Finance Magnates' initial coverage of the Avail Trading Corp chapter 11 story provided details of how litigation from a customer led the firm to seek bankruptcy protection. Avail Trading had provided us with a statement that it planned to release to clients.

Now further details are unfolding. The client's attorney contacted us yesterday, providing court documents from the case, in which a San Diego court found Avail Trading to be violation of a number of laws over the management of its relationship with an investor in a managed account program held at FXCM, where Avail Trading acted as an introducing broker.

[gptAdvertisement]

This third update from Finance Magnates will not be the last, as a court date is scheduled for next Tuesday, when the parties will meet to decide on the bankruptcy proceedings. The client remains the largest creditor of Avail Trading Corp, as well as being a creditor of one of the firm's principals David Manoukian, who also filed a personal chapter 11 to protect his house.

Court found Avail Trading Corp in breach

The client’s lawyer, Jeffery Lendrum of Lendrum Law in San Diego, offered Finance Magnates further information regarding the litigation proceedings between Avail Trading Corp and his client George S. Bos, including two recent court documents.

This helped to clarify what really led up to the chapter 11 filings. We also spoke with David Manoukian to hear his side of the story.

Distinctions

With regard to some of the court's findings against Avail Trading Corp, theft under Californian law is broadly defined as obtaining someone's money under false pretences. So although theft is a criminal matter (normally handled in a criminal court), it can also be contested in a civil case.

The court found that the defendants recklessly or intentionally breached their fiduciary responsibilities to the client. Despite the California Penal Code, it is well-known that in the US introducing brokers cannot hold customer deposits, and in this case the funds were held by FXCM (at its UK division).

However, this doesn't remove the fiduciary responsibility of the IB, as decided by the Los Angeles Court, even though the IB may have had no way to directly monitor trading activity by the fund manager.

Background and current situation

This is a story of a client getting churned and burned, fighting back and winning a court decision against the IB. Avail Trading Corp has taken numerous steps to protect itself from the 'creditor rights' that the client now has, as the court entered a judgement including damages, losses and other fees to be paid to the client.

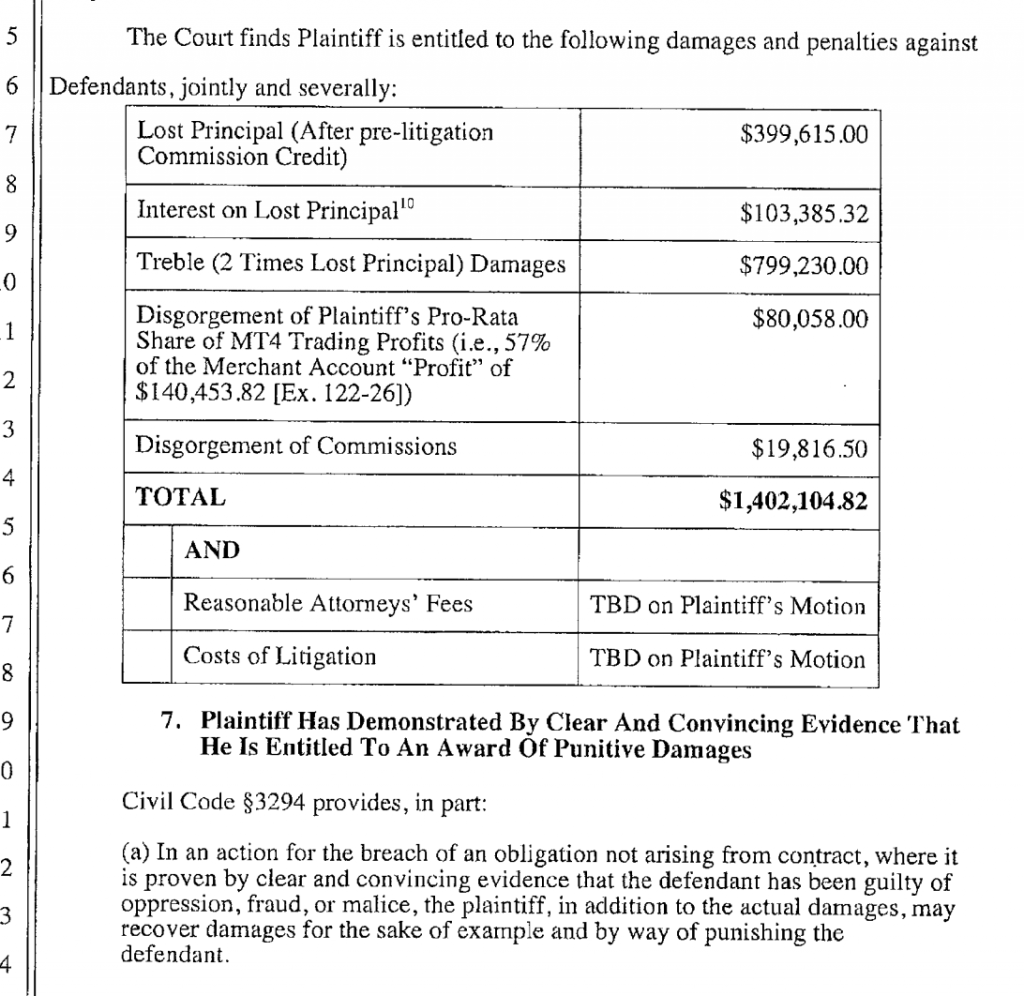

The judgement had been finalized except for the attorney fees, which was expected to be an extra few hundred thousand dollars.

However before the judge could sign off the fees and enter the judgement officially, Avail Trading Corp filed for a chapter 11 in an effort to protect its assets. However the bankruptcy process is being disputed - the investor's lawyer in his recent court filings brings an objection to how the funds are being distributed.

Mr. Lendrum shared with Finance Magnates two court documents that reveal the details of how his client (Mr. Bos, a 63-year old, retired English teacher) was treated by Avail Trading Corp in connection with his investment in a managed account program introduced by the IB to FXCM. .

Potential future litigation

While FXCM wasn't named in the initial cases, it could possibly be considered in future cases related to this client's losses, because Avail Trading Corp relied upon FXCM to judge the client's suitability according to KYC.

However this doesn't release Avail Trading Corp from its responsibilities as the introducing brokerage, despite a document - viewed by Finance Magnates - from FXCM stating that it "will perform customer due diligence on all new and existing clients introduced by your NFA registered entity."

Avail Trading Corp blames money manager

Avail Trading Corp points blame at the money manager, and had a cross-claim against that entity, but dropped it as it was unable to ascertain the responsible owners of that business. This distinction also was leaned on by the court with regard to improper authorization on the POA, even though that form was accepted by FXCM.

In the Grisaeles vs Forex Capital Markets case (2011) a similar claim was dismissed, as FXCM disclaimed responsibility for the consequences of a client choosing a 3rd party, whether on a discretionary or non-discretionary basis.

Current: $1.5m creditor, IB chases bankruptcy

The judgement that was awarded (but not yet entered) to Mr. Bos – who is now the single largest unsecured creditor of Avail Trading Corp – includes a claim totalling $1,502,106.82 (damages included).

Mr. Bos’ attorney continues to take legal steps against Avail Trading Corp as it attempts to maneuver its assets away from its bankrupt company. There is a long list of what appear to be last-minute actions on the part of Avail Trading Corp and its principals to move assets away around the time of its filing for chapter 11. David Manoukian explained that he personally filed bankruptcy to protect his home.

Court date next week

The filing cited California corporations’ code 506. Bos’ lawyer said that Avail Trading Corp and the Manoukian brothers violated rules designed to protect creditors, and stated that they are thus personally liable for the distribution of more than $500,000 in 2015. Bos’ lawyer sought the appointment of a new trustee citing mismanagement and misapplication of funds. That will be one of the matters discussed in court next Tuesday, March 8th.

Manoukian's attorney had argued that the case law cited by the plaintiffs was SEC-related and nothing to do with foreign currency trading, and that the CFTC has jurisdiction rather than the SEC. He cited the cases of Index Futures Group vs Ross (1990) and CFTC vs Heritage Capital Advisory Services Ltd (7th Circuit 1987), adding how the fiduciary role was the responsibility of the money manager and not the IB. And the NFA's KYC rule 2-30 was mentioned as a comparison to the suitability rule that the court applied which it said was contrary to the NFA rule (as it cited SEC related rules and case law).

'Churned and burned'

One of the court documents describes that Avail Trading Corp earned roughly $3 million in annual commissions between 2011 and 2014, meaning that it was successful at running its business, even though the NFA had reprimanded it for $10,000. It has maintained registration since 2005, which is impressive for any IB. However it only takes one wrong decision, and one mistake, against just one client to change everything.

To make a long story short, the court found that this case was driven by churning that occurred in the client’s account, inspired by high commissions that the parties involved generated at the client’s expense, burning their equity to the ground.

$730 million traded at FXCM on $445,000 deposit

On January 26th 2012 Mr. Bos deposited $445,000 into his Avail Trading Corp-introduced FXCM account, yet between February 14th and February 23rd of that year $730 million in volumes were traded in the account, driving the balance down to $25,568. This was after signing a POA with TTTG, a money manager from Canada.

The overall volume traded appears to be huge relative to the balance, and it is - no matter how common leverage might be in FX. What is not common is that it happened within the span of barely a week, and to a customer that invested nearly his entire net worth, and who indicated that he was retired.

This was further complicated as there were additional layers between the clients access to his statements from the MT4 platform and an additional account held by Avail Trading Corp that mirrored the master account’s trades. Avail Trading Corp had a rebate account where commissions and funds were lumped together, when it withdrew them from FXCM in order to pay its sub-IBs and money managers.

Rebate account was not pooled funds

Thus the customer could not have had a clear understanding of what was happening in his account. The minimum reporting rights that clients are entitled to were a bit convoluted according to the court findings. Or, could it also be that the way the information was presented to the court made it difficult for them to understand the FX industry? Perhaps, partially.

Findings of additional profits held in a merchant account may have been rebates and commission, and not profits that were withheld from a client per se, as both sides argued.

There was an expert from the securities industry that gave testimony, but even the most experienced stock brokers might not know what a pip is (no disrespect to them - as most FX brokers couldn't tell you how to calculate 25 mills worth of commission on securities). Yet that testimony may have helped cement the fiduciary related breaches while the other side argued that it was the money managers fault.

Even so, that doesn't negate the one-week draw down and super-fast churning that burnt Mr. Bos, even if the court didn't get everything right. Therefore, someone needs to take the blame, and Avail Trading Corp got hit - as its counter-claim against TTTG was later dropped.

Burnt by a PAMM

The process of overtrading a client's account for the sake of generating commission, or rebates, without regard for the client, often causes clients to lose their money as large commissions are generated while trading capital is depleted and bad investment decisions are made. This is known in the trading industry as churn and burn and appears to be what occurred to Mr. Bos. That seems to be the bottom line of this story.

In addition, the trading that took place within the PAMM account was via the MetaTrader 4 (MT4) ) platform, as the authorization that was needed for a third party to trade the account was described in the filings. Considering the volume traded on Mr. Bos’ account within such a short amount of time, there may have been signals used, although the trading was performed manually.

TTTG prior cross-defendant

More importantly, after Mr. Bos' account was churned and burned despite the firm's knowledge of his personal circumstances. A substantial loss does not necessarily imply wrongdoing as investors take such risks, but the key here is that the investment was not suitable. The court found that multiple laws were breached.

Ian Soberal of Top Tier Trade Group (TTTG) was mentioned as a former cross-defendant related to what appears to be signals-trading that took place with a letter-of-directions (similar to a POA). The court found that the name on the authorization didn’t match the person initiating the signals which caused the trading in Mr. Bos’ account.

There was no evidence that Ian Soberal was a real person, and the sole owner of TTTG was a Mr. Yahaqqi. This distinction helped the court prove that proper trading authorization hadn’t been obtained in the first place. Avail Trading Corp thought that Ian was a partner at TTTG and therefore authorized to act for it since its name was on the POA. This didn't hold weight in court, even though FXCM allowed the trades to occur. This could be the turning point that caused the court to shift blame to Avail Trading Corp..

Overtrading = churn

Even if the investment had been suitable, the high degree of trading turnover were wash trades with the sole purpose of generating rebates and commission. Even if every trade was break-even, the account balance would still have been depleted just from the trading costs.

This is the type of behavior that has triggered the many waves of regulations over the years to protect clients.

The client's attorney believes that there were, in fact, profits generated and held in a different account under Avail Trading Corp's name, whereas Avail Trading Corp says that account was the master rebate account (merchant account) where its commissions and rebates were added. Avail Trading Corp claims that it refunded some $19,000 in commission back to Bos, and supposedly didn't make a penny from his trading activity.

Avail Trading Corp claims that it informed Bos when his balance reached nearly $130,000 yet he decided to stick with it, and that most of the losses incurred on the last day of trading. David Manoukian added that Bos continued to trade with his fund manager (TTTG), even following him to IronFX with a $45,000 investment, and only years later did he return to seek legal action against Avail Trading Corp. Avail Trading Corp's attorney, Paul Thomas, described Bos in a court document as a sophisticated investor who held accounts at Alaron Trading, Mann Financial and FXCM before he met Avail Trading Corp.

US regulators are aware

If a client agrees to some really high-risk trading strategy, and was determined that the investment was suitable for them, then it's perfectly okay to make such investments. This doesn't seem to be the situation in the case of George S. Bos vs Avail Trading Corp.

Given the complexity of this case, and how it proceeded from a local civil court, it will be interesting to see how it unfolds, as it could have an effect on the legal processes regarding such disputes.

A spokesperson for the National Futures Association told Finance Magnates: "We are aware of the situation with Avail Trading Corp, and have been in touch with the Commodities Futures Trading Commission (CFTC), as well as the firm."