CMC Invest, the equity trading arm of CMC Markets (LON: CMCX), is broadening its services in the United Kingdom by introducing a Self-Invested Personal Pension (SIPP) scheme. Announced last Friday, this new offering is presented as a flat fee product in collaboration with Quai Investment Services, exclusively available through its Premium plan.

Targeting Long-Term Investors

A SIPP provides UK individuals with a self-managed pension corpus that guarantees a pension upon retirement, offering significant tax advantages. The inclusion of SIPPs in the Premium plan is designed to entice long-term investors with its appealing features: £0 commission on all trades, a 0.5 percent FX fee, flexibility in pension drawdowns, and access to multi-currency wallets. Moreover, investors can transfer existing pensions into the SIPP.

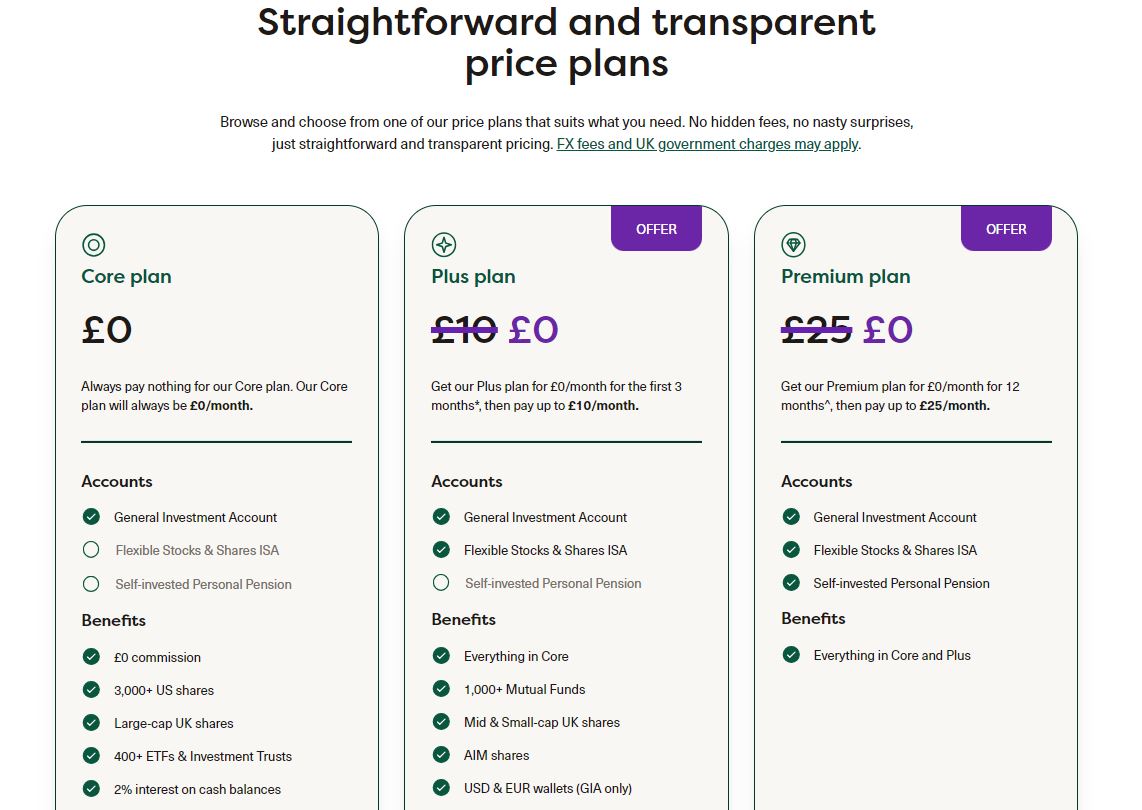

To attract new clients, CMC Invest has waived the Premium plan's usual £25 fee, offering it free for the first 12 months.

“Navigating the complex landscape of pension and investment fees can be daunting, and it’s easy for customers to feel overwhelmed. That’s precisely why we’re introducing a flat fee structure with our Premium plan," stated David Dyke, the Head of CMC Invest.

A Simplified Fee Structure

The justification for the flat-fee model stems from a survey of 2,000 investors, each with over £10,000 in investable assets, which revealed that one-third of pension-holding investors were unaware of the fees charged on their pensions. This percentage rises to 44 percent among female investors.

“With our flat fee, regardless of portfolio size or trading frequency, customers will pay a consistent monthly fee. This transparency simplifies financial planning, eliminating the need for complex calculations to understand pension costs,” Dyke further explained.

CMC Invest was initially launched in the United Kingdom in October 2022 and expanded to Singapore in September last year. It is also accessible to investors in Australia. Operating independently from CMC’s established contracts for differences (CFDs) trading platform, CMC Invest aims to offer a distinct experience focused on direct investments.

Earlier this year, CMC Invest signed Shanti Pereira, a Team Singapore track and field sprinter, as its brand ambassador to promote early investing and financial literacy, especially among young female investors.