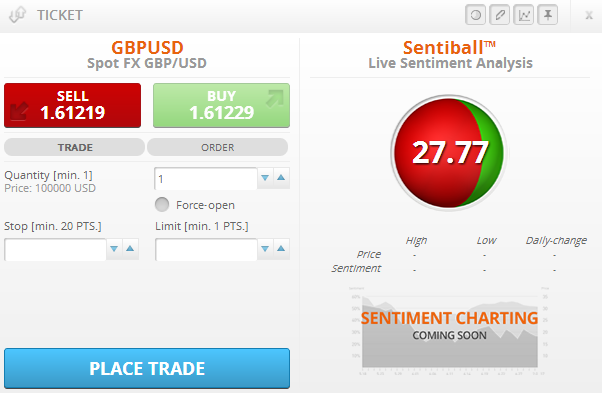

It didn’t take long, but social analysis sentiment tools are becoming one of the big trends in the trading world. We wrote last week about LiveSquawk, and in 2012 about DataMinr and Knowsis. Now, another firm is launching the first social analysis Trading Platform . London based DCM Capital, a one-time hedge fund endeavor has pivoted to become a retail broker, and launched its operations today. Using its proprietary social analysis sentiment tool, DCM Capital has created a trading interface which assigns a sentiment score to each trading instrument from 0-100. The scores are used to track bullish/bearish sentiment among traders.

DCM Capital Trading Platform

Unlike other services that are provided as third party solutions, DCM Capital has integrated its technology within an entirely new trading platform to leverage the sentiment analysis. The broker is FSA regulated and is led by Founder & CEO Paul Hawtin, formerly of Saxo Bank. The firm is backed by serial entrepreneur Mark Pearson.

DCM Capital operates as a partner of IG Group with its platform connected to IG through a FIX connection. As such, clients place trades on the DCM Capital trading platform with execution and Liquidity provided by IG Group.

When asked whether there are plans for the release of automated trading, whereby clients can enter preset strategies to buy or sell based on specific sentiment measures being achieved, a DCM Capital representative told Forex Magnates “We don’t have any plans to release any automated, sentiment based trading strategies. We are however considering releasing an API where institutions can build their own automated trading strategies from our real-time data.” As such, if the broker does become popular, it could lead to the creation of an app marketplace leveraging the sentiment analysis.