In our latest daily digest of news from across the global retail trading industry, we note that brokers are taking steps to help clients become more informed traders. This is seen as MCM FX launches educational workshops and Admiral Markets releases a trading calculator.

Additionally today, we saw two developments from the UK market. First, ThinkForex announced the opening of its London office, a move that was expected since the Australian broker obtained an FCA license. Second, the shareholders of LSE-listed gaming and trading giant Playtech approved the acquisition of Plus500 with 100% of the votes cast for the motion, at a general meeting held this morning

Trading Support

UK-based broker MCM FX has started cooperating with technology provider GWAZY Ltd. to offer educational workshops in order for beginners to familiarize themselves with the GWAZY trading method and platform.

MCM FX is offering three types of packages. The ‘GWAZY for Starters’ workshop includes a 2-hour training programme and a live trading account worth $50. The ‘GWAZY Gold’ workshop includes a 3-hour training programme and a live trading account worth $150. The ‘GWAZY Deluxe’ workshop includes an intensive 4-hour training programme and a live trading account worth $250.

The training programmes will be conducted by the professional FX trader Paul Wallace, who the company explains has over 20 years of experience in trading, performance coaching and trading education.

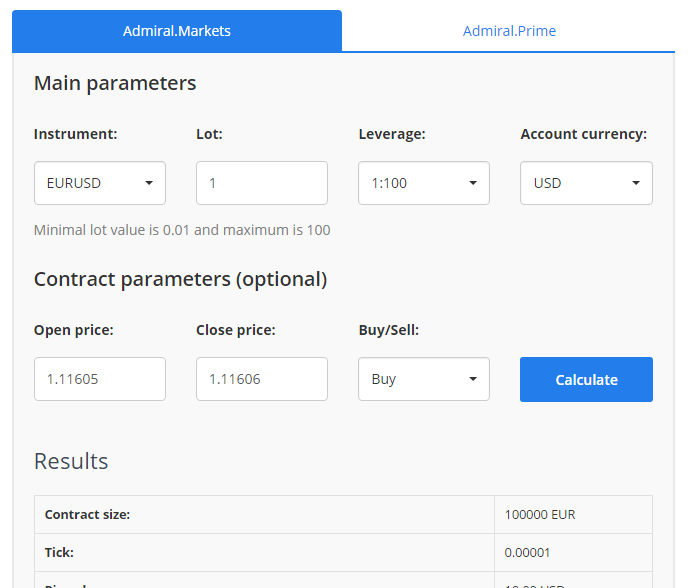

Admiral Markets announced that it is launching Trading Calculator, which is now available on the website. The Forex & CFD trading calculator will help to estimate trades' profit or loss and compare the results for different opening and closing rates that could be both historical or hypothetical.

The company explains that the trading calculator will help its clients to calculate: the potential profit and also the risks of a trade; the required margin for positions; Swap costs for holding overnight; recognize not only the cost of the order, but also the pip value of a given financial instrument; understand the margin change depending on the respective Leverage and more.