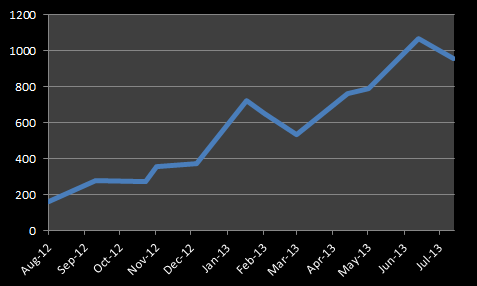

Japan’s and the world’s second largest retail broker by volume, DMM Securities, has reported its July trading volumes. During the month, clients traded $958.5 billion, 10% below June’s record volume of $1.069 trillion. The decline comes as brokers and trading venues have reported a sharp drop in yen related activity during July. As such, DMM’s 10% contraction in volumes isn’t surprising, and can be viewed positively when compared to 15% and more declines seen at Monex Group, EBS, and Thomson Reuters. After today’s figures, GMO Click becomes the only broker to top $1 trillion during July, as the broker solidified its hold on the top spot among retail brokers.

DMM Securities July FX Volumes ($billion)

Later today, KCG, operator of the Hotspot FX ECN and FXCM are scheduled to announce their quarterly financials, with volume figures expected to be released as well. Since finalizing the GETCO/Knight Merger and rebranding as KCG, shares of the new formed company have struggled. KCG stock has fallen over 25% to a recent $8.61 since reports surfaced that US regulators were looking into high frequency trading among Market Makers . In addition, the firm has recently announced the divesture of reverse mortgage originator, Urban Financial Group for $80 million. As such, while Hotspot FX remains entrenched within KCG, and there haven’t been any signs of a desire to sell the group, we could see the ECN come into discussion during the company’s conference call later today. In regards to FXCM, it will be worth watching how their volumes fared in July with the decline in yen trading. The broker has been a beneficiary of the spike in yen activity during 2013, achieving record volumes, however their revenues per million has dropped as a result of lower margins in yen crosses.