It’s been a couple of years since Capital.com launched its mobile-centric brokerage. The firm used AI technology to attract clients and offer them a different value proposition when compared to its numerous MT4/5 competitors.

The branding efforts and the firm’s capital-intensive domain (pun intended) made it different to other companies in the industry who similarly purchased expensive domains.

Earlier this week, the parent company of Capital.com also announced the launch of Currency.com. In what certainly has been another significant investment into a domain name, the firm purchased Currency.com.

While traditional acquirers of impactful domain names have been focusing on direct marketing advertising, Capital.com's strategy has been to approach the market with a different offering. The success of mobile-centric companies such as Plus500 and Trading212 and the ever-increasing penetration of mobile devices have opened a window of opportunity for many firms.

The new regulatory framework in Europe, which was well known to Capital.com as it was starting its business changed the industry in a big way (at least initially). This week’s announcement about Currency.com represents the company’s pivot to adapt existing technology in order to attract more traders.

A Play on Leverage and New Clients

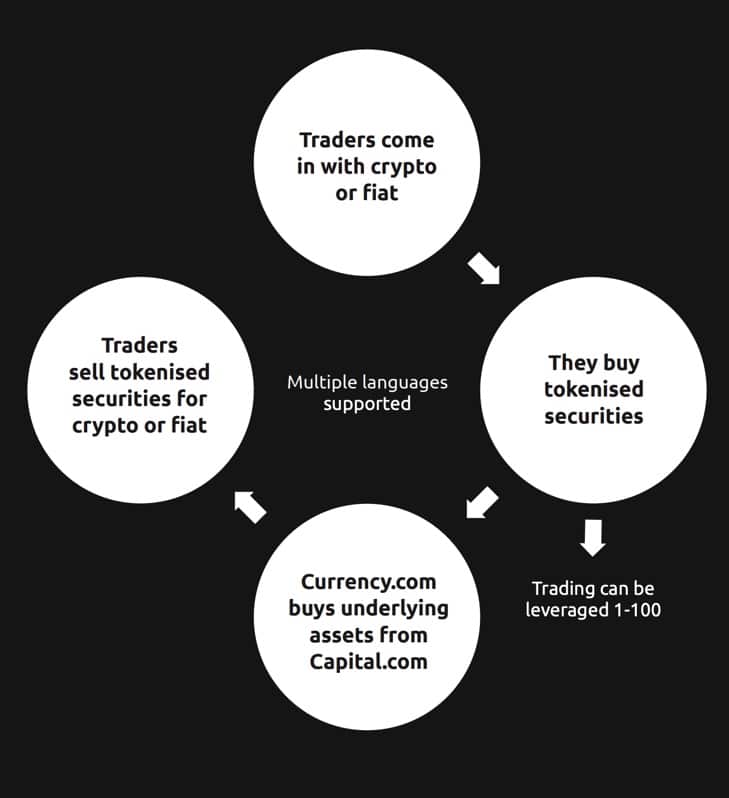

The company is positioning its new venture as a place where cryptocurrency investors can trade traditional markets. The company is offering them leveraged bets from 1:10 to 1:100 on tokenized assets including shares, indices, and commodities.

Tokenized assets backed by market transactions, Source: Currency.com White Paper

The company is registered in Belarus, which surprisingly has been one of the first countries in the world to commit to a regulatory framework with the goal to attract foreign investment. While some traditional cryptocurrency investors could be attracted to leverage their capital to enter the market, the new company is opening a new door for traditional leverage-hungry traders.

The only new qualification which such traders would need to use Currency.com is to purchase either Ethereum or Bitcoin . The offering of the new tokenized assets is in line with the regulatory framework in Belarus and complies with strict AML and the new GDPR standards.

Currency.com's Plans

Speaking with Finance Magnates, the CEO of Currency.com and Capital.com, Ivan Gowan said that the company had committed a strong team to ensure the security of crypto deposits. The team of the firm includes experienced industry professionals, one of whom was instrumental for the launch of the crypto offering of Swiss bank Vontobel.

The company is starting its offering with deposits in Bitcoin and Ethereum. Mr. Gowan shared that the firm is also planning to build additional markets and support more deposit options. The mobile application of Currency.com is planned for launch before the end of the first quarter of 2019.