CMC Markets has just issued an update on the operating metrics of the brokerage for the six months ending on September 30th, 2015. The company’s key financial performance metrics have increased across the board when compared to last year's and the possibility of the brokerage seeking a public listing in the coming quarters is becoming an increasing possibility.

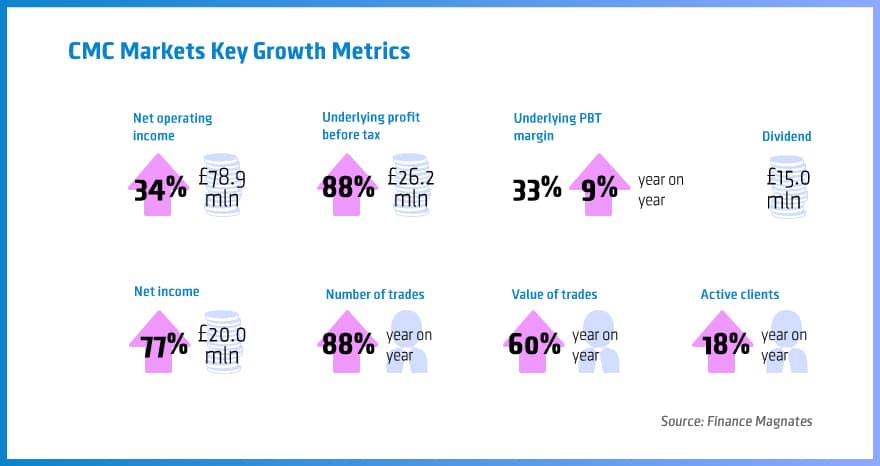

According to the data published by CMC Markets net operating revenue has increased by 34 percent to £78.9 million ($118.9 million). Underlying profits before taxes have risen by a whopping 88 percent to £26.2 million ($39.5 million), bringing up the pretax profit margin figure to 33 percent, which is higher by 9 percent when compared to last year.

Net income has also increased substantially - CMC Markets reported it at £20 million ($30 million), while dividends totaled £15.0 million ($22.6 million).

Trading Metrics Increase Sharply

The major driver for the revenue and profit growth for CMC Markets is the number of trades executed by clients. Those have shot up by 88 percent year-on-year with the value of trades also rising materially - 60 percent to £1.112 billion. Aside from more activity on the part of traders, the nominal number of clients of CMC Markets has increased by 18 percent when compared to the same period last year.

The CEO of the company, Peter Cruddas, said, “We have delivered a very strong set of results for the first half, demonstrating impressive growth across all metrics. Our clear strategy of offering our clients award winning technology, superior service and automated Execution with transparent and competitive pricing is continuing to deliver results.”

The average revenue per active client of CMC Markets increased by 15 percent, while the company’s balance sheet further strengthened with cash on hand totaling £151 million ($227.6 million) and a capital adequacy ratio of 30.5 percent.

These figures have moved materially higher in comparison to the start of the year when in the aftermath of the Swiss National Bank crisis the ratio was 24 percent and the cash holdings totaled £130 million ($196 million).

Dividends

In relation to dividends, the company has been adhering to a policy of distributing 50 percent of its profit after tax into dividend Payments . That said, the company has become even more generous to its shareholders and will be distributing a total of £15.0 million this year. The number includes £10.0 million as an interim dividend and £5.0 million as a special dividend.