CMC Markets (LON:CMCX) has just issued an interim management statement via the London Stock Exchange newswire. The UK brokerage that won the 2016 Finance Magnates London Summit award for best CFDs broker has reported a decline in net revenues and profits for the six months that ended on September the 30th.

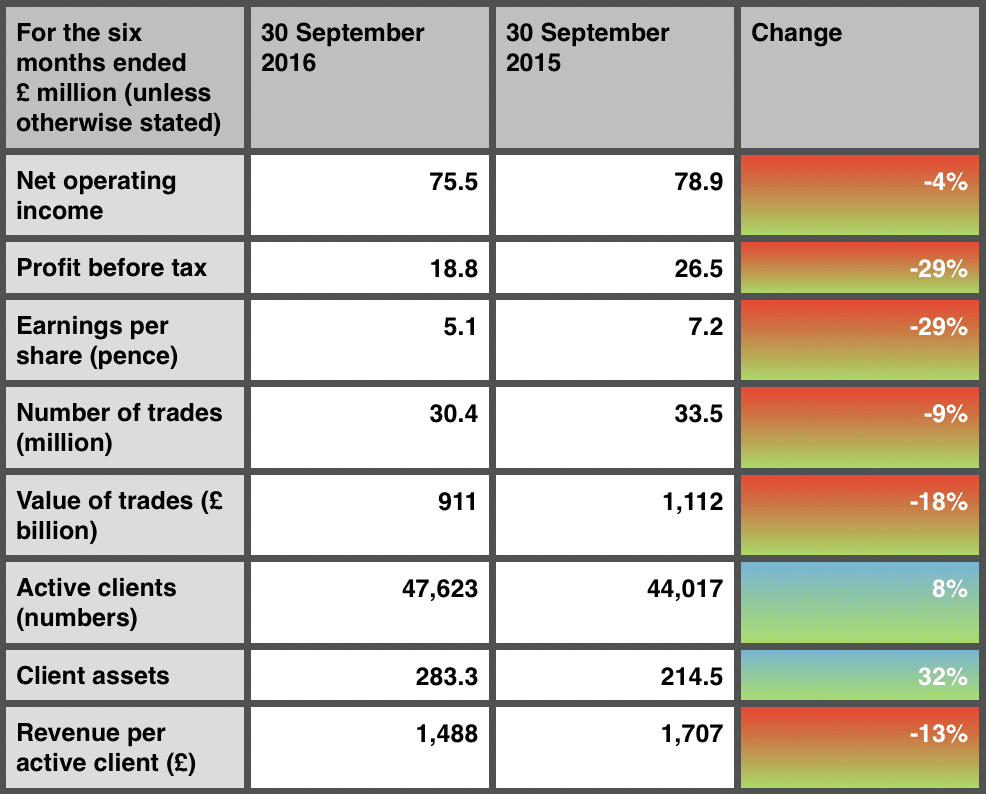

The brokerage reported that client assets and client numbers have increased by 32 and 8 percent respectively, but the company’s top and bottom line have underperformed when compared to the same period last year.

With trading activity being largely focused on pockets of Volatility during the reporting period, the results are hardly a surprise. Brokerages across the industry have been reporting slowing numbers for the better part of 2016, with the main risk events on the market standing out in terms of trading volumes.

CMC Markets (LON:CMCX) reported that its net operating income contracted 4 percent year-on-year to £75.5 million ($93.7 million). The company’s bottom line has decreased substantially with profits before tax amounting to £18.8 million ($23.3 million), a number which is lower by 29 percent when compared to last year.

CMC Markets Interim Results for the 6 months ending on the 30th of September 2016

The decline in revenues and profits has been largely due to lower number of trades and trading volumes. For the 6 months ending September 30th the average value of trades at CMC Markets (LON:CMCX) totaled £911 billion. The number is lower by 18 percent when compared to last year’s £1.11 trillion. Looking at the total number of trades, that declined by 9 percent to £30.4 million.

Due to the aforementioned declines, the average revenues per active client dropped 13 percent to £1,488 ($1846).

Operating Costs Increase, Binary Options and Countdown Revenues £4.1 million

The operating costs of CMC Markets (LON:CMCX) increased by 9 percent to £53.6 million due to increased investment in talent and marketing. The company reported that its market share in the established market has increased, reflected by the rise of active clients by 3 percent, despite client trades being lower by 15 percent.

In France, a market that has been mired in controversy due to the upcoming regulatory challenges, the value of client trades increased by a whopping 37 percent.

The company’s binary options and countdown revenues totaled £4.1 million, a figure that increased 26 percent when compared to the second half of fiscal 2016. The binary options offering of CMC Markets (LON:CMCX) was rolled out tin April.

Elaborating on the institutional lofting of the firm, the interim management statement highlighted that the new API connectivity that the firm launched in May alongside the development of white and gray label offerings resulted in a 34 percent increase in the value of client trades.

Commenting on the prospects for the firm in the coming months, the CEO of CMC Markets (LON:CMCX), Peter Cruddas, said: "We continue to make significant strategic progress, delivering against our five pillars of growth. We are growing our active client base through retail and institutional channels, rolling out new products and platform enhancements and looking at opportunities to develop our international footprint."