Shares of Alibaba Group Holding Ltd. opened for trading on Friday on the New York Stock Exchange (NYSE) with the ticker NYSE:BABA, after its initial public offering (IPO) on the New York Stock Exchange's (NYSE) trading floor. The shares of the company opened on Friday at $92.70 which was about 36% above the IPO price of $68.

The Chinese company placed the largest ever US IPO, with $50.6 billion in total proceeds. Its value represented 57% of all technology company IPOs in the US this year and it has caused quite a stir among investors.

48.09 million shares crossed at the opening at 11:53 ET with a total of 270 million shares changing hands on Friday's trading.

Forex Magnates' reporters reached out to one of the leading brokerages which offers shares, CFDs and stock options trading to its clients - Danish Saxo Bank, to ascertain the interest of retail investors in such a widely media covered IPO.

In a statement to Forex Magnates, Saxo Bank’s Head of Markets, Claus Nielsen, shared, “Due to our multi- asset offering, we've been very active in recent IPOs; from Twitter, GOPRO, King Digital (Candy Crush), Bravofly, now to Alibaba.”

Top 10 Performing IPO's for 2014

He elaborated on the strategies which Saxo used to inform its clients about the opportunities surrounding the biggest IPO in the history of the US market, sharing, “Our equity research team started to highlight the potential in Alibaba early on, getting our clients familiar with the company via Saxo TV and a good amount of research and analysis published on Saxo’s TradingFloor.com portal.”

“The activity in Alibaba from our clients and new clients signing up has clearly exceeded all our expectations. We had more than 2,000 trades going through our books Friday (as cash stocks and CFDs). We are planning to add Alibaba as a stock option next week,” Mr Nielsen said.

Judging from the trading activity which we saw on Friday and today, when the company's shares dropped about 4%, it looked like we had another addition to the swing traders' favorites, or so called "momo" stocks (momentum plays).

Mr. Nielsen concluded, “Saxo Bank expects Alibaba soon to be in our top 10 most traded stocks/CFDs together with Apple, Facebook, Netflix, Google, Tesla, Yahoo etc.”

While the interest in trading massive IPOs is big, there is an important aspect to really awaken the interest of traders to such companies. Information is key to provide the new offering as a real trading opportunity.

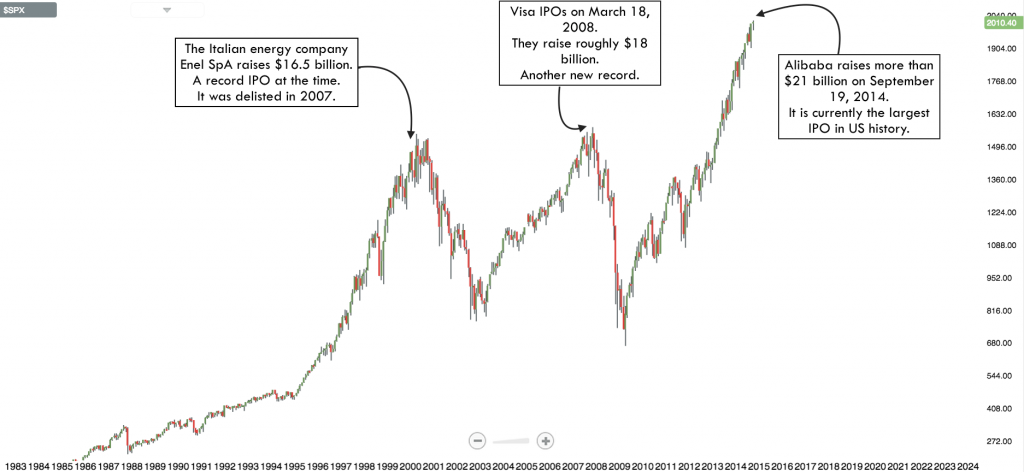

The chart that follows, courtesy of Stephan Cheplick from StockTwits, reveals a worrying trend though.

Record IPOs Marking Market Tops, Source: Stefan Cheplick, StockTwits

The current state of the US stock market is quite different from what it was a couple of years ago. It has now been relentlessly rallying for more than five years. With the clouds of the FED's tapering effort starting to hang over the heads of traders, are we going to see another record breaking IPO mark a top in the US equity market (as usually is the case)?