US-based online brokerage and bank operator, E*TRADE Financial Corporation, listed on the NASDAQ under ticker symbol ETFC, today announced its first quarter (Q1) financial results showing net income of $153 million for the first three months of the year, up from $89 million reported for Q4 2015.

For the three months ending March 2016, the amount of net revenue reported was $472 million, up from the $439 million reported in the prior quarter, and higher than $441 million when compared Year-over-Year (YoY) to Q1 2015.

The Q1 net income represents 53 cents per share (CPS) on a diluted basis, up from 14 cps on a diluted basis or $40 million reported for Q4 2015, when compared quarter-over-quarter (QoQ).

On an adjusted basis, net income totaled 43 cps or $122 million during the period, excluding a $31 million income tax benefit that the company received in connection with the release of a valuation allowance against state deferred tax assets, according to the official press release, and which caused its net income figure to reach $153 million.

In all, this has been a solid start to the year and we look forward to continuing to deliver for our customers and shareholders as 2016 progresses.

Non-interest expenses of $312 million weighed down the company’s net income, while margin receivables reached $6.3 billion by the end of Q1 2016, and daily average revenue trades (DARTs) were 165,000 for the quarter, up 12% from the previous quarter yet 3% lower when compared YoY.

Excluding the impact from shutting down the company’s operations in Singapore and Hong Kong, E*TRADE added 45,000 net new brokerage accounts and maintained an attrition rate of 7.3% on an annualized basis and reflected a retention rate of nearly 92% over the measured period.

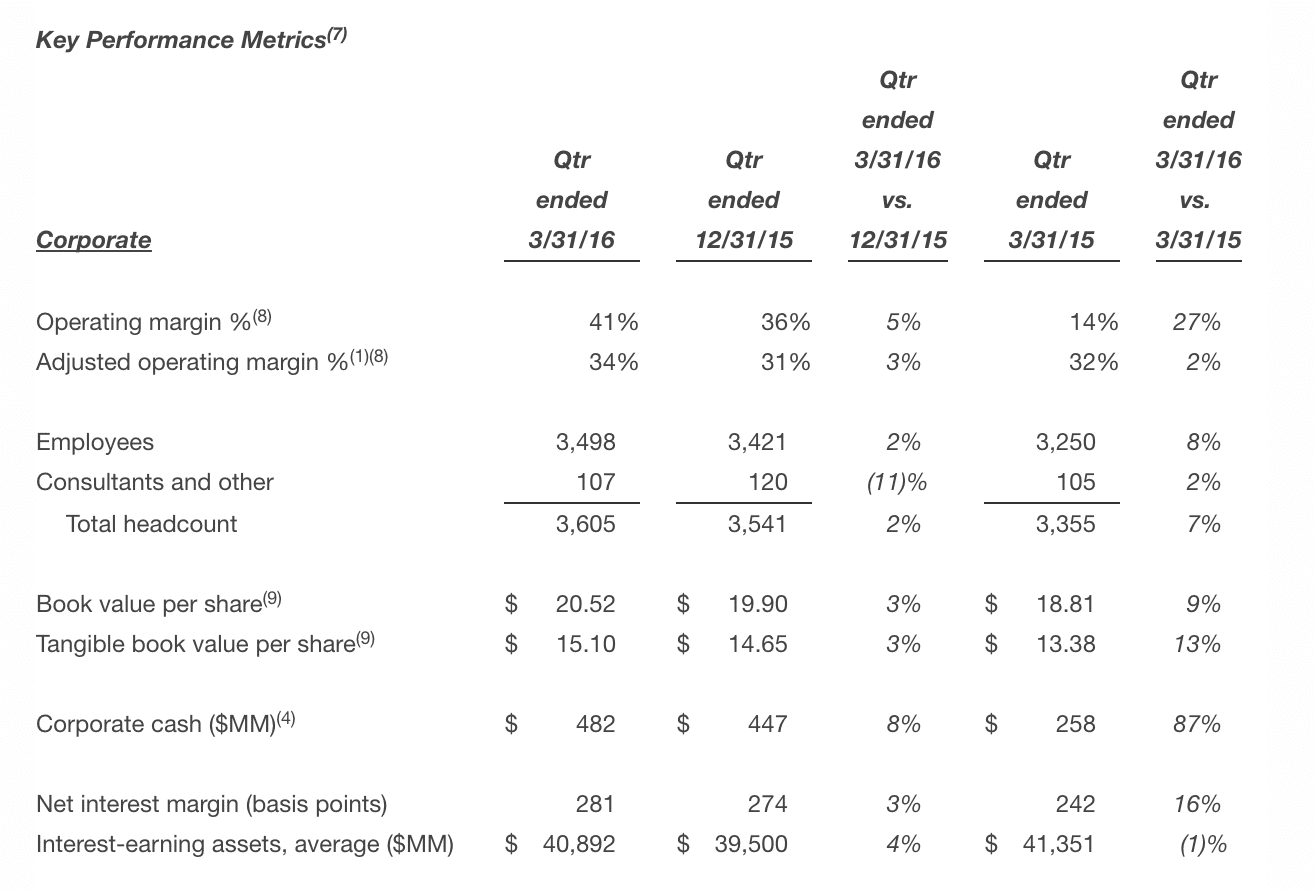

The increase of net new customer accounts brought the total number of brokerage accounts at the company to 3.3 million at the end of Q1 2016, as the company's staff headcount increased along with operating margins.

In addition, net new brokerage assets of $2.9 billion were added, and total customer assets reached $285 billion at the end of the quarter, down from $288 billion when compared QoQ.

Paul Idzik, Chief Executive Officer at E*TRADE, commented in the official press release: “While economic uncertainty persisted throughout the quarter, our customers remained active while generating healthy levels of new accounts and assets. Further, we moved $400 million of capital from our subsidiaries to the parent, began operating our bank at a lower capital threshold, and moved our balance sheet closer to its target size. We also took advantage of market conditions to accelerate our share repurchase program and aggressively return capital to our owners, completing nearly half of our $800 million authorization in just a few months. In all, this has been a solid start to the year and we look forward to continuing to deliver for our customers and shareholders as 2016 progresses.”

Shares of the company closed up 1.4% from the main session today and traded down half a percent in the after-hours session and were little-changed following the news.

Key Performance Metrics

Source: E*TRADE Q1 2016 Results