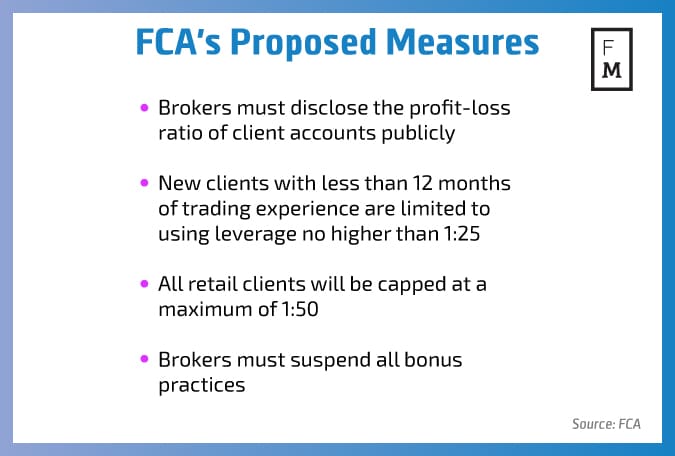

The FCA's proposal includes several points. Starting with transparency, companies are to be required to disclose the profit-loss ratio of client accounts publicly in order to adequately demonstrate the risks associated with trading.

The UK watchdog proposes that clients with less than 12 months of trading experience be limited to using leverage of no higher than 1:25. In addition, all retail clients will be capped at a maximum of 1:50. The regulator highlights in its announcement that some clients are receiving leverage of over 1:200.

and about time... where do people think those bonus's come from? Trading is hard enough without dealing with a shit broker#forex #fx https://t.co/Bfl0r3SlDd

— Fat Bee Trader (@fatbeetrader) December 6, 2016

Lastly the FCA is proposing to suspend all bonus practices regardless of whether they are related to trading or account opening.

We have serious concerns that an increasing number of retail clients are trading in CFD products without an adequate understanding

The UK financial regulator is also looking into binary bets and is in the process of devising a new framework that will add to the existing conduct of business rules, when the products are brought into the FCA’s regulatory scope.

Commenting on the news, Christopher Woolard, the Executive Director of Strategy and Competition of the FCA, said: “We have serious concerns that an increasing number of retail clients are trading in CFD products without an adequate understanding of the risks involved, and as a result can incur rapid, large and unexpected losses.”

“We are introducing stricter rules for CFD products to ensure the sector addresses the shortcomings identified, and that firms make sure that retail clients are aware of the high risks involved in trading these complex products. The FCA also has concerns that binary bets pose investor protection risks and question whether binary bets meet a genuine investment need,” he added.