As the need for greater transparency in its oversight of member firms increases, the Cyprus Securities and Exchange Commission (CySEC ) has released a circular to Cyprus Investment Firms (CIF) today which requires that each company provides certain entity related information by November 15th, 2013, with regards to its structure and relation to any parent company, holding company, subsidiary or other direct or indirect common ownership structure as detailed below.

CIF firms must submit a questionnaire by November 15th and choose from a list of applicable options for each CIF member. This announcement is part of a directive (namely Part E of the Directive DI144-2007-05 of 2012) pertaining to the supervision of firm's capital adequacies, among other issues, as well as the supervision of companies on a consolidated basis.

More specifically, CIFs which fall under the cases specified in paragraphs 1, 2 and 3 of Part E of the Directive are supervised by the Commission on a consolidated basis, in addition to the solo supervision already exercised for them by now, according to the circular.

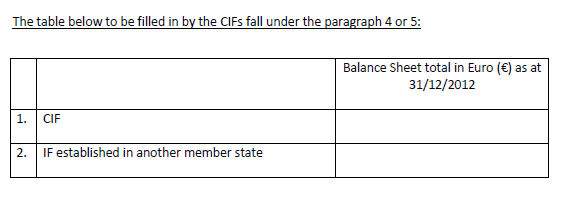

CIFs that do not fall under certain categories may continue to be supervised by the Commission only on a solo basis. However, in order to determine such applicability, all CIFs are requested to complete a table in the form and return via electronic email to an address provided by CySEC in the announcement, and no later than November 15th, according to the circular. Below is a portion of the form pertaining to applicable categories where firms must indicate year-end balance sheet totals (in Euros as of December 31, 2013).

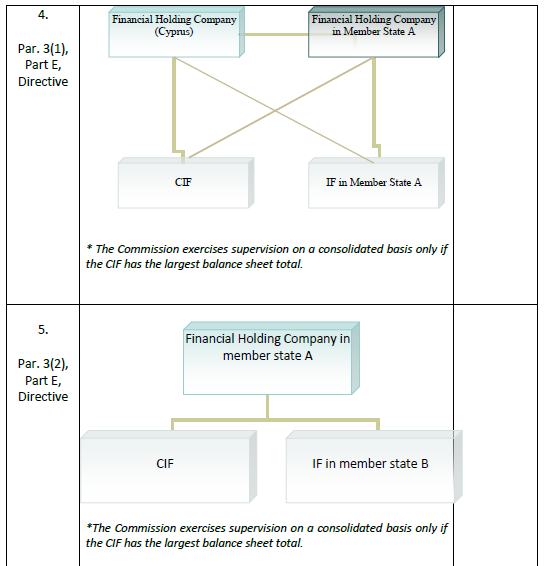

Example excerpt from Circular CI144-2013-27

The table that was included in the announcement from CySEC today, must be submitted together with a chart of the structure of the group in which the CIF belongs to, up to the ultimate beneficial owners – natural persons.

The chart must include the name of each entity, percentage of holding, country of establishment, activities and competent authority, if applicable. For certain firms whose Cyprus-based financial holding companies have subsidiaries that are in non-member jurisdictions, section 6 is reserved for further information to be provided by the CIF.

Example excerpt from Circular CI144-2013-27

Additionally, for CIF firms that fall under categories 4 or 5 on the above mentioned form, as can be seen in the diagram above, must disclose the year-end balance sheet in Euros as of 12/31/2013. The full circular by CySEC can be found on its website.

General Regulatory Challenges in FX Globally

In addition to the steep economic challenges that the country has faced in recent years with regards to its banking center, and recent challenges faced by Forex companies, if the regulator can continue to improve its oversight and efficiencies with regards to providing members with ease in cooperation and compliance, the future of the much sought out hub for Forex companies may return to the spotlight that it has recently enjoyed as link between Europe, Asia, Africa and the Middle East.

The paradox of this challenge for the regulator (or any regulator for that matter), is the balance between providing market participants with enough protection while not limiting their freedom to the degree that causes customers to seek out other alternatives (as seen in other jurisdictions with regards to FX Market regulations). Hopefully by now, regulators can start to learn even more by the previous mistakes of their foreign counterparts (or their own mishaps), as methods for policing participants evolve alongside the evolution of the underlying market places as well.

The amount of cross-regulatory cooperation that has been seen is also a potential driver of standardizing rules across markets which could pose another challenge of eliminating regulatory arbitrage that providers often seek when considering cost and ease of business operation. This is another paradox, as the benefits of globalized rules eliminate the diversity of regulatory efficiencies and their consequent effects on end- users and firms.