The Cyprus Securities and Exchange Commission (CySEC) has imposed a €30,000 fine on the smart money management app Plum for multiple violations of “prudential requirements.”

CySEC Cracks Down on Plum Money over Capital Rules

The enforcement action stems from several compliance failures identified during CySEC's supervision. The regulator found that Plum Money CY Limited, the regulated company behind the fintech brand, failed to maintain adequate funds consisting of required capital tiers as of December 31, 2023.

- Capital Requirements: The company was fined €8,000 for not meeting minimum own funds requirements and another €8,000 for failing to maintain capital levels in accordance with regulatory thresholds.

- Liquidity Issues: A further €8,000 penalty was imposed for insufficient liquid assets, as Plum Money did not maintain the mandatory one-third of its fixed overhead requirement.

- Reporting Breach: The remaining €6,000 fine related to the company's failure to submit its annual report for 2023 by the February 11, 2024 deadline.

The company should not feel the financial burden of the relatively low fine. Especially, it just raised £16 million, successfully closing the series B funding round.

Plum Secures £16m in Series B Funding Round

The funding comes as the fintech firm has seen its assets under management (AUM) grow significantly, reaching over £1 billion in the past year.

The latest round was led by iGrow Venture Capital, with additional investments from existing backers like Venture Friends and Ventura Capital, and a further contribution from strategic partner Eurobank. The crowdfunding segment, hosted on Crowdcube, attracted more than 5,500 investors from the UK and EU, making it one of Crowdcube’s most popular campaigns this year.

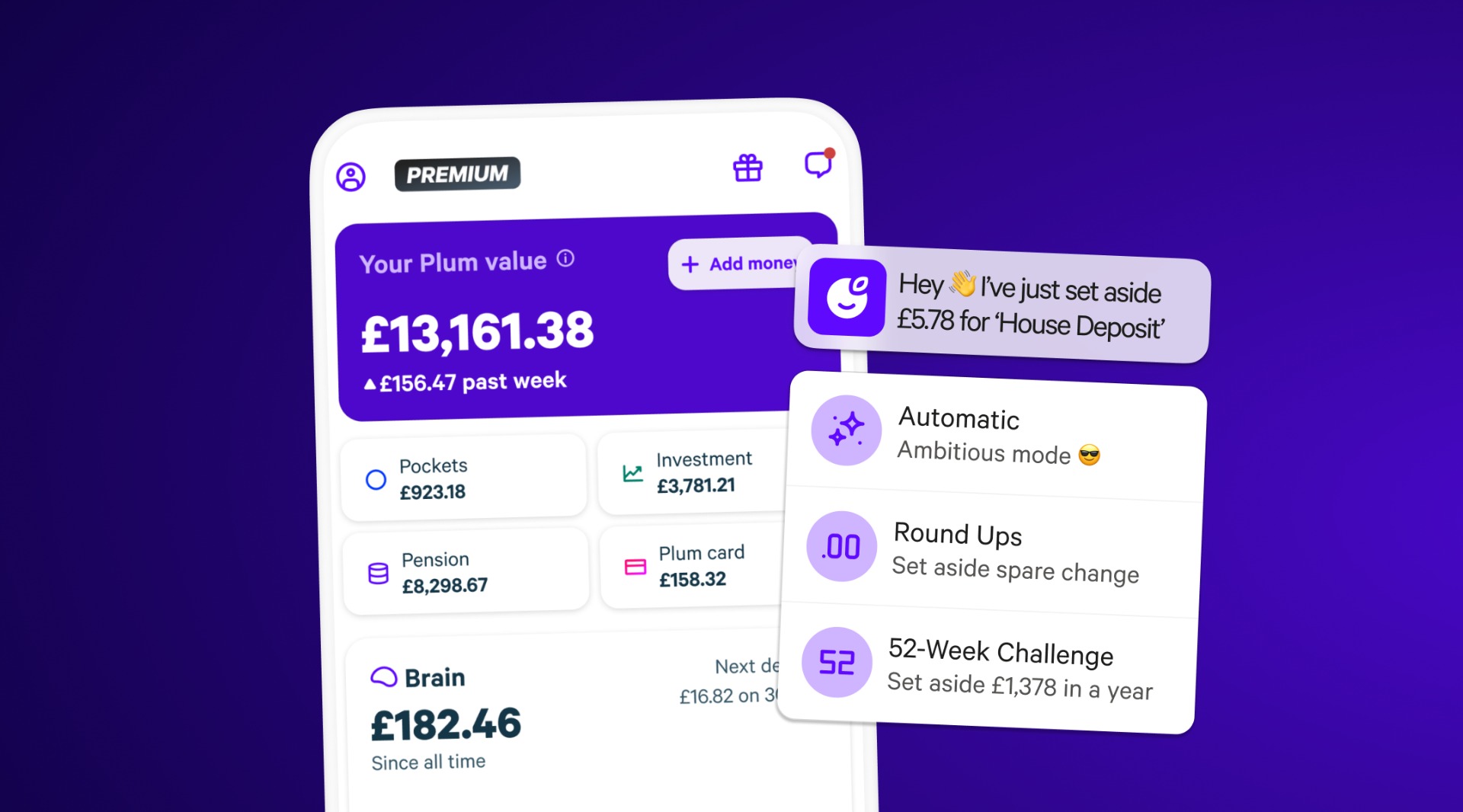

In the past year, Plum expanded its services to several new markets, including Italy, Portugal, the Netherlands, Greece, and Cyprus. The platform offers automated saving options for retail clients and commission-free access to invest in a range of U.S. stocks, with up to 3,000 available for trading, alongside a VISA debit card for additional financial flexibility.

Additionally, Plum has partnered with cryptocurrency service provider Bitpanda, allowing European customers to trade major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH).

The company also announced the appointment of Erinoula Kyrantonis as Head of Branding and Communications. Kyrantonis will oversee Plum's brand strategy and maintain consistent messaging across channels, bringing experience from her past roles with brands like Red Bull and Vita Coco.

Plum Money operates as a smart money management app offering automated savings and investment services to European customers. The company is regulated in Cyprus and provides services across the EU under its CySEC license.