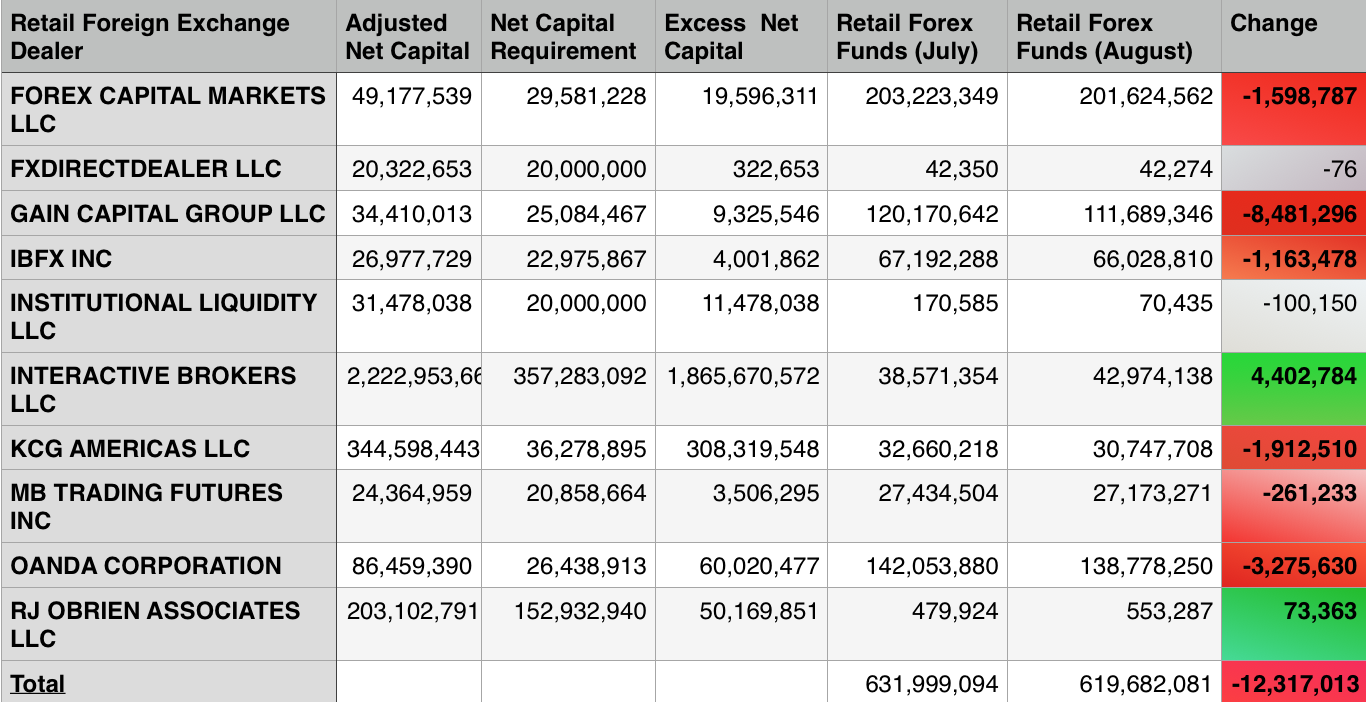

The CFTC issued its regular set of detailed data from reporting Futures Commission Merchants (FCMs) as of the end of August. While the foreign exchange market was silently preparing for the sharpest spike in FX Volatility and trading since the beginning of the year, retail Forex funds have registered a modest drop by 2%.

After July’s steady increase, August didn’t bring in more client funds despite FX volatility and trading volumes slowly ticking up. Total retail forex funds dropped by $12.3 million, with GAIN Capital Holdings (NYSE:GCAP) shedding the most - $8.5 million, followed by OANDA with $3.3 million.

FCM Retail Forex Funds August, Source: CFTC

With FXCM Inc (NYSE:FXCM) losing $1.6 million, the top three brokers reported declines in retail forex funds in August. That said all of them reported much larger increases in July. The brokerage which stands out is the Interactive Brokers Group (NASDAQ:IBKR), which reported an increase by $4.4 million, which is an impressive rise by more than 11%.

In the view of Forex Magnates this big increase for Interactive Brokers, can be attributed to clients of the multi-asset brokerage switching their trading preferences back to foreign exchange after earlier this year we’ve seen the lowest G7 FX volatility in 21 years.

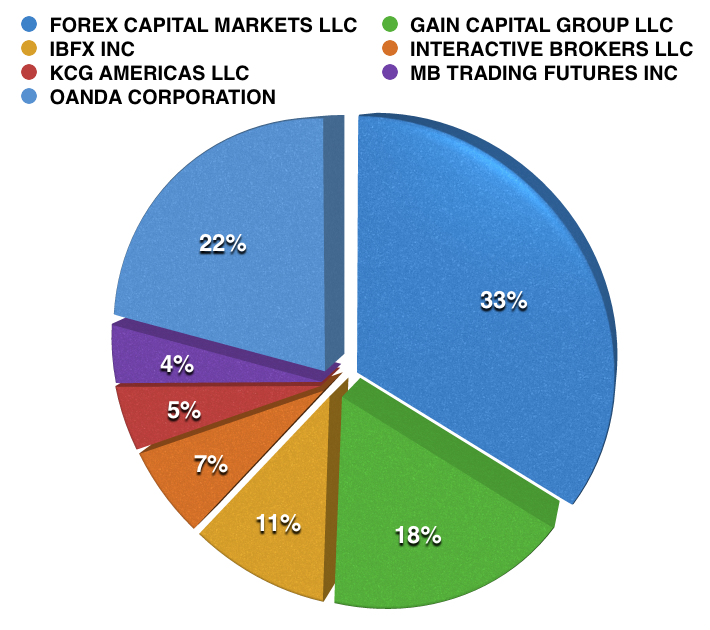

US FX Brokers Market Share, August 2014

Looking at the market share data, client funds at FXCM Inc (NYSE:FXCM) holds 33% as of August (before acquiring the MT4 accounts from IBFX), which is higher by 1% when compared to July. Interactive Brokers (NASDAQ:IBKR) is the other FCM rising its market share by a full percentage point to 7% of the U.S. market.

OANDA and GAIN Capital Holdings (NYSE:GCAP) both lost ground, shedding 1%, with MB Trading, KCG America and IBFX all remaining unchanged. Expect the market share pie chart to change markedly next month as the data for September will take into account FXCM Inc’s (NYSE:FXCM) acquisition of IBFX’s MT4 accounts. The latter has announced that it will be focusing to offer the company's TradeStation solution to institutional clients.