With the Chinese market continuing to grow, more brokers are getting interested in acquiring clients from the region. Not that many however are using an original and tailor-made approach. One firm that does is TigerWit, a technology company turned brokerage founded by Summer Xu and Weilong Song that is fully committed to the Southeast Asia region.

Summer Xu

[gptAdvertisement]

One of the founders and currently CEO of the firm, Summer Xu, spoke to Finance Magnates about the challenges the company faced in China and the peculiarities of the Chinese retail trading market in general.

How did you start the company?

TigerWit was founded as a technology company with venture capital backing in 2015, focused on fintech and we identified the retail Forex sector as an opportunity. As we developed our product we realized that we could push our development efforts further if we had some first hand data from retail brokerage clients. This is how we got the idea to establish a brokerage of our own.

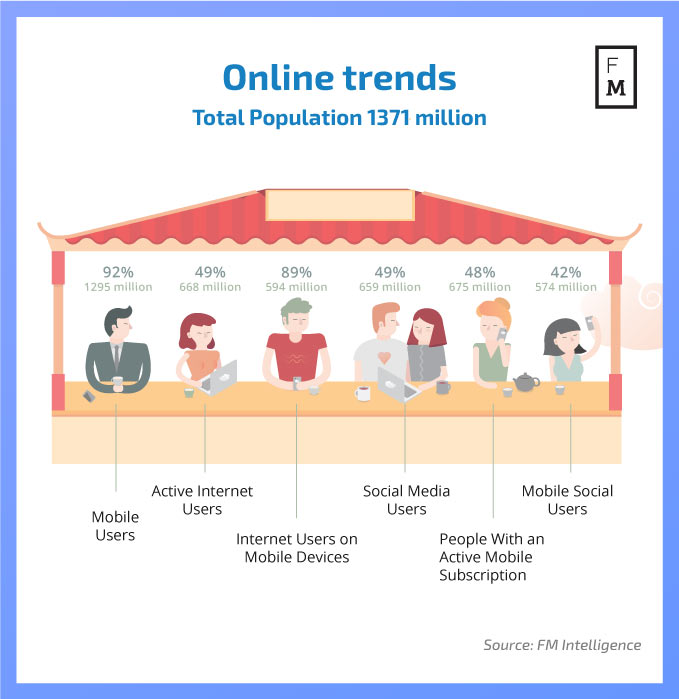

To date we have gone through three funding rounds from venture capital firms raising $10 million in total which has really helped us to make an impact. Following significant research and development we’ve found that clients trade more frequently using smaller amounts and they don’t want a complicated trading interface, so our goal is to make a product for retail forex clients that simplifies trading and focuses on mobile devices.

We decided to launch our product as proprietary software that is not only available to our clients, but to open it up to other companies’ APIs for their mobile applications. Our copy trading solution was launched in August 2016 and by now it is a fully functional, mature product.

What is your experience with regulation? Do you plan to get licensed in one of the popular jurisdictions?

During the development of our product we needed to get real time market data which meant opening an account with a Liquidity provider and a requirement for at least a Financial Service Providers Register (FSPR) number from the New Zealand regulator. This led us to have an unusual experience as we hired an outside compliance consultant to get our brokerage licensed in New Zealand. Some text was overlooked by our partners and we ended up using the word “regulated”, when in fact the correct term was licensed financial services provider. This misstep prompted the New Zealand Financial Markets Authority to contact our director in the country, who overlooked the warning. As a result our company was included in an FMA warning list.

After we rectified the content on our website, the FMA removed us from the warning list. We have since deregistered from the Financial Service Providers register in New Zealand and certainly learnt our lessons.

We started looking for alternative regulatory solutions in other jurisdictions, and we expect to be able to make an announcement on this in the near future. Getting regulated is essential to our business and our investors are relying on us to get a serious compliance solution for the company to eventually go public.

What are the main differences between operating in China and the rest of the world?

There are two main differences between the Chinese market and the mature market. The first one is that traders in this market are less educated and the second one is that there is less regulation. The education issue is common in new markets however the regulation aspect has been a major issue for the industry in China.

From a regulatory point of view, the retail trading Chinese market is not open yet. For brokers who want to commit to the market and make serious investments this is a big disadvantage. At the same time, this encourages illicit practices for brokers which are operating offshore and are not bound by any compliance rules, which is clearly not good for anyone.

The good news is that the Chinese government is committing a lot of efforts to open the retail trading market. For TigerWit this is a positive development as we will be very well prepared. Once the market is regulated, our company’s focus on technology will give us a competitive advantage. We are in contact with some officials who are working on Chinese regulation.

What about the education of Chinese clients?

A very small proportion of people in China know what is forex trading and how to trade. There are a lot of companies outside of China that are attempting to enter the market, but localization is a big challenge. Not all of the software and the data solutions which works well for established markets is suitable for the Chinese market. As a result brokers have to retool their software and content, especially on the education side of business.

Offshore brokers also have to educate their clients first, which means that the conversion time can be much longer. Education has proven to be essential in addition to offering top rate service to Chinese clients. Typically, customers are frustrated from long response times and the companies have to commit to a month-long conversion process with our estimate for the acquisition cost ranging at between $200 and $300 per client.

The services that offshore brokers provide are mostly the same that are popular globally - a standard MT4 offering is the typical solution, and the lack of differentiation is apparent.

Do introducing brokers still play a crucial role on the Chinese market?

In China the number of introducing brokers is quite big and they play a key role in the market. IBs are acquiring the most of business for brokers operating in the country. Market education and trading signals are some key services provided by IBs in China. What happens on the local market is the opposite that usually happens in the rest of the world. Brokers in China are actually fighting to acquire IBs, with a major challenge being that the lifetime of a client is currently less than half a year.

When we started TigerWit we were very well acquainted with these trends and we decided to tackle the issue differently. We wanted to make a product that is both simple and transparent for the end client. We believe that a fully localized, client-focused and intuitive proposition has been largely missing in China. More than that, we believe our efforts to do things the right way and embed a compliance culture will enable TigerWit to succeed both within China and globally.