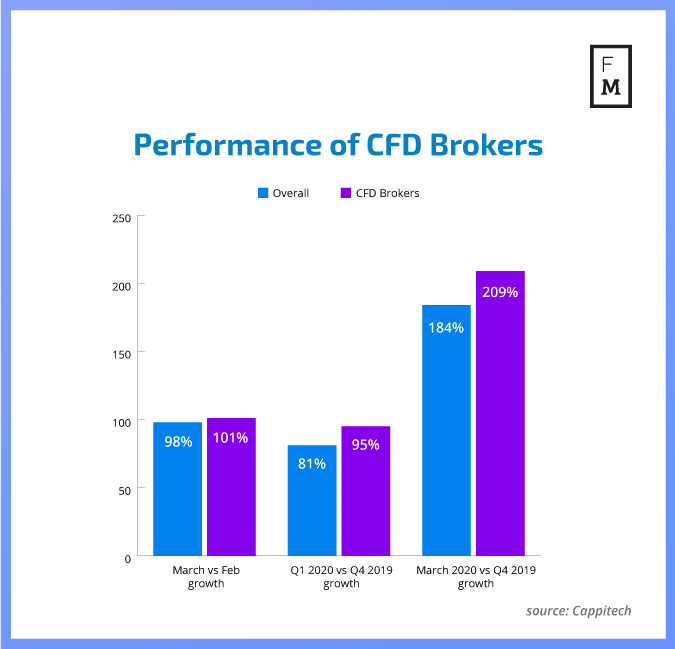

2020 has so far proven to be a good year for brokerages, with a number of factors contributing to a return in Volatility and, therefore, healthy trading volumes. While overall, the year so far has been good, March, in particular, was a stellar month.

As Finance Magnates reported, foreign exchange (Forex ), contracts for difference (CFD), and multi-asset brokers, alongside exchanges and trading platforms, reported very solid trading volumes during March, with many reporting all-time high performances.

Cappitech, a Fintech provider focused on compliance and regulation technology for banks, brokers and asset managers, has compiled data from investment firms which use the company’s compliance reporting technology to submit reports EMIR, MiFIR and other global transaction reporting regimes.

The importance of a strong equity offering

The data collected from Cappitech shows just how well brokers did during the first quarter of 2020 as well as March, as the coronavirus pandemic contributed to a return in market volatility. The most interesting insight the data has shown, which is based on just under 50 European Union based CFD brokers both in the institutional and retail space, is how important it is for them to have a multi-asset offering.

“Not surprisingly, brokers that had a strong March of equity volumes, outperformed their peers during the quarter (equity volumes include CFD trades of single stocks and equity indexes),” Cappitech explained. “Reviewing statistics for top five brokers by quarterly increase of equity volumes showed a greater than 50% outperformance of Q1 vs Q4 growth compared to their peers (330% vs 195%).”

“Interestingly, among the brokers with the strongest Q1 equity growth, increases in transaction volumes began to be seen in January and February. While for laggards, their equity volume increase primarily took place during the volatile March period.”

According to the regtech firm, there could be a number of factors that have contributed to this, such as laggards offering a limited selection of equity trading products. This is because the data shows that brokers that offer and promote their equity products, in comparison to those that focus on FX and metals, were in a better position to benefit from the increased trading volumes in the first quarter of 2020.

“Overall, the figures support the argument that CFD brokers benefit in volatile markets with a wide ranging cross-asset offering,” Cappitech said.

FX-focused brokers greatly underperform

After looking into the data for the final quarter of last year more deeply, Cappitech discovered that the top five brokers with the largest percentage of equity transactions of their overall totals had a weighted average Q1 vs. Q4 growth of 105 percent. This is in comparison to the overall 95 percent figure for all CFD brokers.

However, the most interesting figure here found by the regtech firm is that, when looking at the brokers who had the least diversity, and FX made up more than 90 percent of the total transactions, their Q1 vs. Q4 growth greatly underperformed everyone else, coming in at only 46.5 percent compared to the overall 95 percent.

Ron Finberg, Ron Finberg, Product Specialist, Regulation at Cappitech

Speaking to Finance Magnates, Ron Finberg, Product Specialist, Regulation at Cappitech said: “When reviewing the data more closely with Finance Magnates, the data point that really striked out to me was the underperformance of brokers with a very heavy weighting in FX trades.

“I believe firms with a greater variety products benefitted from both more trading from the active clients as well as being able to re-engage dormant accounts that returned when they saw such large moves in stocks and oil.”