As the deadline for Australian brokers to submit a significant amount of data to the Australian Securities and Investments Commission (ASIC) is looming, their strategic approach is vastly different.

Some companies have bowed to the regulatory demands from the Australian watchdog. They are proactively informing their overseas clients about the closure of their accounts. The latest batch of brokers who have joined the camp is some of the leading names in the Forex brokerage industry in the land down under.

Over the past couple of days, AxiTrader, IC Markets, and OANDA Australia have become the latest companies to inform their overseas clients that their accounts are facing changes. The first two brokers have offered to their customers to have their accounts migrated to offshore subsidiaries in Saint Vincent and the Grenadines and Seychelles accordingly.

To our best knowledge, there is a significant number of other companies that appear to continue operating as usual, at least when it comes to non-Chinese clients.

Legal Opinions

Earlier this spring, ASIC has requested that brokers provide the regulator with legal opinions that enable the companies to onboard overseas clients. Finance Magnates can confirm that several firms have acquired legal opinions as requested, that allow them to service clients outside of Australia.

Some brokers have even acquired documents that show ASIC that they are legally allowed to operate in China. The relationship between Australian and Chinese regulators over recent quarters has become detrimental to the industry, and many brokers believe that ASIC is greatly abusing its powers.

That said, the Australian watchdog is preparing to enforce its product intervention powers in the near future.

Post-June Insurance

While both AxiTrader and IC Markets are stating that clients can keep their accounts in Australia, the firms are not providing any guarantees to traders whether they would be able to keep the same trading conditions and namely Leverage .

While some ASIC-regulated brokers have mounted a resistance against the demands on the part of the regulator, others are choosing a safer approach and informing overseas clients about a pending migration of their accounts.

Clients do not need to undertake any actions to migrate their accounts to the offshore subsidiaries of the brokers. That said if they do not wish to be migrated, they need to opt out by filling a form online.

Some Australian brokers did opt to apply for European licenses over the past several months, arguably to be able to advertise their services in the EU.

China and.. Hong Kong

While ASIC regulated brokers have been divided about the rest of the world, their operations in China have been on a decline in recent quarters. The companies have been looking for ways to continue operating, but most of them encountered pressure from local authorities and significant hurdles, especially when it comes to taking money out of China.

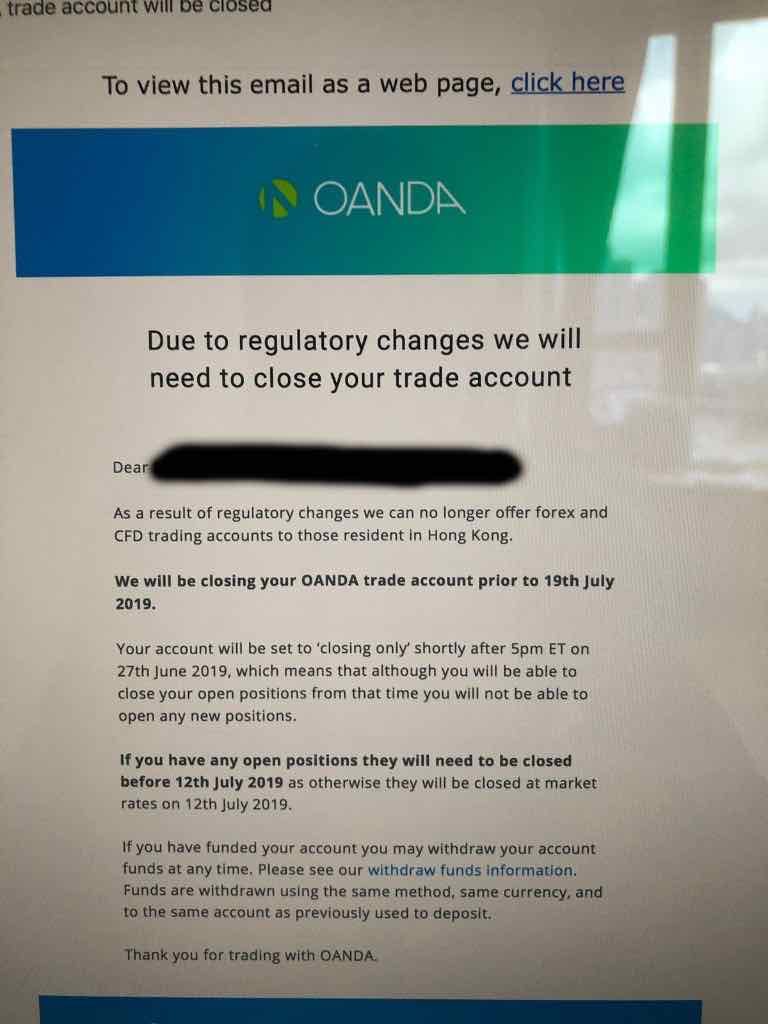

Meanwhile, according to an email from OANDA Australia to a client in Hong Kong, the company stops servicing its clients in the area. The customer is not even offered the opportunity to migrate the account, as the broker states implicitly that all positions should be closed no later than the 12th of July.

OANDA Australia's letter to clients in Hong Kong

OANDA Australia also states that it will automatically close the account before the 19th of July. After the escalation in tensions between China and Hong Kong, it appears that brokers are also reassessing their presence in the Chinese special administrative region.