CMC Markets Plc, one of the big players in the retail trading space, has downgraded its outlook for fiscal 2019. The company's revenues from contracts-for-difference (CFD) and spread betting are now expected to drop by 20 percent year-on-year.

The company shared the news in the firm’s pre-close trading update today. After a solid first quarter, the firm saw a decline in key metrics. According to CMC Markets, seasonal low market Volatility in the summer and the new Regulation from the European Securities and Markets Authority (ESMA) have impacted the company's bottom line more materially than expected.

The previous forecast was for a year-on-year decline in revenues totaling between 10 and 15 percent. Shares of the company dropped sharply as the LSE opened for trading.

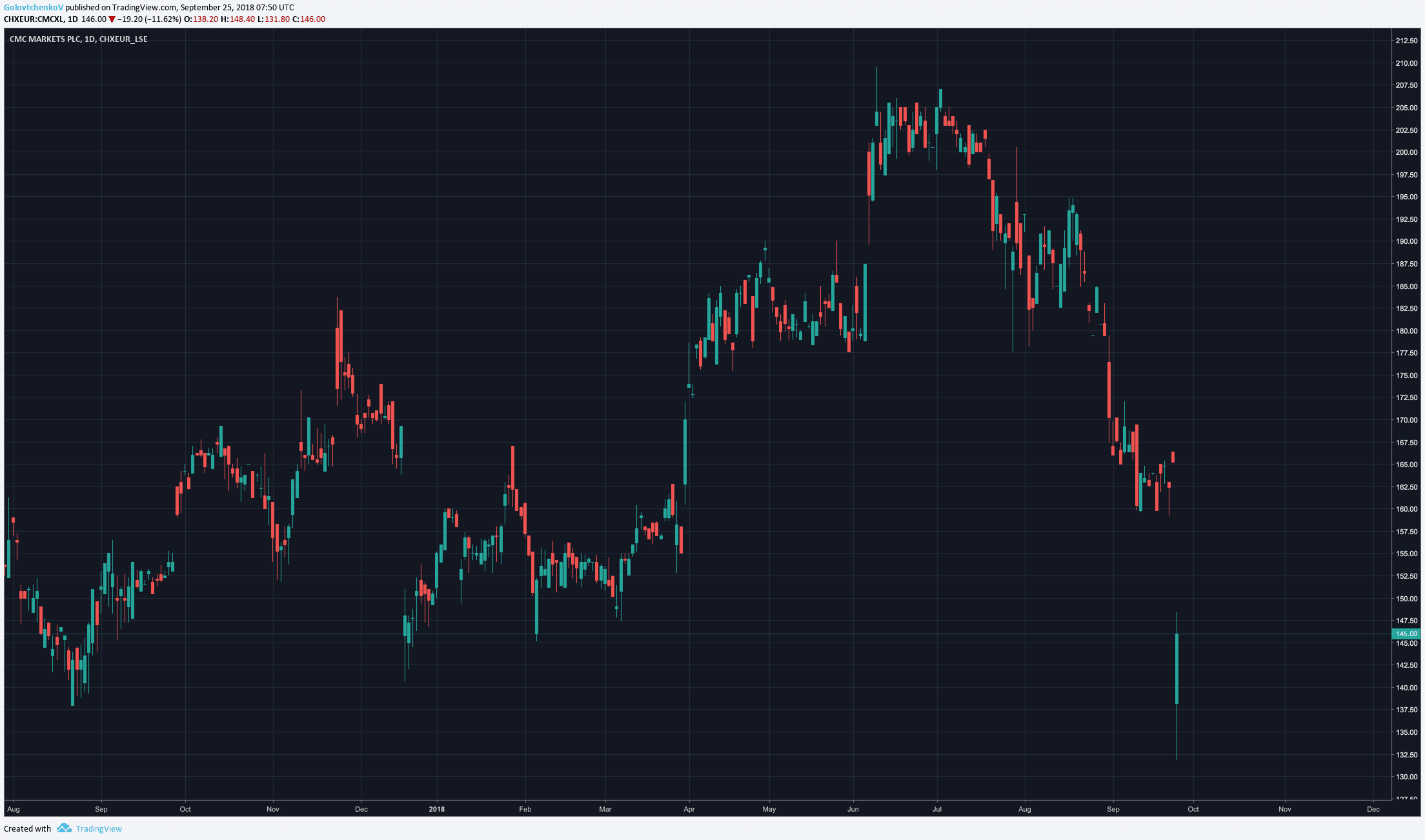

After opening 20 percent lower, the UK broker's stock is now trading about 12 percent lower at 146 pence per share.

Daily chart of CMC Markets, Source: TradingView

As the broker expected, retail client activity has dropped in the United Kingdom and Europe. This follows the implementation of the ESMA's new measures. However, since it’s only been two months, the firm believes it is too early to draw any reliable conclusions.

With the summer slowdown coming to an end, the firm has seen an uptick in client activity levels. However, the weight of ESMA has forced CMC Markets to reevaluate its forecasted results for 2019. Specifically, the firm expects its net operating income for 2019 to be below its previous guidance. However, the firm does not believe the change will be too drastic as it has been tightly controlling its costs.

In addition, the broker has also forecast an increase in its operating costs in 2019. This will partially mitigate revenue for the second quarter of 2019 and also for the full year.

CMC Markets Focus on Professional EU Clients

Now, with the ESMA regulation in effect, CMC Markets is focused on increasing the proportion of revenue generated by British and European professional clients. On a rolling 12-month view, professional clients in the UK and Europe generate 40 percent of revenue.

The broker will release its results for the six months ended September 30, 2018, next month on November 22, 2018.