FXCM Inc. (NYSE:FXCM) and Leucadia National Corporation (NYSE:LUK) have entered into a memorandum of understanding (MOU) to alter the terms of their Amended and Restated Credit Agreement as well as their Amended and Restated Letter Agreement dating back to last January, according to an FXCM statement.

The original agreement spans back to January 2015, when the Swiss National Bank’s (SNB) snap decision left FXCM obtaining nearly $300 million in financing from Leucadia in a bid to keep the broker in business. Since then, FXCM has been selling non-core assets to cover the debt and is emerging as a retail focused FX broker.

As recently as December 31, 2015, FXCM had $192.7 million debt outstanding with it after having paid $144.7 million of principal, interest and fees throughout the 2015-year. The $192.7 million figure did constitute a decrease from the $203 million amount reported by FXCM for the end of September.

Fast-forwarding to today, the new nonbinding MOU will remain subject to the Execution of definitive agreements – board and regulatory approvals will also be required, though are unlikely to provide any blocks. For its part, FXCM has already stated its belief that it will repay the debt portion in full back to Leucadia during 2016 – Leucadia and FXCM expect to complete the amendment by June 2016.

Changes to the Credit Agreement

In other developments, Leucadia’s Credit Agreement with FXCM will be extended by an additional year, or January 2018 in order to grant FXCM more time to facilitate its remaining asset sales. Thus far, many of these sales have helped the broker generate cash, as illustrated by several notable sales during 2015. The decision comes after both parties concluded that greater value could be realized for all stakeholders via additional time to complete the asset sales.

Furthermore, FXCM would retain the right to defer any three of the remaining interest Payments by paying interest in kind. This is important for FXCM as payments in kind will still allow FXCM to honor its debt obligations, whilst reiterating maximum flexibility to invest and grow its core business moving forward. According to a recent regulatory manifest however, until the loan and interest under the Credit Agreement are repaid in full, all distributions and sales proceeds shall continue to be used solely to repay the loan plus interest.

Internalized Changes

In addition to the Credit Agreement, FXCM has also reported a series of changes to its Letter Agreement. This agreement is pegged to be terminated, while its terms will herein be shifted to Newco's LLC agreement.

An existing FXCM Newco agreement is also slated to be amended, as Newco would be renamed FXCM Group LLC, with Leucadia owning a 49.9% common membership interest in FXCM Group. By extension, FXCM Holdings LLC would own a 50.1% common membership interest in FXCM Group.

FXCM Group itself will also be governed by an eight-member board, with three directors appointed by Leucadia. A preliminary look suggests that the board will be comprised of Rich Handler, Brian Friedman and Jimmy Hallac, as well as three directors appointed by FXCM, two independent directors, and one each to be nominated by Leucadia and FXCM.

The nature of the partnership between FXCM and Leucadia will continue until at least January 2018, whereupon after Leucadia and FXCM would each hold the right to begin a process that could yield a schism between the two groups, and ultimately trigger a sale process for FXCM Group.

Moreover, a long-term incentive program with a five-year vesting period will be put into place for FXCM senior management to retain and incentivize management. This will help maximize cash flow generation and the growth of the business that would operate only after Leucadia's principal and interest under the Credit Agreement is repaid and would equal the following:

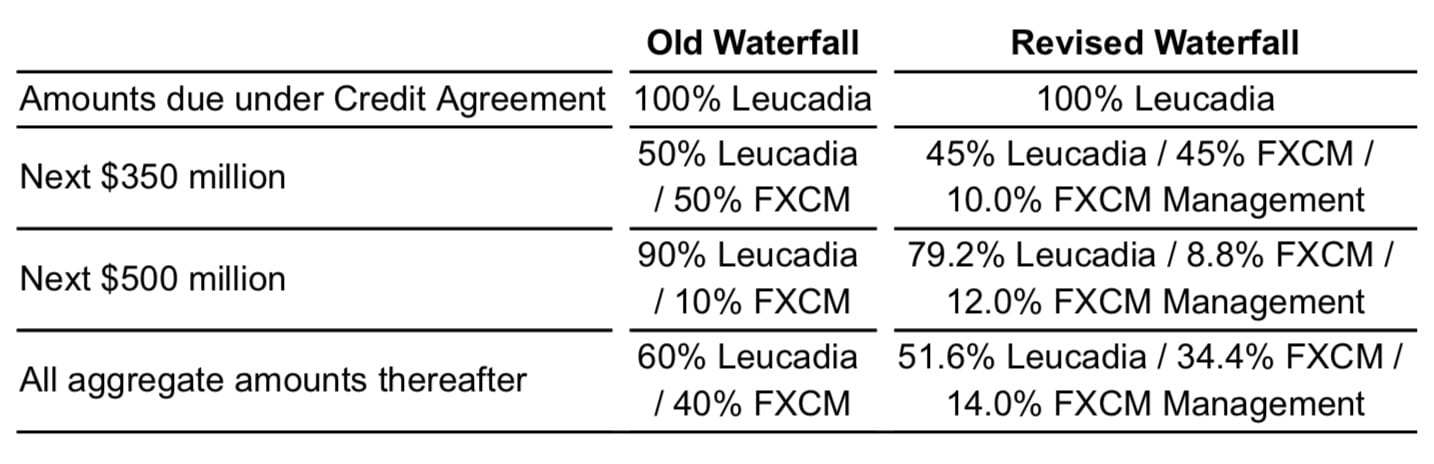

- 10% of all distributions or sales proceeds from FXCM Group up to $350m

- 12% of all distributions or sales proceeds from FXCM Group from $350m to $850m

- 14% of all distributions or sales proceeds from FXCM Group above $850m

Finally, Leucadia will own a non-voting preferred class of membership interest – this will also be added to the aforementioned 49.9% common membership interest, resulting in the following distribution of proceeds from FXCM Group:

Source: FXCM

Leucadia as a long-term partner in FXCM will be of great benefit to all FXCM stakeholders, clients, and employee

According to Rich Handler, Chief Executive Officer, and Brian Friedman, President of Leucadia, in a recent statement on the new MoU: "We are pleased to amend our agreements with FXCM, and affirm our long-term commitment to FXCM and our confidence in FXCM's future in the retail FX market.”

“We believe that our anticipated deal will be beneficial to both companies and solidify Leucadia's role as a long-term partner. The FXCM management team has been essential to building the company into the industry-leading FX brokerage that it is today, we fully support them, and feel that retaining them is vital to FXCM's future success. We are optimistic about what we can achieve together moving forward,” they added.

"Leucadia as a long-term partner in FXCM will be of great benefit to all FXCM stakeholders, clients, and employees, as well as confirm the health and stability of FXCM to our customers. The extension of the Credit Agreement should also help FXCM realize appropriate values for assets we expect to sell, while also allowing us to continue to grow our core business," reiterated Drew Niv, Chief Executive Officer of FXCM, in an accompanying statement.