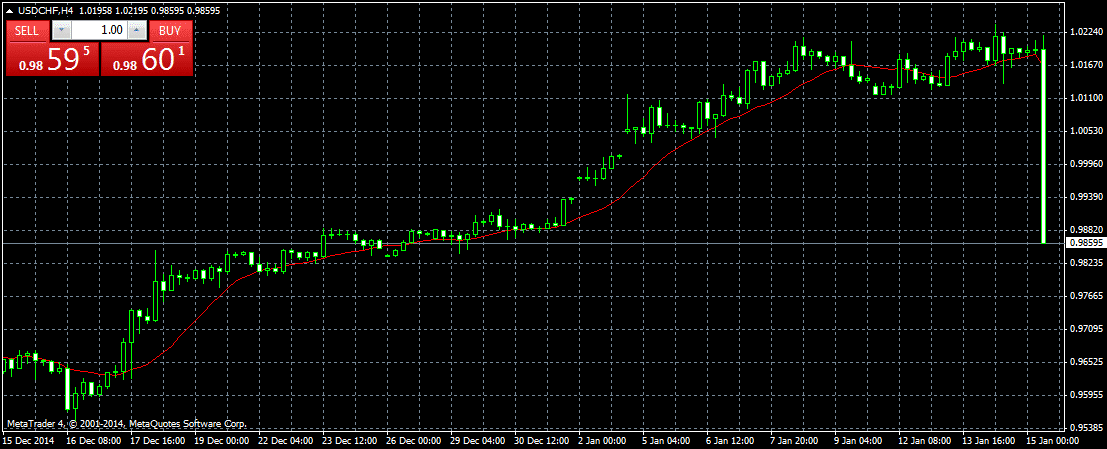

USD/CHF, 4 Hour Chart, MT4

Several brokers have been forced to freeze trading after the EUR/CHF dropped through the 1.20 floor, resulting in an unprecedented widening of spreads on multiple pairs.

Alpari has announced that eight CHF currency pairs will be traded in "close only" mode so traders will not be able to open any new positions or place pending orders.

GAIN Capital's Forex.com suspention of trading in Swiss francs even made it to the general news headlines as Reuters quoted Kathleen Brooks, Research Director at Forex.com, who said: "We're just waiting for our Liquidity providers to come back and say they will provide liquidity again. It's very difficult to get liquidity in Swiss francs against anything right now. The whole market has dried up."

GAIN Capital (NYSE: GCAP) later issued this official statment: "In the minutes following the SNB’s announcement, the FX markets did experience significant price gaps and periods of extreme illiquidity, but GAIN Capital’s Forex.com maintained its price feed throughout and filled client orders as liquidity became available. Price action has stabilized from earlier today and trading of Swiss Franc currency pairs remains available to all to our customers. However, volatility is still high and we are advising clients to manage their risk exposure accordingly."

Saxo Bank has sent out this statement to its clients: "Due to today’s exceptional market movement in CHF crosses, we have been filling client orders and positions in an extremely illiquid market. Once we are better able to establish true market liquidity, all executed fills will be revisited, and will be revised and amended to more accurate levels. This may result in a worse execution rate than the originally filled level."

FXCC sent out this message: "At this moment FXCC is working diligently with its Liquidity Providers to restore pricing for clients and verify executed trades for validity. We would like to reassure you that our best efforts are placed into keeping you up to speed with any updates we might have."

FXCM MT4 CHF Freeze

Over at FXCM (NYSE: FXCM), the prices of CHF crosses have not been updated from approximately 4:30am – 5:15am Eastern US Time. Support representatives advised clients who were negatively impacted by this to log an audit using the subject line, “CHF Crosses spike 15/1 – Price freeze.” They are still asking traders to note that the moves on CHF crosses were a result of a legitimate news announcement.

Certain CFD products of FXCM may also be impacted by the widening spreads, so clients are being told, "Pricing will resume as soon as banks provide spreads that our trading desk can trade. Clients should close out unwanted exposure at the first available opportunity."