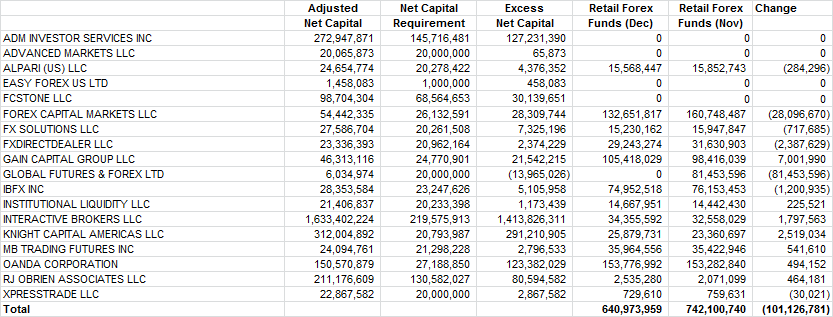

The CFTC has posted December’s end of the month FCM financial data. Typically these reports don’t provide much of a surprise as brokers tend to be either very well capitalized or doing a good job of having just enough funds to cover net requirements with the rest most likely put to work in different areas. Last month’s figures were an exception as it showed both GFT and FXDD’s net capital dropping below its requirements. The shortfall was due to a change or perhaps better said, the reinforcement of old auditing rules in relation to funds from foreign subsidiaries. The result was GFT leaving the US entirely. In this month’s figures, FXDD has once again covered its requirements and is holding excess capital.

Looking at December’s data, Forex funds dropped by over $100 million with the majority due to GFT leaving the market. Also, FXCM experienced a $28 million decline in retail forex funds, but their figures tend to be volatile with large month to month changes. Worth noting is the modest $7 million (7.1%) increase of client forex funds at GAIN Capital after the broker purchased the US business from GFT. As such, the $7 million increase suggests that GFT’s overall US exposure was less than 10% as they had total forex client funds of over $81 million in November, or a substantial amount of clients either moved their accounts to GFT’s non-US entities or closed them outright.

With 2013 starting off with a bang and brokers and venues reporting substantial volume increases, it will be interesting to see how the activity effects total deposits. Generally, retail funding is a lagging indicator. Therefore, we may not see boost in forex account deposit sizes until the February or March figures are out.

December US FCM Financial Data