Trading statistics for the month of May have just been released by E*TRADE Financial Corporation, an online US-based brokerage that is listed on the Nasdaq under ticker ETFC, according to its most recent monthly activity report which showed a 6% decline from the prior month.

The company reported that its Daily Average Revenue Trades (DARTs) reached 149,475 in May, lower by 6% compared to April 2016 on a month-over-month basis, and lower by 1% when compared year-over-year (YoY) to May 2015. E*TRADE reported strong earnings in April for its Q1 2016, as reported by Finance Magnates in a related post.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

10,866 gross accounts added in May

E*TRADE added 30,607 new brokerage accounts on a gross basis during May - down from 34,724 reported in April, and ended the month with a total of 3.3 million accounts – higher by 8,448 compared to the prior month.

The company also detailed in its report that the May 2015 totals for its accounts include the closure of 1,314 accounts related to the shutdown of the firm's global Trading Platform , and an additional 3,484 accounts that had been closed in connection with the escheatment of unclaimed property.

Brokerage cash up $600 million

Net new brokerage assets totaled $1.2 billion in May, and customer security holdings rose by 2% or $3.5 billion from April, whereas brokerage-related cash increased by $600 million to $43.2 billion over the same period, according to the company’s monthly report.

However, bank-related cash and deposits remained flat at $5.3 billion, and the company said that clients were net-buyers of securities with nearly $400 million worth of related transactions in May. The news follows after the company received a fine from FINRA for $900,000 earlier in June in relation to trade executions.

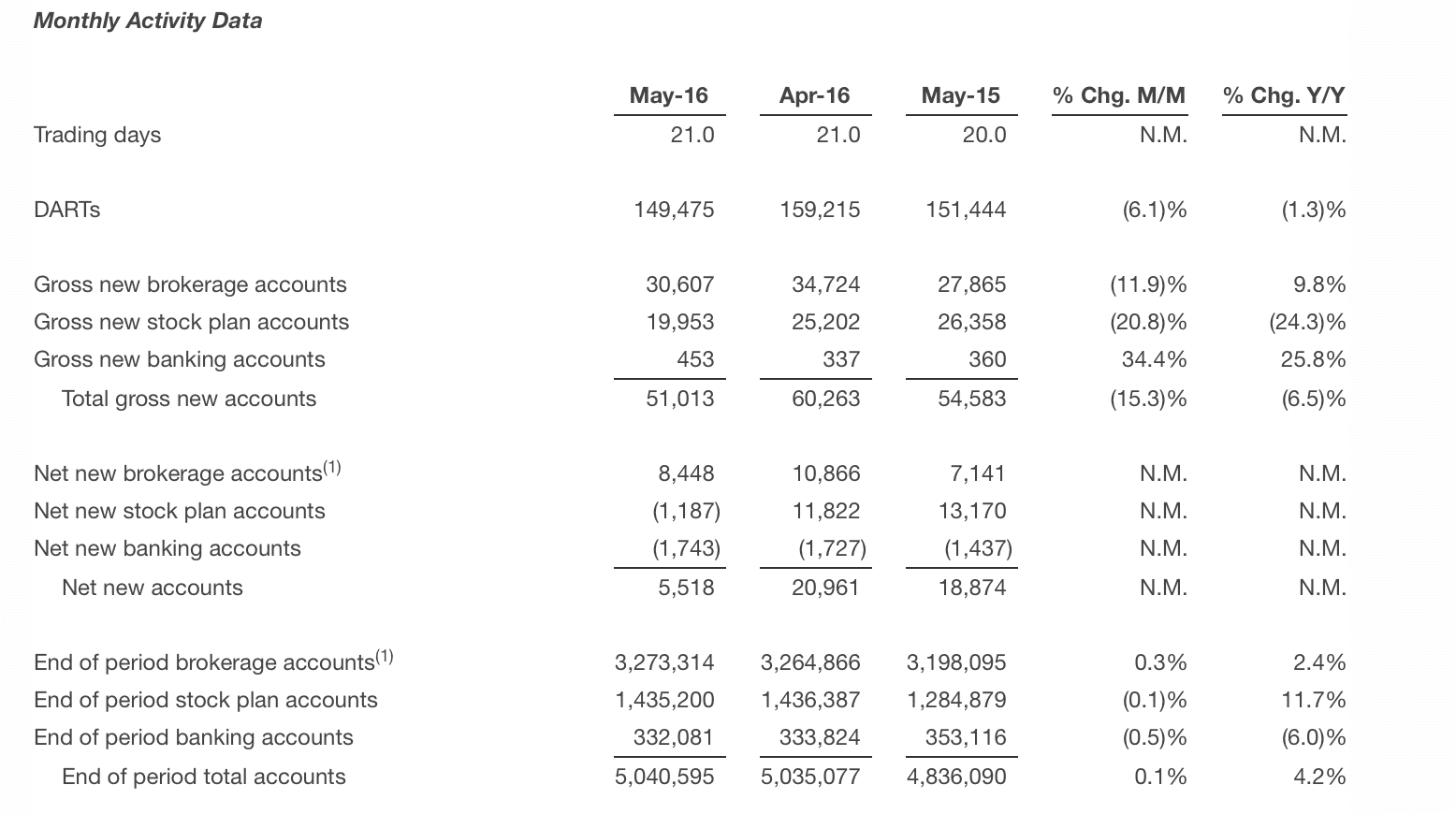

An excerpt of the monthly report for May 2016 can be seen below, highlighting May with the prior month and on a year-over-year basis for some of the reported statistics including DARTs and new account fields.

Source: E*TRADE May 2016 monthly statistics