A huge benefit of having your own cryptocurrency exchange is being able to use available features that are easy to use and understand. If you have basic knowledge of how a brokerage operation works, you will be able to run a cryptocurrency exchange with ease.

IS THIS RELEVANT FOR YOUR BUSINESS?GET LIQUIDITY HERE

[gptAdvertisement]

The crypto exchange in-a-box solution will get you into the crypto game quickly and efficiently. And if you can easily navigate the software and features, it will allow you to focus more on how to maximize your earning potential.

Tech and Infrastructure

There are already a few crypto exchange in-a-box solutions currently available in the market. When you contact Nekstream, we can discuss your business model further and match you up with the best-fit solution. For now, let’s address some of the best features available.

Front-end solution

With most crypto exchange solutions you get a full front-end solution. This includes a web, desktop, and mobile platform that your clients can transact on and a comprehensive backend that will allow you to maximize your profitability. Keep in mind that your clients will be able to trade on leverage and take physical delivery all in the same platform. And you will be able to provide Liquidity into your FX connectivity provider.

Back-end suite

With the backend suite, will have full client onboarding and verification systems to make the account opening process seamless. They will also provide a backoffice to track your client base and Liquidity Aggregation . Additionally the solutions are integrated into many of the popular payment processors, which will allow for easy funding via fiat or cryptocurrency.

Financial Connection to crypto LPs

There are two ways to post margin in order to get liquidity into your exchange. Some solutions require you to post margin with each exchange or market maker that you will be getting liquidity from. Other solutions allow you to place funds with them directly (in many cases regulated entities) in order to transact with exchanges and LPs.

These types of solutions will all handle netting and settlement. And there are also solutions that provide Prime of Prime services in the crypto space with major brokerage and banking licenses that you can connect with.

Monetization

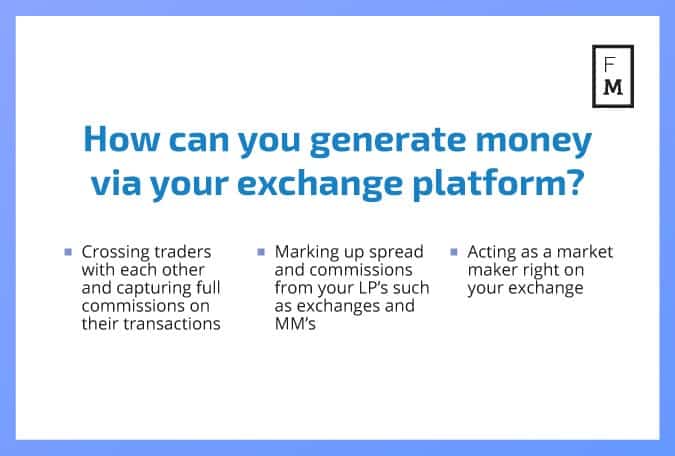

Now that we have addressed how crypto exchanges work from the liquidity and infrastructure standpoint, let’s summarize how you can make money from them. When your clients trade on your exchange platform you will be able to generate money three ways:

Pump your liquidity into your FX broker

You will be able to integrate your liquidity into your connectivity providers such as OneZero and PrimeXM and pump your liquidity into your FX broker offering. Now your clients can trade on leverage from your own liquidity stream. You will make money the same way you would when your clients trade on your platform.

Pump your liquidity to other brokers

Now that you will have a full-blown crypto exchange, you will be able to sell your liquidity to the ever-growing list of FX brokers eagerly trying to add cryptos to their offering. You will have the ability to cross orders from your exchange to the LPs that you are connected to and earn high markups.

What will set you apart from traditional crypto exchanges would be your customer service experience. Typical crypto exchanges don’t understand the FX space or have ‘FX broker-centric’ customer service on the B to B (business to business) or B to C side (business to consumer). You already have this in place and it will make you much more attractive to FX brokers that are looking for their liquidity.

Conclusion

Currently there are only a few crypto exchanges in a box on the market. This is due to the fact that the industry is still in its early stages, which is a great thing. The features and benefits of each 'Crypto Exchange in a Box' solution differ. So the best way for you to jump on this opportunity is to reach out to our qualified crypto specialists at Nekstream and get matched up with a solution that will be a best fit for you.

Alex Nekritin is the Managing Director of Nekstream Global, a liquidity and technology consulting company helping brokers, HFT traders and money managers to find proper liquidity and tools for their ventures. Alex has over 10 years of experience in the financial space. Contact Nekstream at info@nekstream.com.