With the publication of the official prospectus for the Initial Public Offering of CMC Markets’ shares on the London Stock Exchange and the imminent pricing of the shares, some key metrics come to light.

We already knew from the company’s H1 2015 report that CMC Markets traders had become more active throughout 2015. The company has already publicized data showing that client trading volumes have grown 60 per cent on a yearly basis, however with the publication of the IPO prospectus the specific figures have come to light.

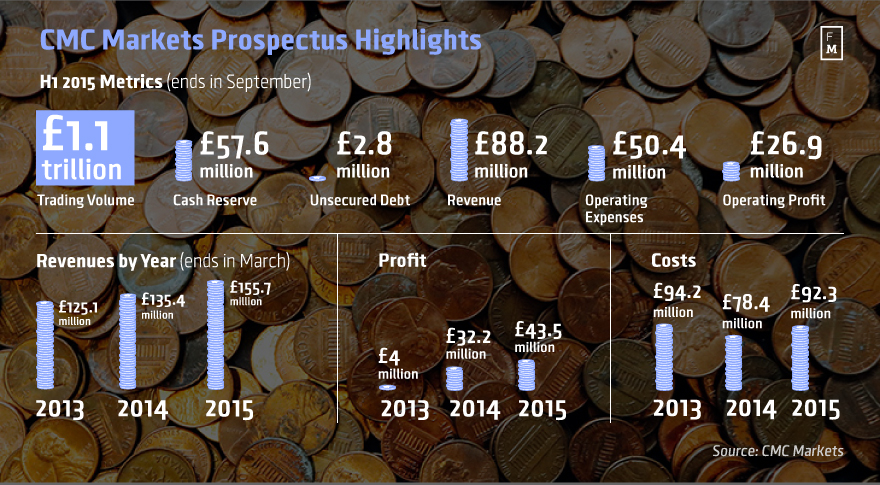

For the first six months of 2015, clients of CMC Markets traded to the tune of £1.112 trillion ($1.6 trillion). The company also boasted solid cash reserves, with £57.6 million in cash and cash equivalents on its balance sheet as of the end of September 2015. The company has virtually no debt with only £2.8 million of unsecured debt outstanding.

Looking at the revenues from 2013 onwards, CMC Markets has reported consistent growth with the firm’s revenues rising from £125.1 million in 2013, to £135.4 million in 2014, reaching an all time record of £155.7 million in 2015 for the figures as of the fiscal year ending in March each year.

At the same time, the company managed to keep costs down, after it spent £94.2 million in 2013, £78.4 million in 2014 and £92.3 million in 2015. The firm has also turned a substantial profit figure for the fiscal year ending in March 2015 with figures totaling £43.5 million before taxation, which compares to £32.2 million in 2014 and a loss of £4 million for 2013.

Operating Numbers for H1 2015

CMC Markets largely generates revenues from its CFDs and spread betting business which accounted in 2015 for £136.6 million of the £143.6 million net operating income. This figure has been growing steadily in the past couple of years from £114 million in 2014 and £96.7 million for the year ending in March 2013.

Looking at the latest H1 figures for the period ending on September the 30th 2015, revenues have been reported at £88.2 million, while operating expenses were about £50.4 million. The operating profit for the same period was £26.9 million, while the CFDs and spread betting business accounted for £75.1 million of the company’s net operating income of £78.9 million.