The developments relating to the proposed bailout of Cyprus and the implications that it is likely to have on the established forex and binary options industry on the island continues to be at the forefront of the minds of most executives of the industry.

Cyprus, a diminutive island nation, has a disproportionately large forex and binary options industry mostly based in Limassol, which has very quickly become a “silicon valley” of online trading companies, making up a considerable proportion of the industry of the entire country.

As with much of Europe, which has become increasingly mired in debt-ridden, de-industrialized and handout-dependent failed economies, Cyprus is now in a position whereby the banks are not able to meet their commitments, and require an IMF bailout. This time however, such a leveling comes with a nasty sting in its tail in the form of a levy of up to 10% on deposited funds, creating a potentially disastrous effect for private enterprise.

Full Structure of Proposed Bailout*

- Bailout program of 17 billion Euros

- Internal Resources: 7 billion Euros

- Tax on depositors worth 5.8 billion Euros

- Bail-in of junior bond holders as part of recapitalization of banks

- Increase in corporate tax rate by 2.5pp to 12.5%

- Privatizations 1.4 billion Euros

- Commitment to fiscal tightening of 4.5% of GDP

- External Resources: 10 billion Euros

- ESM/IMF: 10 billion Eurs, with exact shares not yet determined

- Russia: Possibly better terms on existing 2.5 billion Euro loan

Details of Wealth Tax on Deposits*

- Tax rates on deposits still to be determined – Expect heated discussions in Parliament

- Cyprus President initial proposal: 6.75% on deposits of less than 100,000 Euros and 9.9% on deposits greater than 100,000 Euros (first 20,000 exempt)

- ECB suggestion: 0% on deposits less than 100,000 Euros and implicitly 25% on deposits greater than 100,000 Euros

- Other proposals: 3% on depoists less than 100,000 Euros, 12.5% on deposits greater than 100,000 among others.

- Total deposits are 68 billion Euros; 34% of deposits are above 100,000 Euros; at least 45% are held by foreigners

- Tax of 8.5 billion Euros is equivalent to 33% of Cyprus GDP and 8.5% of deposits (Nom GDP

- 17 billion Euros, Deposits 68 billion Euros as of Jan 13)

- Only deposits in the island will be affected and not in branches/subsidiaries outside of country

- Compensation may be provided through allocation of bank stocks and incentives may be given not to pull money out of banking sector by providing bonds backed by returns from gas exploration.

Background

One of the contributing factors to the initial lead up toward this situation was that for the last three years, the Cypriot government have ignored any signs of decline, and made themselves unavailable for any provision of information, resulting in such a lack of transparency that companies and individuals are left unaware of the real gravity of the situation.

Explaining the situation, sources told us that calls to government departments were met with the relevant official being engaged conveniently “in a meeting” and therefore unable to assist.

Furthermore, nobody was allowed to discuss government affairs or policy, as a kind of taboo. A red line that the public or industry officials did not cross, a particular taboo being the subject of cost cutting which simply never came into question.

With regard to the increasing number of forex and binary options companies establishing themselves in Cyprus, a vast amount of them were funded and managed by overseas investors, who went to Cyprus completely unprepared, without doing proper research. A large amount kept absolutely no money at all in banks located in Cyprus as the EU financial crisis worsened.

FxPro, an international forex company, has operations in Cyprus among other locations. Speaking in great detail on this subject, Director of Operations at FxPro, Phidias Phidia, explained that the region had been an attractive location to not only set up operations, but also to invest money in the bank.

“In 2009 there was an interest income of around 3 Million Euros on our corporate funds invested in banks in Cyprus. This did not continue, and during 2011 and 2012 there was no interest at all, and having studied the downgrading of the banks’ credit rating and seeing the signs of a problem approaching, FX Pro moved their money abroad. It is certainly better to be safe than sorry” explains Phidias Phidia.

Potential Damage

When considering the fate of other companies which did not take such prudent action, there is a question as to whether the effect of the proposed 10% levy on deposits will actually ruin their business completely.

Phidias Phidia says “The question is if the companies have a strong enough balance sheet to cover the levy plus the subsequent withdrawals from clients. Some are very thinly capitalized. If they only have 500,000 of client funds at any one time and they lose 1 million from this as a result of the levy plus subsequent client withdrawal of profit and trading balance, they will be immediately bankrupt.”

“With the same analogy, if a client withdraws profits only but continues to trade, then the company will have to give the client the total amount of the profit withdrawal plus pay the levy to the government to safeguard the client, resulting in a huge cost to the broker”.

It is a common view according to Forex Magnates sources that there is a substantial presence of disreputable bucket-shops operating in Cyprus. It is highly likely that clients of such companies will not be able to withdraw anything at all. These companies will find a way to safeguard themselves by preventing any clients from profiting and to stall withdrawals to the point where the client continues to trade until the account is zero. If such companies have their accounts based overseas, they will not be affected by the levy and will simply close their operations in Cyprus and make off with the money.

Capitalization and proper management is key to survival in this industry, and Phidias Phidia believes that the regulatory authorities should look at increasing the capital adequacy requirements to be in line with North America and the UK.

“CySEC should set the minimum capital requirements with which to operate a forex brokerage to 10 million Euros as a prerequisite to gaining a license. At present, nobody has the capital to survive. Without financial strength, a company will go under and in the case of Cyprus’s forex industry the vast majority are not well capitalized at all.”

In FX Pro’s case, the corporate strategy is to offer its clients the facility to move all of their accounts to the company’s FSA regulated London operations. The company views the FSA as a highly respectable regulator and London as being a financial safe haven. FX Pro has provided clients option to move their funds to the UK which will provide them with peace of mind.

Adaptability is important in this industry, as the asset is liquid rather than physical and therefore companies must be able to change their business plan without huge additional cost in order to save clients from financial problems if a crisis like this occurs. Those who cannot move their clients to another jurisdiction are vulnerable to an expected surge in client withdrawal requests.

Nick Bang, CEO at Liquid Markets explained, “We are appalled over what has happened this weekend. In fact, the way in which this whole EU levy has been planned is reminiscent of one of those movies where a bunch of criminals organise one of those "bank heists" over a 3 day weekend.”

“The reality though is that this may be the start of a new, very worrisome era. The EU has breached probably the most important principle that characterises free western society: The inviolability of private property.”

“This does not bode well for personal and financial freedom going forward. If the EU can just "take" 10% of anyone's savings (property) in exchange for some worthless, bankrupt stock, and use the feeble excuse that "it's for the common good" what' stopping them taking half of anyone's savings, or appropriating their house and selling it off to raise assets?”.

Nick Bang deplores the decision to plunder the accounts of investors in Cyprus, but is equally critical of the banking sector: “Big businesses such as large banks have two very large flaws; The first being that they are public companies and as such are not run by the bank’s shareholders. The second flaw is their sheer size and the fact that you can hide pretty much whatever you want in their balance sheets for a long time.”

“For many years and still today, the depositor, the average Joe on the street has had the impression that "a big bank is a safe bank". Well, after so many accounting scandals, bailouts and such I sincerely hope the average Joe has learnt that big does not necessarily mean safe” he explains.

The Immediate Future - Many brokers will default on client funds

Considering a likely scenario where if the bill passes (and even if it doesn't) every person and organization will try to withdraw their funds from Cypriot banks the result will be a snowball and eventually collapse of all Cyprus banks. Banks in general do not hold 100% of cash, they reinvest it for instance in mortgages. Banks usually reserve less than 10%, many times less than 5%, which means they will not be able to meet their obligations to clients if bank run takes place.

In a worst case scenario, the majority of brokers will leave Cyprus. There is really only one reason for this, which is the inability to sustain the loss of their clients due to mass withdrawal, plus the effect of the 10% levy and then the potential inability to generate new business. This could be further aggravated if the levy also affects regulatory capital - the 730,000 EUR minimal capital requirement. In this case Cyprus brokers will need to cough up 73,000 EUR more - and some of them can't or won't do that. Some will reach into client funds to be able to cover this further escalating the problem.

In the immediate aftermath of the weekend proposals, many brokers have sent statements to clients assuring them that their funds are safe and their accounts will be unaffected by the bailout. Firms have provided explanations ranging from accounts being located out of Cyprus, to claims that only personal and not corporate accounts will be levied.

We however have no way to verify the accuracy of these statements and given our estimate that a large percentage of Cyprus brokers are either outright scam or are in financial trouble we can unfortunately predict that many of them will not meet the obligations to clients. It's especially concerning that almost all brokers stated that client funds are kept outside Cyprus - this simply cannot be the truth.

Statements from brokers:

- eToro: From Co-CEO Yoni Asia “We want to reassure you all that your deposits will not be affected by this “haircut”. ALL eToro client funds are deposited in leading European banks outside of Cyprus. Our finance staff at eToro were well aware of the bailout discussions that took place and thoroughly considered any potential consequences.”

- XFR Financial: XFR Financial (xforex) – “With regard to the conditions for the Cyprus bailout from the EU, the cypriot parliament will take a vote later on today. Our management would like to inform you of the following: The Company has kept and safeguarded your funds in non Cypriot banks 2. Any decision taken by the local government or the EU will not affect the Company or your trading activities and your funds.”

- AFBFX: AFBFX – no official statement, but representative said “this new decision applies only to individual account holders (Cypriots and foreigners) in Cyprus, it has nothing to do with corporate accounts”

- FXCC: No statement, but representative said “did not released an official statement, yet as there is no decision made by the government of Cyprus about the bailout. However Clients funds will not be affected by the bailout.”

- Liquid Markets: Representative said “I would like to inform you that indeed Cyprus is facing banking problems, but this does not affect us as a company or the funds of our clients. We have segregated accounts and hold funds in European Banks like Unicredit and Commerzbank. No government can appropriate the funds as long as they are used as margin collateral in a trading account."

- TFI Markets: No statement, but representative said “all money outside of Cyprus , no clients will be effected”

- IronFX: ” Large, global well-regulated brokers based in Cyprus, like IronFX, which keeps all client and own funds outside of the country is a much safer trading counterparty than a small FX broker (often unregulated) based in a perceived “safer” jurisdiction. As a result, existing and future clients do not care if their FX broker is based in Cyprus but whether it is a large, reputable, well regulated firm that holds client funds with reputable investment grade international banks.”

- Easy-Forex: "We believe that there will not be a single, united answer for “what’s going to happen to the industry”, but rather a separate answer for each broker. All brokers operating here will be affected, but the impact will vary based on their exposure to Europe and EU clients, the ratio of the funds they hold in Cypriot banks Vs. other banks, their operational structure, etc. So far, requests for withdrawals and deposits are at their normal levels and we have only seen a handful of emails coming in with questions"

Russian Effect

Currently, there is a freeze on all withdrawals from bank accounts in Cyprus and the banks remain closed for today and tomorrow, following which it is possible that a bank run may occur. If this occurs, the Cypriot government will prevent international transfer of funds, but despite this, there will be massive divestment.

At present, there is around $30 billion of Russian investments in Cyprus. Phidias Phidia believes “Russian investors will move the whole lot out of Cyprus. At first, they will repatriate the capital to Russia, whilst they do their research on where to reinvest in a safer place which also has favorable tax treatment. It is likely that they may look to invest in London. This in itself will have a devastating effect on the economy”.

Mass Russian divestment of this value would be greater than the entire value of the bailout.

Liquidity Liability

Companies which keep their money only in Cyprus face not only financial ruin but also operational difficulties including liquidity problems. In the majority of European countries, companies in this situation can call on the EU Liquidity Emergency Fund, but there is no guarantee in place for Cyprus.

The EU declined to give written confirmation of use of the fund to Cyprus, so therefore if called upon, the request could easily be declined. Discussions failed because Cyprus wanted unlimited support for Cypriot banks, which would equal a liquidity backing of 40 billion Euros.

That amount represents the safety net required if 60 to 70% of investors decide to move their money out of Cyprus, however nobody will commit to a guarantee of 40 billion Euros.

Legal Perspective

The ease with which such a draconian measure can be implemented will be demonstrated in this move, and could set a legal precedent, meaning that it can be carried out elsewhere in Europe, thus causing concern to investors as to the safety of their investments.

From a government perspective, many scenarios are being discussed about this matter however the Cypriot parliament which sits today at 18:00, will rule on whether to approve President Nicos Anastasiades’ agreement with Eurogroup for the haircut on deposits in Cyprus banks.

Such tax would be at 6.75% on all deposits from EUR 1 – 100,000 and 9.9% on deposits over 100,000 Euros.

In compensation or exchange for the amount of deposits that is proposed to be taxed by the Government of Cyprus, President Nicos Anastasiades has confirmed that shares will be issued in the capital of either Bank of Cyprus or Laiki Popular Bank at the same price as the Cyprus Government will get in recapitalization of both banks.

In addition to that, President Anastasiades stated that those depositors that will keep their deposits in Cyprus banks for the next 2 years they will receive, for free, bonds on Government Gas Company, equal to the half of the amounts that will loose from the proposed tax/cut.

The value of the proposed collateral is uncertain at this point in time.

Cyprus based law practice A.G.Paphitis & Co LLC outlined the following guidelines from a legal perspective:

Nothing though is clear yet until Parliament sits today. Many economists are attempting to insist that Cyprus parliament adjourns its’ meeting today so that nothing is decided under such pressure or until Eurogroup change its’ position towards Cyprus. Russia seems assistive towards Cyprus, pushing Eurogroup, and Germany more particularly, in changing their current standing position. Last night, the Eurogroup has already given flexibility to Cyprus to differentiate of the originally agreed rates provided however those alternative scenarios are agreed. However, the problem that we all face in Cyprus is the fact that banks remain closed and no bank transfers can take place using Cypriot banks. Depositors are prohibited of using their own money. This, surely have some business, practical and legal implications. Money is a private property belonging to people. According to Article 6 of the Lisbon Treaty and the European Convention on Human Rights, the only reason that you can take away a person’s property is in very extreme and serious cases where the public interest is more important than the private interest, and only if the State pays damages to the person for taking that measure. The State cannot take away part of your property unless extreme situations arise. In the event that a tax/cut of the bank deposits passes in Cyprus and becomes a law, it is likely that it will be in violation of international laws, and the laws of the European Union. We further estimate the law to be in violation of the Constitution of Cyprus and as such members of parliament should reject voting in favor of such law. Sure our intention is not to recommend people to take legal actions against banks now; we should wait and see the way things will move forward and take actions accordingly. It is a serious legal matter which needs deep consideration. In addition to the above, an increase of 2.5% on corporate tax from 10% to 12.5% is also being discussed. In case this increase to Cyprus Corporate tax passes the end result will be insignificant since on the tax regime side as is, clients can carry out tax planning and practically pay very low effective tax rates in Cyprus which can practically go well below 10%. Summary of Alternatives and Solutions Use Cyprus companies for holding or trading operations and do the banking (if the company has a bank account) outside Cyprus - we can open a bank account in countries like Singapore, Switzerland, Latvia, Malta, St. Vincent and the Grenadines and other jurisdictions for you; at least for a few months until normality returns to Cyprus. So we do recommend that clients continue using the Cyprus Company as tax advantages are being maintained AND do the banking outside Cyprus for the time being. We underline that the corporate tax rate increase does not affect non trading companies, such as holding, real estate holding, portfolio trading or royalty companies.

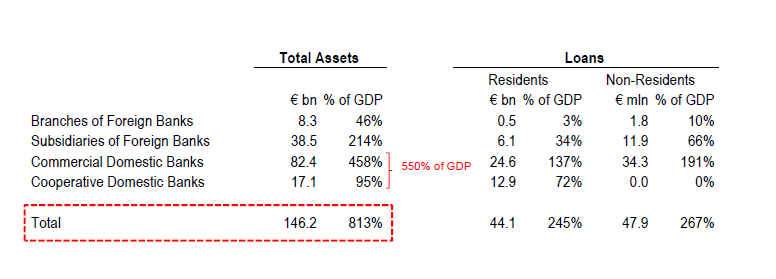

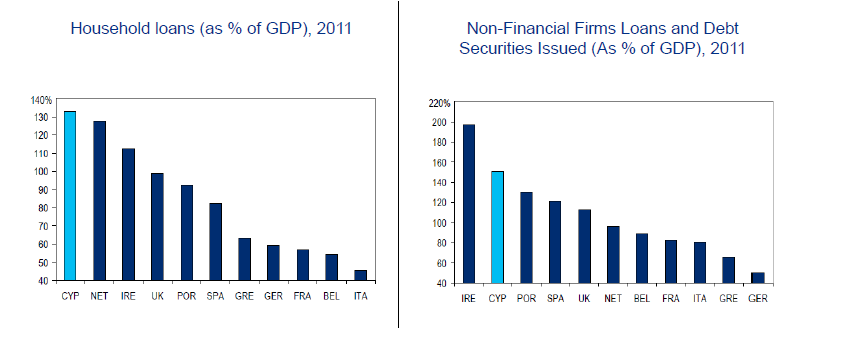

Cyprus Bank Asset Structure

Cypriot Bank Lending to Households and Firms

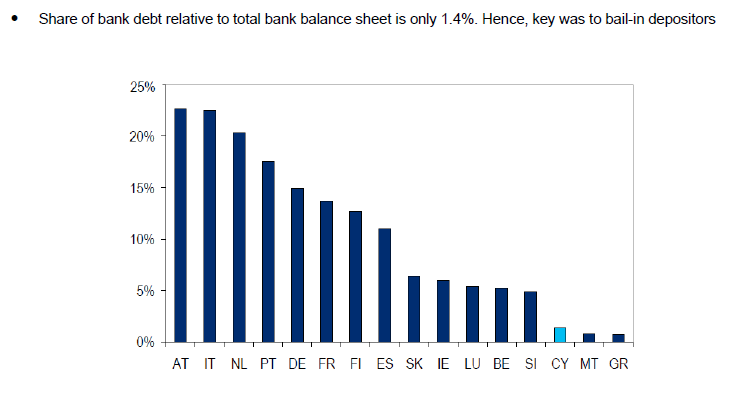

Low Number of Bank Bonds

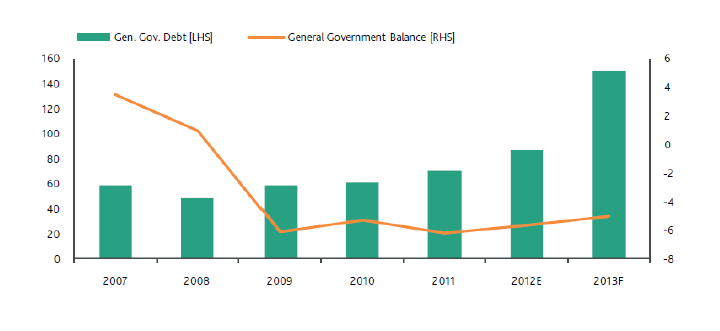

Cyprus Government Finances

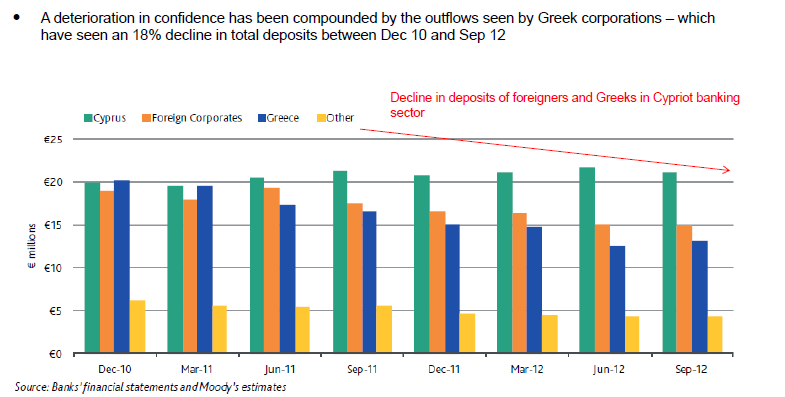

Decreasing Trend in Cyprus Deposits

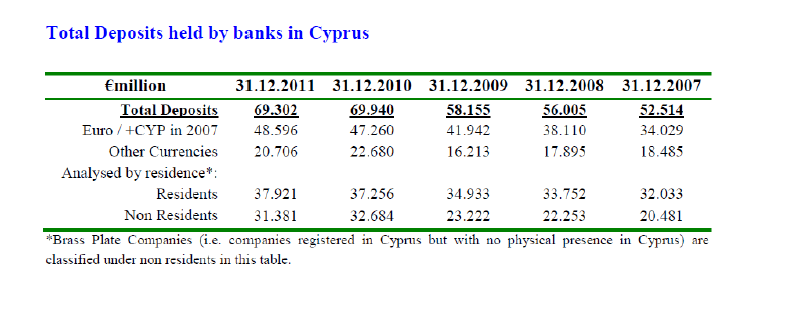

Total deposits held by banks in Cyprus

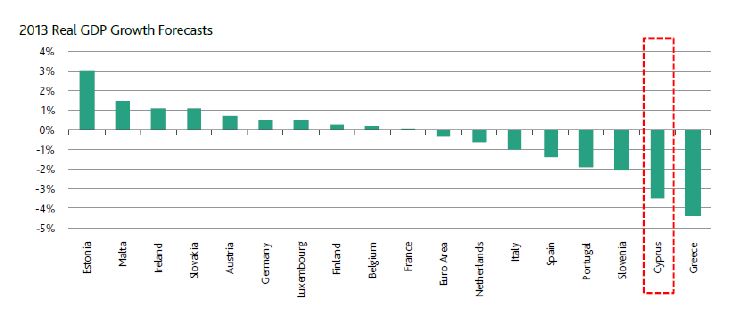

Divergence of Growth in the EU

*Data provided by Citi