GAIN Capital posted their Q2 earnings last week with a bang. Reporting record revenues of $73.0 million, net income of $17.2 million, and EPS of $0.44, shares of the broker surged as they closed the week at $7.71, higher by nearly 40% from last Wednesday’s pre-news price. Propping the revenues were record volumes from the broker’s retail and institutional business. On a year over year level, revenues were 59.7% higher. However, this could be expected due to the overall increase in industry volumes during 2013 as well as the addition of GFT’s US retail customer volume which was acquired at the end of 2012. The real surprise was in the 62.7% quarter over quarter retail trading revenues increase that occurred even though total retail volumes were only 6.5% higher. Taking a closer look we analyze how GAIN Capital achieved such a strong quarter as well as other takeaways from their conference call and SEC filings.

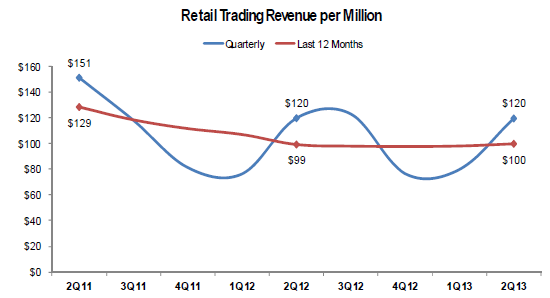

$120 revenues per million – Among all the details of GAIN’s report, the most important (in my eyes at least) was the huge pop in their revenues per million (RPM) figures. As you can see in the chart below from the earnings presentation (entire slide deck at the end of this post), RPM of retail volumes soared to $120 from just above $80 in Q1. Q2 has been seasonally strong in terms of RPM at GAIN Capital. If the figure was at the $100 historical average, it would have knocked out around $10,000 in revenues and income. Commenting about the RPM on their conference call, GAIN Capital CEO Glenn Stevens explained that the growth in the figure was a combination of broad based volatility (which included Gold and the GBPUSD), client engagement, as well as that market makers do better as volumes rise. The takeaway from the RPM is that GAIN’s earnings are very cyclical and even were the broker to continue recording strong volumes, their revenues could easily decline during the remainder of 2013. Therefore, it's too early to jump on the bandwagon and annualizing GAIN's EPS at north of $1.00 and the stock being one the cheapest on the market.

GAIN Capital Retail Revenue Per $Million Volume

GFT – No news is.. well no news. GAIN was completely quiet about the GFT acquisition, saying only “The transaction is subject to customary closing conditions, not all of which have been satisfied as of the date of this report. The Company continues to work through the issues that must be resolved in order to close the acquisition.” During the call, Stevens also couldn’t comment on whether the acquisition delays were due to regulatory issues.

Institutional revenues rising – Forex Magnates interviewed GAIN Capital CPO, Muhammad Rasoul last year after he arrived at the firm from GFT. One of the points he made was the broker’s move to diversify its revenues from just its FOREX.com retail unit. In that account, the firm continues to be achieving this goal, as retail revenues fell to 78.7% of total revenues from 89.4% in 2012. This is a result of average daily volumes at GAIN’s institutional business, GTX, jumping from $7.5 billion in 2012, to $15.1 in 2013. Steven’s remarked that the gains are due to a combination of existing clients trading more and the addition of new customers. Without the firm naming customers, we surmise that partially attributing to the increase of volumes at GTX, is the unit’s ability to leverage the company’s existing broker relationships by offering them Liquidity services for their businesses. GTX has also been hiring new staff to bolster its growth.

WLs and IBs - Talking about partners. In their SEC filing, GAIN Capital reported that white label and introducing broker business composed of 35.2% of their total retail trading volumes. The figure was slightly below 2012’s 36.9% share.

TV marketing fall – In regards to marketing expenses, GAIN reported a decline to $4.7 million from $7.2 million in the same period last year. GAIN attributed the fall in expenses to a decline in TV advertising. This follows similar news from FXCM which dropped its sponsorship of a CNBC show. As such, it’s worth noting that two of the better known brands in the industry, FOREX.com and FXCM are moving their marketing dollar’s away from TV. Often cited as a means to create branding presence, TV advertising has its place in among online brokers, but remains difficult to track for campaign optimization.