OTC Markets Group, a US-based marketplace of 10,000 US and global securities, has announced that shares of IG Group are now available for trade on the platform. Offered as an American Depository Receipts (ADR) of the London Stock Exchange trade shares, each IG ADR represents one share of its UK counterpart.

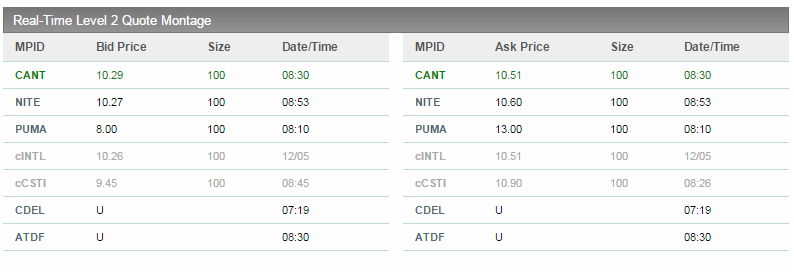

Trading under the ticker symbol IGGHY, the ADRs have started their first day of trading on the OTC Markets platform with primary Liquidity in the stock from Cantor Fitzgerald and KCG. Aiming to offer open and transparent trading, OTC Markets publishes Level 2 data for all of its listed equities, including IG Group which is available here.

OTC Markets Group Level 2 Data for IG Group

Earlier in the year, IG Group ADRs were made available for sale in the US OTC markets after the UK broker had appointed Citibank as its depository bank for creation of a Level 1 ADR. The listing on OTC Markets Group adds Level 2 market depth and trading to the ADR allowing shares to become more easily available to US traders. It also provides more options for local traders and investors to gain exposure to the online Forex and CFD broker sector along with shares of FXCM and GAIN Capital which trade in the US.

Having US exposure is nothing new for IG Group, as it operates the NADEX binary options exchange in the country. In addition, IG Group was licensed with US regulators to provide forex trading services in the US, but was left along with many other foreign brokers following the enactment of increased minimum capital requirements of $20 million in 2011. With their existing involvement in the US and current push to increase awareness of their shares in the country, IG could be positioning itself for larger plans, such as to tap the local capital markets or an equity-based acquisition with its new found liquidity in its stock.

In a shared public statement about the news, IG Christopher Hill, CFO of IG Group commented, "We are delighted to have IG Group shares trading on the OTCQX marketplace. This follows the launch of our Level 1 ADR earlier this year and demonstrates our commitment to offering U.S. investors the best possible access to IG Group stock."

R. Cromwell Coulson, president and CEO of OTC Markets Group, added, "We are pleased to welcome IG Group, a FTSE 250 company, to the OTCQX marketplace. By joining OTCQX, IG Group ensures U.S. investors will have transparent trading and convenient access to its news and disclosure allowing them to more easily analyze, value and trade its securities. We look forward to working with IG Group as the company continues to increase its profile in the U.S. market."