With the referendum day finally upon us, foreign exchange trading brokerages and their clients are preparing for the outcome with vigilance. The uncertainty about the vote has brought substantial Volatility in recent days which ultimately culminated with the British pound rising to its best levels against the U.S. dollar in 2016.

With the polls now, we are following up with the most important times for the Forex and CFDs brokers and traders alike. During the day, the publication of exit polls is forbidden by U.K. law. That said, a number of hedge funds are conducting their own polling and the industry should be aware that price swings that may seem random at first, might actually have some meat behind them.

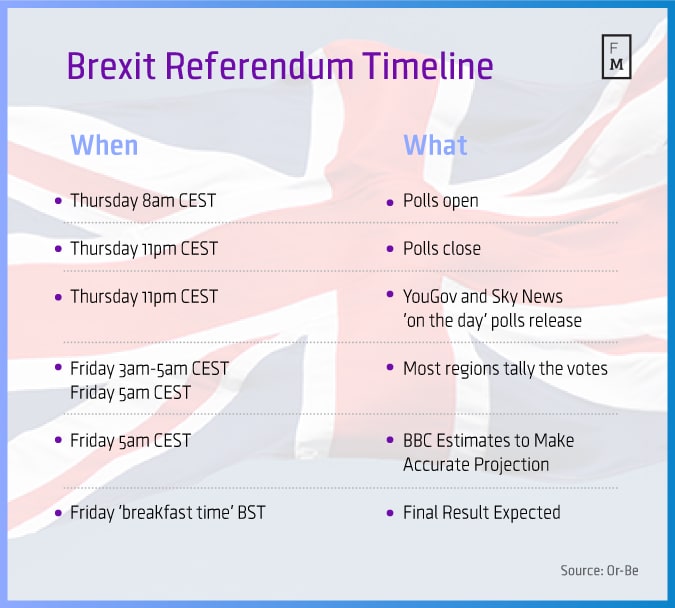

The polls will close at 09:00 PM GMT, which is 10:00 PM London time during the summer, also known as BST.

Just as the polling stations close, YouGov and Sky News will announce the results from their ‘on the day’ polls. In the case of the Scottish referendum, these polls have proved to be quite an accurate assessment of the final outcome. This is likely to be the most eventful time of the night, as all market traders actually conform to some publicly available results.

After the polls close, we are coming to the vote count phase of the night, where polling stations start counting locally and announce results between 02:00 AM and 04:00 AM BST. According to the BBC, an accurate estimate of the final outcome of the vote should be available sometime around 04:00 AM London time.

The estimate of The Electoral Commission will be coming in at around “breakfast time” on Friday, 24 June. The markets will have fully priced in the outcome of the referendum, so that is not expected to be a big event for the GBP pairs and for global financial markets.